The Stock

While experts are of the view that the company had a positive third quarter, it would be the management’s outlook for the current quarter that decides the stock’s future course. It is estimated that revenues rose more than 6% and reached about $1.36 billion in the February quarter. That is expected to have translated into an 8% increase in adjusted earnings to $1.24 per share. The third-quarter report is slated for release on Wednesday before the market opens.

Financials

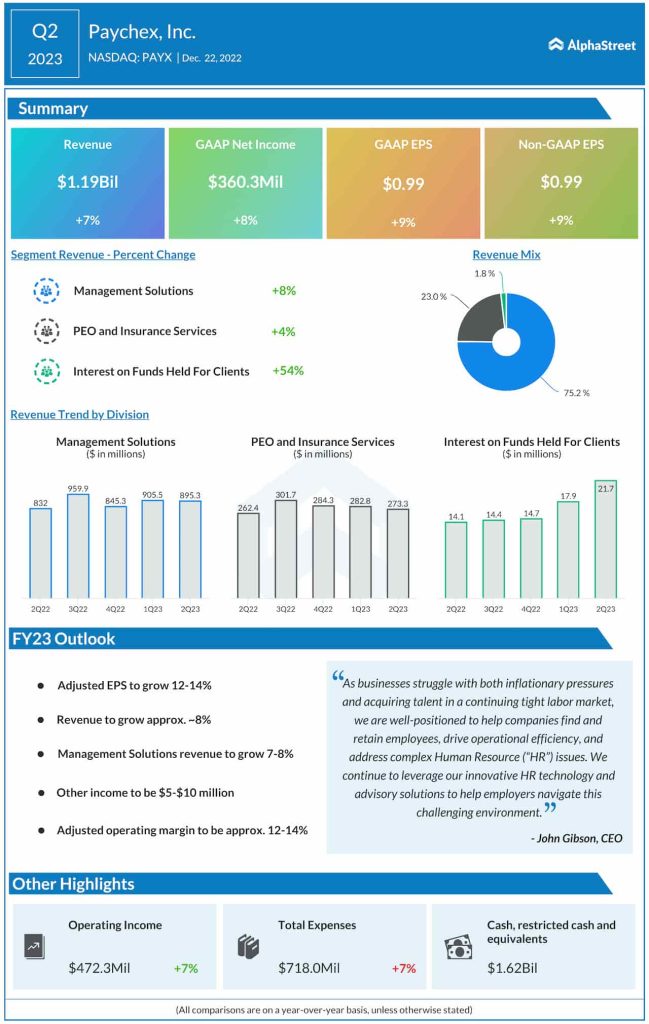

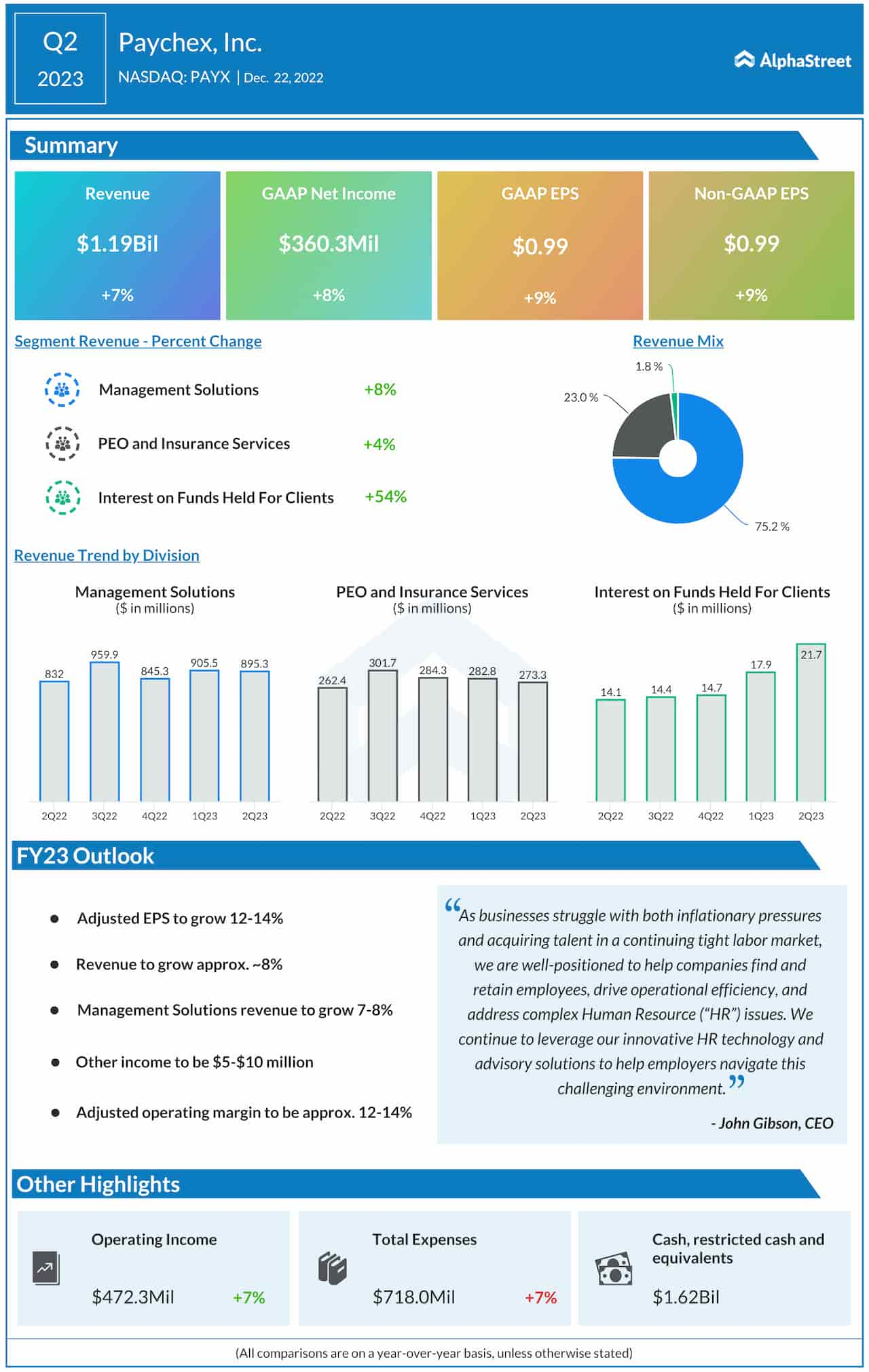

In the November quarter, the company registered growth across all operating segments, which resulted in a 7% rise in revenues to $1.19 billion. Consequently, adjusted profit moved up 9% annually to $0.99 per share. Earnings beat the estimates, while the top line came in line with the market’s projection. Interestingly, Paychex’s quarterly profits topped expectations regularly in recent years, even at the peak of the pandemic.

Commenting on the Q2 results, Paychex’s CEO John Gibson said, “as businesses struggle with both inflationary pressures and acquiring talent in a continuing tight labor market, we are well positioned to help companies find and retain employees, drive operational efficiency, and address complex Human Resource issues. We continue to leverage our innovative HR technology and advisory solutions to help employers navigate this challenging environment. We’ve helped more than 50,000 of our clients’ secure available government funding through the Employee Retention Tax Credit program.”

Though Paychex shares recouped a part of their lost momentum ahead of the earnings, they traded lower throughout Tuesday. The stock opened the session at $108.75 and stayed below the 52-week average.