Revenue

Earnings

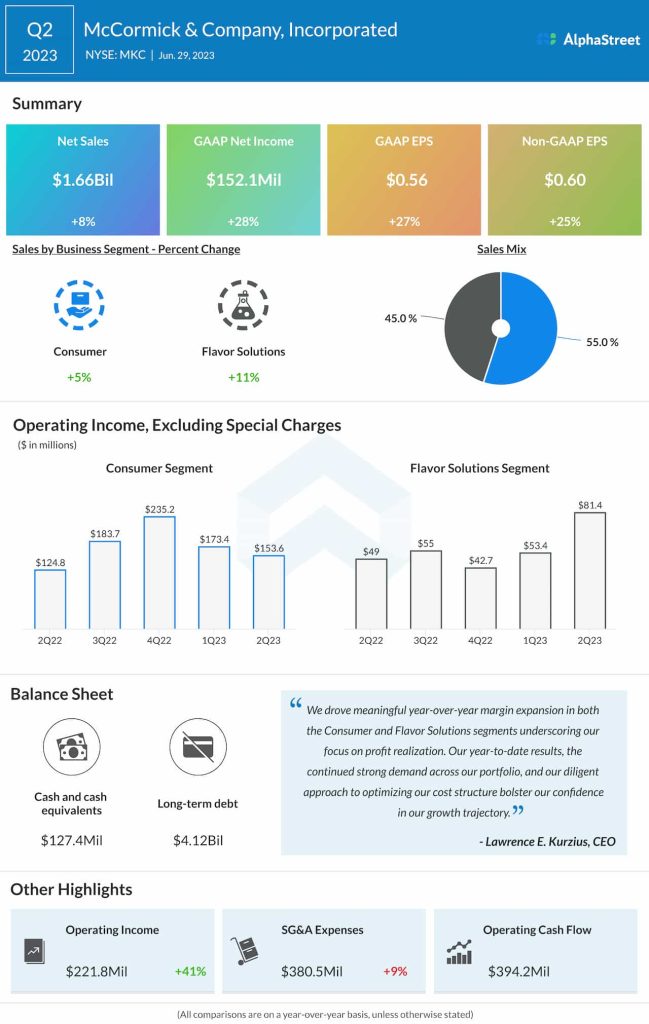

The consensus estimate for EPS is $0.65 which compares to $0.69 in the year-ago period. In Q2 2023, adjusted EPS increased 25% to $0.60.

Points to note

McCormick expects to benefit from consumers’ continued interest in healthy and flavorful cooking as well as the strength of its brand portfolio. In the second quarter, sales growth was fueled by pricing actions. Volume, however, declined 1% in Q2 due to the decision to discontinue low-margin business.

McCormick expects the operating environment to stabilize as the year progresses and it anticipates stable demand for its brands to continue to drive sales growth, which bodes well for the third quarter.

In Q2, the company saw sales growth across both its segments – Consumer and Flavor Solutions. This growth was driven by pricing actions but was offset by declines in volume. The condiments producer anticipates continued gains from its segments through the year helped by product innovation and marketing.

McCormick’s gross margin expanded by 310 basis points in the second quarter, driven by favorable product mix and pricing, as well as cost savings from the Comprehensive Continuous Improvement (CCI) and Global Operating Effectiveness (GOE) programs. The company expects these factors to help drive margin expansion through the year, which is a positive for the third quarter.