Q4 Report Due

When the company reports fourth-quarter results next week, Wall Street will be looking for earnings per share of $2.93, compared to $2.69 in the corresponding quarter of 2023. The year-over-year increase reflects an estimated 14.5% growth in revenues to $64.36 billion. The report is slated for release on Tuesday, July 30, at 4:10 pm ET.

After partnering with OpenAI and entering the AI race relatively early, the company looks well-positioned to continue dominating the AI space, giving tough competition to rivals like Meta and Google.

From Microsoft’s Q3 2024 earnings call:

“Microsoft Cloud gross margin percentage should decrease roughly 2 points year over year. Excluding the impact of the change in accounting estimate, Q4 cloud gross margin percentage will be down slightly as improvement in Azure, inclusive of scaling our AI infrastructure will be offset by sales mix shift to Azure. We expect capital expenditures to increase materially on a sequential basis driven by cloud and AI infrastructure investments. As a reminder, there can be normal quarterly spend variability in the timing of our cloud infrastructure build-outs and the timing of finance leases.”

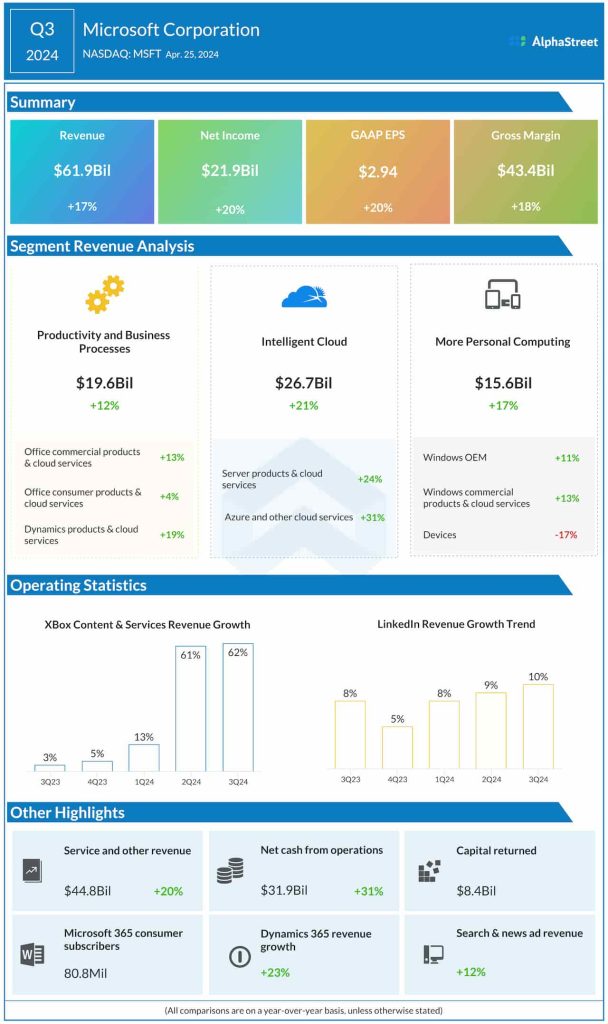

Q3 Results Beat

In the third quarter, revenues increased to $61.86 billion from $52.86 billion in the same period of 2023 and came in above Wall Street’s projection. The top line benefitted from strong contributions from the cloud business segment. Net income increased to $21.9 billion or $2.94 per share in the March quarter from $18.3 billion or $2.45 per share in the comparable period of the previous year. The bottom line has beaten estimates consistently in the past seven quarters.

Microsoft’s stock traded lower early Wednesday, after gaining about 12% in the past six months. It has stayed above the long-term average during that period.