What to Expect

PepsiCo’s fourth-quarter report is scheduled to be published on February 9, at 6:00 a.m. ET. It is estimated that adjusted earnings increased 3% annually to $1.72 per share in the December quarter. The consensus revenue estimate is $28.4 billion, which is slightly higher than the revenue generated in the fourth quarter of 2022.

The snacks and food business has expanded steadily and now contributes significantly to the top line. At the same time, margins have benefitted from a series of price hikes, especially in the soft drinks, snacks, and packaged foods sections. The company’s ability to innovate and tweak the product portfolio as and when required has helped it stay unaffected by changes in people’s consumption patterns.

Risks

Meanwhile, it is estimated that the growing popularity of obesity drugs, which make people less hungry and reduce food intake, might slow down the demand for the kind of snacks offered by PepsiCo. Also, rising interest rates and the pressure on purchasing power could be a challenge for the company this year.

PepsiCo’s CFO Hugh Johnston said during his post-earnings interaction with analysts, “We obviously have a long history here of meeting or exceeding expectations, both our internal expectations, as well as the guidance, including this quarter, where we beat revenue and we beat EPS. In fact, we’ve now met or beat consensus for 55 straight quarters. So, we tend to be, I think, appropriately conservative in the way that we communicate to you all. So, from that perspective, I think you can go into 2024 with a similar expectation that we should at least achieve the numbers that we’ve laid out for you.”

Good Track Record

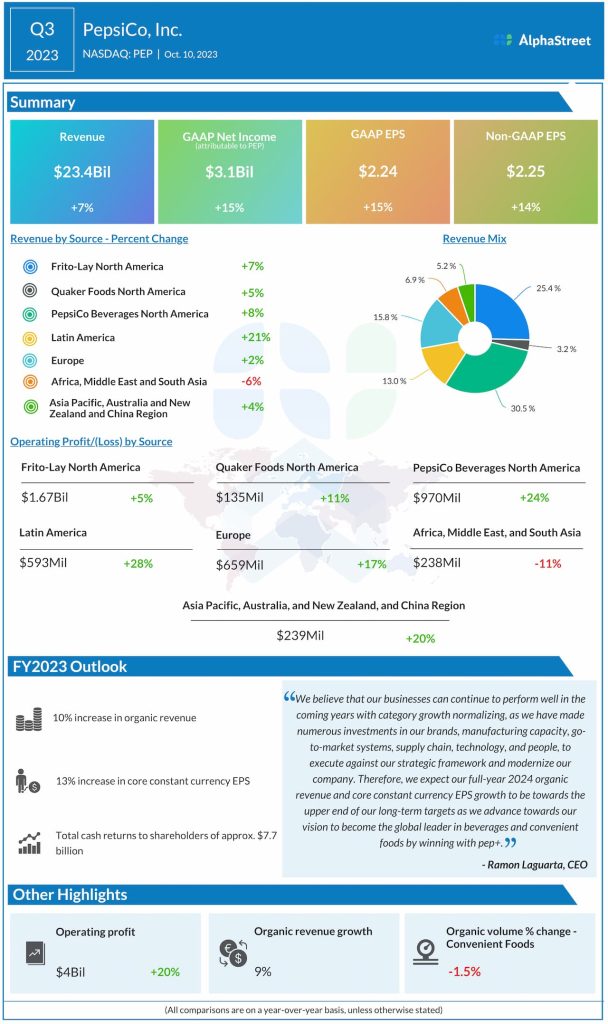

PepsiCo enjoys the rare distinction of delivering quarterly revenues and earnings that either beat or matched analysts’ forecasts consistently for more than a decade. In the third quarter, all the business segments and geographical regions, except the AMESA market, witnessed sales growth, driving up total revenues to $23.4 billion. Q3 earnings, adjusted for special items, moved up 14% year-over-year to $2.25 per share. Encouraged by the positive outcome, the management raised its full-year guidance.

Over the past four months, shares of PepsiCo have been trading below their 52-week average. They opened Tuesday’s session slightly above $170 and traded higher in the early hours.