Revenue

Earnings

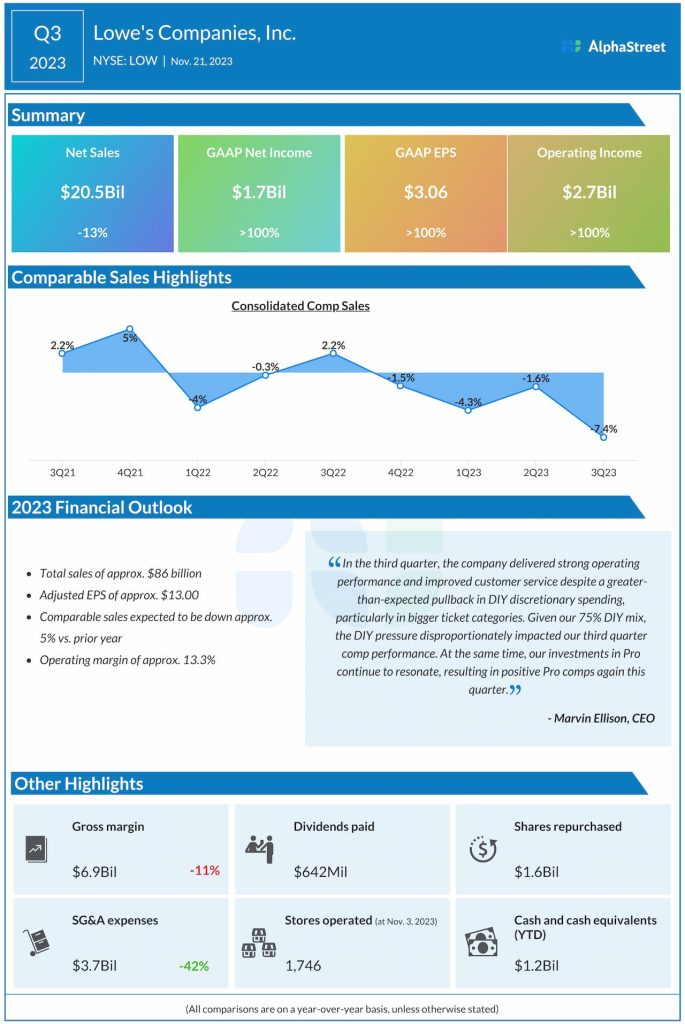

The consensus estimate for Q4 2023 EPS is $1.68, which compares to adjusted EPS of $2.28 reported in the year-ago quarter. In Q3 2023, reported EPS was $3.06.

Points to note

Earlier this week, Lowe’s competitor Home Depot reported its Q4 2023 earnings results, in which its top and bottom line numbers declined from the previous year but surpassed expectations. Home Depot saw softness in big-ticket discretionary purchases, and customers choosing smaller projects over larger ones during the fourth quarter. Lowe’s is likely to have faced a similar situation.

At an analyst event in December, Lowe’s said it was seeing a larger-than-expected pullback in discretionary spending in the DIY customer segment. This has a disproportionate impact on the company as 75% of its revenue comes from the DIY segment. The retailer also said customers were taking on smaller remodel-repair projects rather than going for big-ticket discretionary purchases. This trend is likely to have continued through the fourth quarter and affected the business.

However, factors such as the age of homes, home price appreciation, and personal disposable income allow Lowe’s to remain bullish on the home improvement market over the medium to long term. As homes get older, they will require repairs which are non-discretionary. Also, the big-ticket renovations tend to get postponed rather than cancelled. These factors will benefit the company.

Lowe’s continues to see strong demand in the Pro customer segment, the core of which is small to medium-sized, and it has managed to increase its penetration in this space. The retailer is also seeing a healthy backlog for this customer, which is mainly driven by the aforementioned unavoidable repairs on older homes. The company’s efforts to improve its service towards its Pro customers are also likely to pay off, benefiting its business.

Home Depot has provided a cautious outlook for fiscal year 2024 as it anticipates certain headwinds to demand during the period. It is worth watching what Lowe’s projections are for the coming year.