Revenue

Earnings

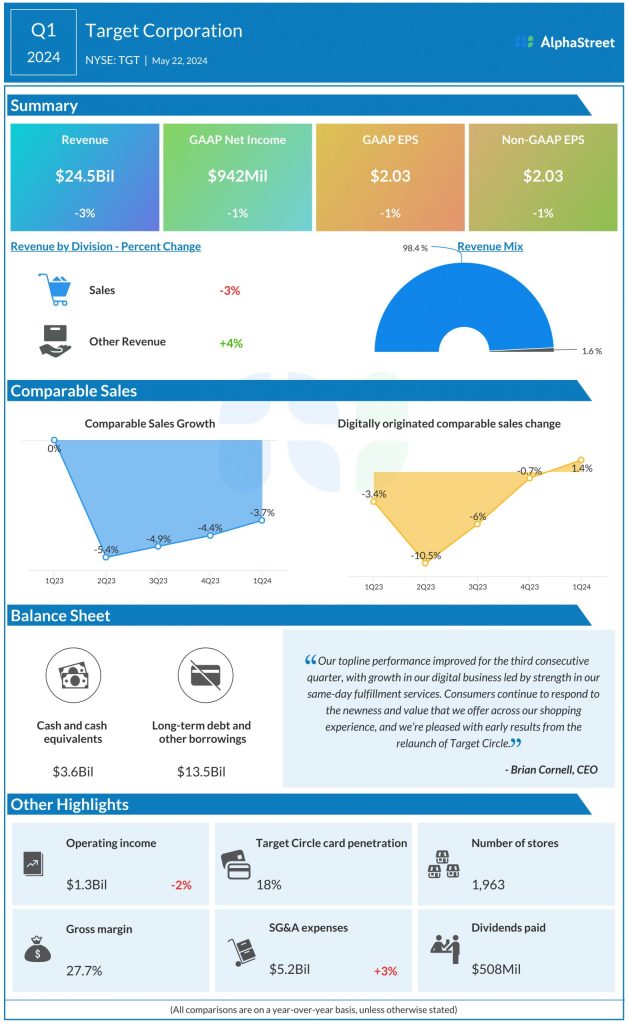

Target has guided for adjusted EPS to range between $1.95-2.35 in Q2 2024. Analysts are predicting EPS of $2.18. This compares to adjusted EPS of $1.80 reported in Q2 2023 and $2.03 reported in Q1 2024.

Points to note

For Q2 2024, Target has projected a 0-2% increase in comparable sales. In the first quarter, comparable sales declined 3.7%, due to continued softness in discretionary categories and softening trends in frequency categories. Comparable store sales decreased 4.8% while comparable digital sales increased 1.4% last quarter.

Although inflationary pressures and economic uncertainty are likely to weigh on discretionary category trends, there is optimism over a sequential improvement in these trends. Target’s investments in its multi-category assortment and fulfillment options are expected to continue yielding benefits. In Q1, same-day services grew nearly 9% YoY.

In the second quarter, the retailer is anticipated to benefit from its wide range of summer offerings. It has also reduced prices on a large number of items to provide value to customers. This could help in driving top line benefits for the period.

In Q1, the company’s gross margin rate improved by 140 basis points, benefiting from cost savings that offset higher discounts. It also recorded 20 basis points of benefit from inventory shrink last quarter. Like its peers in the retail industry, Target has been taking various steps to tackle inventory shrink. On its last quarterly call, the company said it believes shrink rates are positioned to reach a plateau this year.