When the company reports its third-quarter 2024 results on August 5, before the opening bell, Wall Street will be looking for a profit of $0.65 per share, excluding special items, which represents a four-fold increase from the prior year quarter. The consensus sales forecast for the June quarter is $13.21 billion. In the preceding quarter, earnings exceeded estimates – the third beat in a row – while sales missed, continuing the recent trend.

Outlook

While the food industry is facing a demand slump due to inflation and cautious consumer spending, Tyson Food’s long-term prospects look intact since it has the potential to come out of the temporary slowdown. The management stays focused on constantly innovating the product portfolio, a strategy that should help the business overcome the recent dip in volumes. The company recently closed some of the meat processing plants as part of its efforts to streamline the supply chain and optimize operations.

From Tyson Foods’ Q2 2024 earnings call:

“While we’re not immune to the macro environment, we are taking steps to reduce our exposure to commodity markets. We are expanding our offerings in seasoned and marinated meats to value up our portfolio across beef, pork, and chicken to provide consumers convenience and new flavor options. Across our brands, we are focusing on meeting the consumers where they are by offering convenient restaurant-quality food options at home.”

Flat Sales

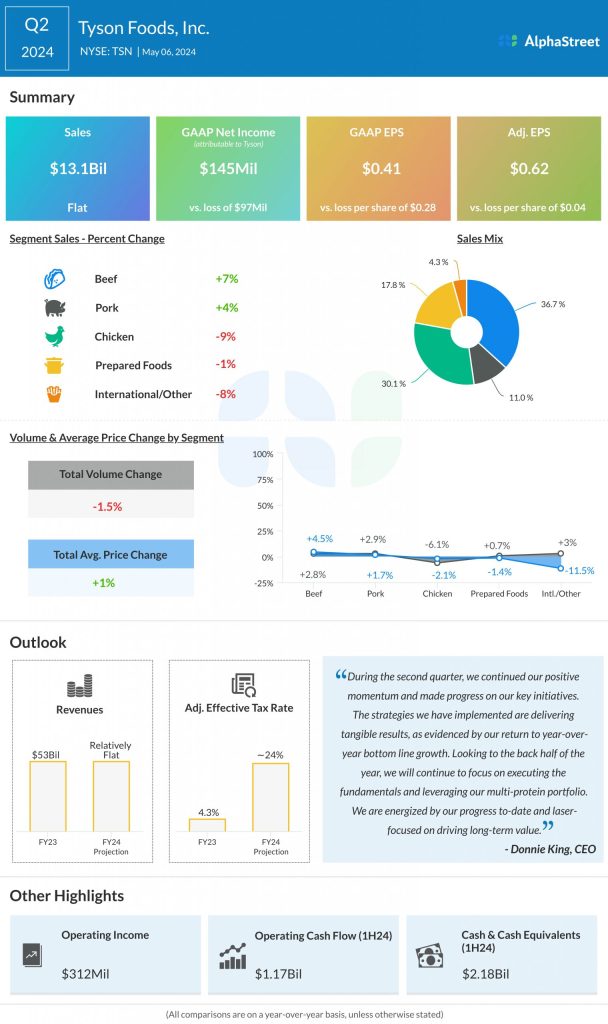

For the second quarter, the company reported total sales of $13.07 billion, which is broadly unchanged from the comparable quarter last year. An increase in the sales of beef and pork was offset by a slowdown in the other categories. It posted earnings of $0.62 per share for the quarter, on an adjusted basis, compared to a loss of 0.04 per share in Q2 2023. On a reported basis, net profit was $145 million or $0.41 per share during the three months, vs. a loss of $97 million or $0.28 per share in the prior-year quarter.

On Tuesday, shares of Tyson Foods opened slightly above $60 and traded higher in the early hours. The current stock price almost matches the value three months ago.