Revenue

Earnings

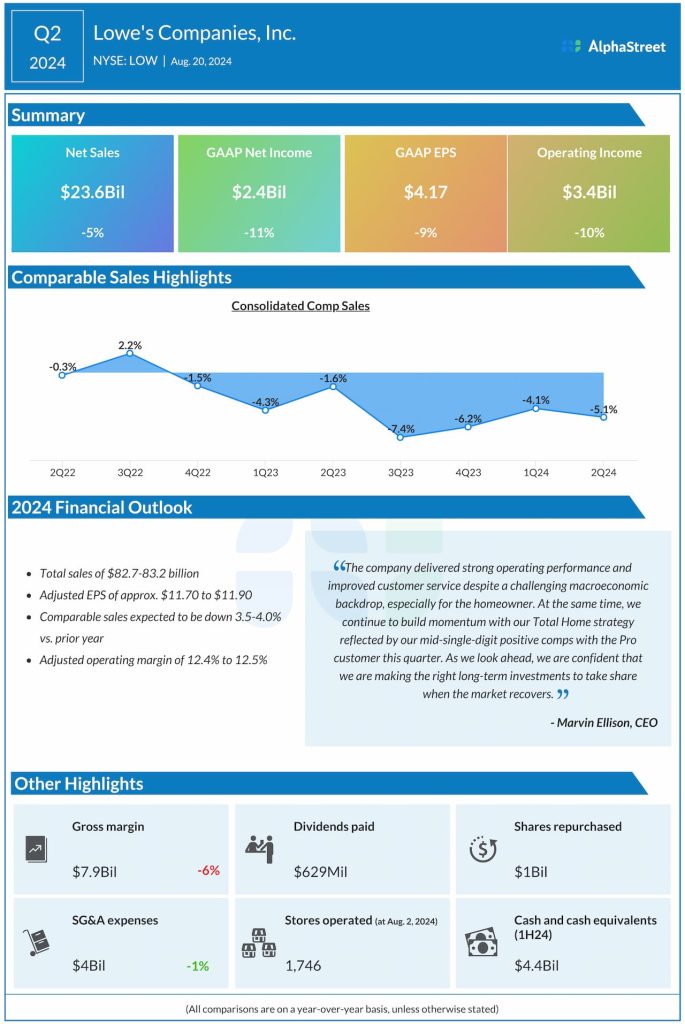

The consensus estimate for earnings in Q3 2024 is $2.81 per share. This compares to EPS of $3.06 reported in the year-ago period. In Q2 2024, GAAP EPS was $4.17 while adjusted EPS was $4.10.

Points to note

The home improvement market has been pressured, with macroeconomic headwinds and inflation taking a toll on big ticket spending. In Q2, Lowe’s comparable sales decreased over 5% due to weakness in DIY bigger ticket discretionary spending and the impact of harsh weather on seasonal and outdoor category sales.

Consumers have been taking on urgent and smaller repairs and putting off large-scale remodels and renovations, which has affected categories like kitchen and bath. Lowe’s generates a large part of its revenue from the DIY, or do-it-yourself, customer segment, and pressures in this category are likely to have impacted its results in the third quarter.

Meanwhile, the company has been seeing stability in its professional, or Pro, customer segment, particularly with the small to mid-size Pro customer. Last quarter, it delivered mid-single-digit positive comps in the Pro segment. Pro-heavy categories like building materials and rough plumbing saw positive comps as well in Q2. The backlog of the company’s Pro customers appear to be healthy, which is an advantage.

The retailer is expected to benefit from the investments it is making to improve the shopping experience for its Pro customers, as well as its loyalty program. It is also seeing strong growth in Pro online sales. These factors can be expected to benefit the performance in Q3.