For the second quarter of 2019, Allergan had projected GAAP revenues to be in the range of $3.87 billion to $4.02 billion and adjusted revenues in the range of $3.85 billion to $4.00 billion. The company had estimated Q2 GAAP EPS to come in the range of $0.50 to $0.70 and adjusted EPS in range of $4.20 to $4.40.

Last-reported Quarter

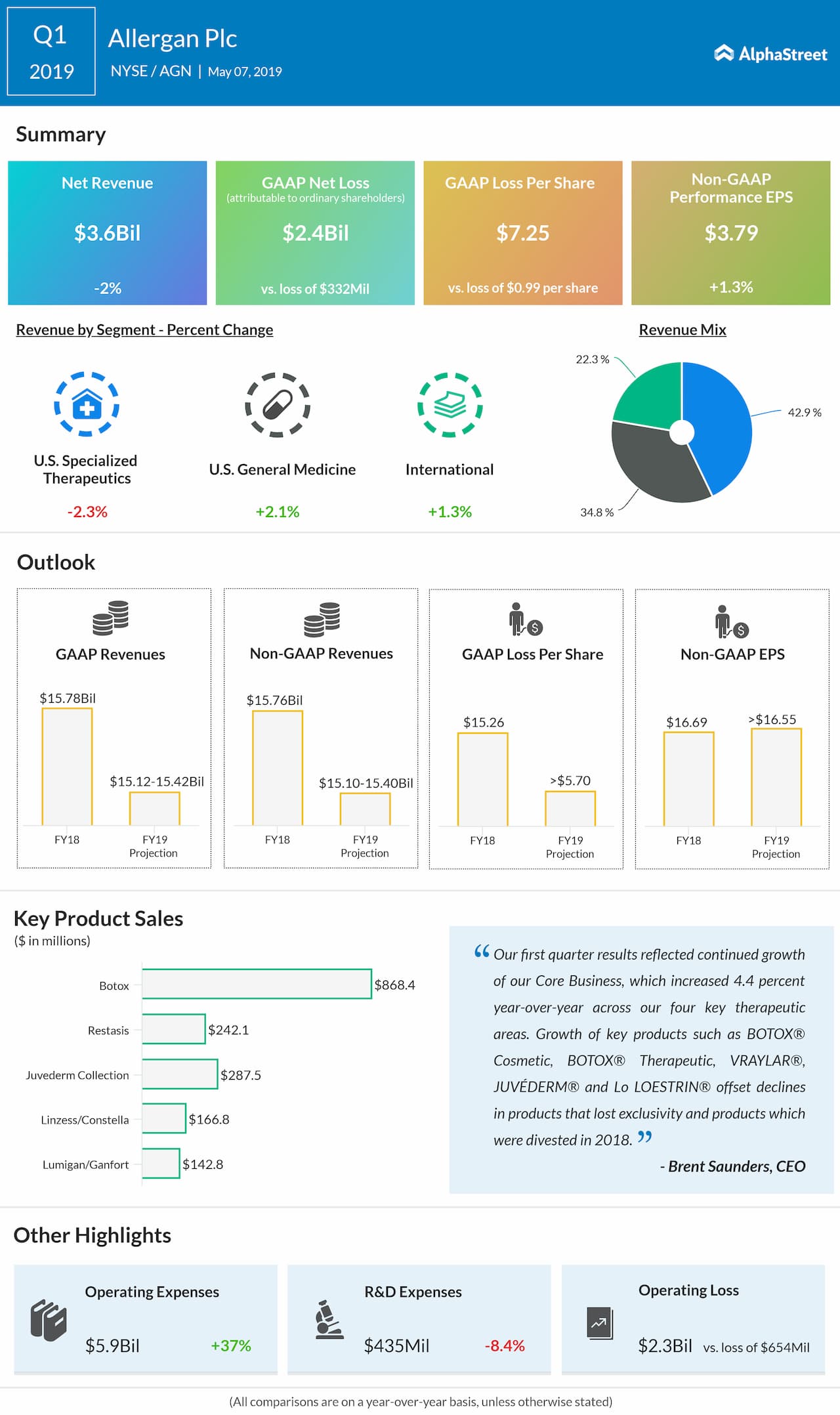

Allergan’s first quarter adjusted EPS of $3.79 and revenue of $3.6 billion surpassed Wall Street’s views. The company’s core business grew 4.4% year-over-year across its four key therapeutic areas, helped by growth of products such as BOTOX Cosmetic, BOTOX Therapeutic, VRAYLAR, JUVEDERM and Lo LOESTRIN.

Recent Developments

On July 17, the FDA accepted the Botox maker’s New Drug Application (NDA) for Bimatoprost Sustained-Release, an implant to treat patients with open-angle glaucoma or ocular hypertension. The FDA is expected to take action on the NDA by the end of the first half of 2020.

On July 24, Allergan announced that is voluntarily recalling BIOCELL textured breast implants and tissue expanders. This global recall was done following an updated safety information from the FDA.

AbbVie-Allergan Deal

After the announcement of AbbVie’s acquisition, which is expected to close in early 2020, Allergan stock soared 25%. AbbVie said that it will acquire the Dublin, Ireland-based company in a cash and stock transaction for $63 billion based on the closing price of AbbVie’s common stock of $78.45 on June 25, 2019.

The combined company will consist of several attractive franchises with leadership positions across immunology, hematologic oncology, medical aesthetics, neuroscience, women’s health, eye care and virology. Allergan’s product portfolio will be enhanced by AbbVie’s commercial strength, expertise and international infrastructure.

Investors will be looking out for more updates from Allergan on this deal tomorrow.

Two weeks ago, AbbVie reported its second quarter results that bettered the market’s predictions. The North Chicago, Illinois-based company also lifted its earnings outlook for fiscal 2019. AbbVie stock had slipped 15% from the date of Allergan deal.

Read: Abbott exceeds Q2 earnings estimates; raises 2019 outlook

Allergan shares, which plunged to a 52=week low ($114.27) on June 17, have increased 20% since the beginning of this year and dropped 14% in the trailing 12 months.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions