Revenue

Earnings

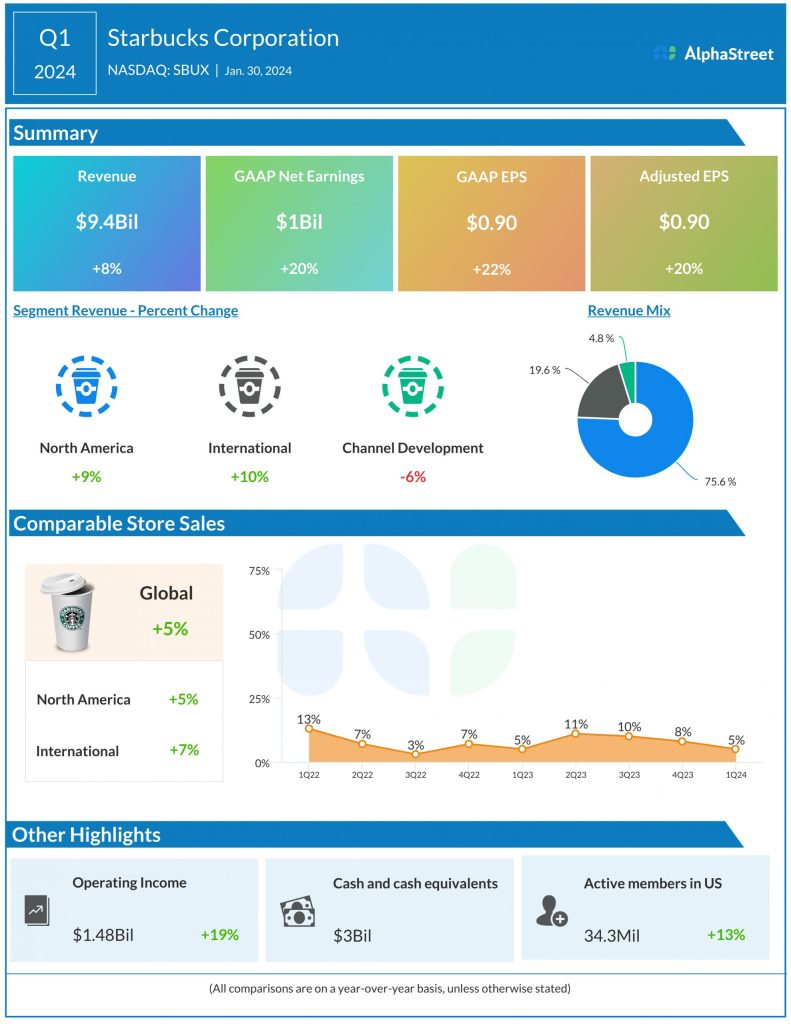

The consensus estimate for EPS in Q2 2024 is $0.75, which compares to adjusted EPS of $0.74 reported in Q2 2023. In Q1 2024, adjusted EPS grew 20% YoY to $0.90.

Points to note

Last quarter, Starbucks faced a couple of challenges that impacted its rate of growth. These included a negative impact to its business in the Middle East caused by tensions in the region, softness in US traffic, and a slower-than-expected recovery in China. The company also saw softness in January, which it expects will weigh on its second quarter performance.

Starbucks expects growth rates for revenue, comps, earnings and operating margin to be the lowest in the second quarter before rebounding and stabilizing during the back half of the year. The company lowered its full-year 2024 guidance considering the impact of the headwinds and the time needed for its remedial measures to take effect.

Starbucks remains optimistic about its long-term opportunity in China. Last quarter, revenue from China increased 20% in constant currency along with a 10% growth in comparable store sales. Its product innovation, digital capabilities and loyalty program in the region are yielding benefits. The company currently has 7,000 stores in China and it remains on track to achieve its 9,000-store target by 2025.

Overall, Starbucks’ efforts in terms of product innovation, digital capabilities, and its loyalty program are paying off. Last quarter, the company recorded a 13% growth in its 90-day active Rewards members. It also saw an 80% YoY growth in its US delivery business and its Mobile Order & Pay facility made up 30% of all transactions in Q1.

The company’s new store openings are proceeding at a healthy pace and it plans to continue to invest in purpose-built stores to cater to its customers. This includes drive-throughs, which grew by over 500 stores YoY in Q1.