Micron derives a significant portion of its revenue from

China and it remains to be seen how much of an impact the pandemic has had on

its topline. Low prices and higher expenses are likely to weigh on margins in

the quarter. Micron also faces tough competition in the industry.

Looking ahead, Micron can be expected to benefit from the rising

demand for data and the rollout of the 5G technology. As machine learning and

artificial intelligence gain in prominence, the demand for data increases.

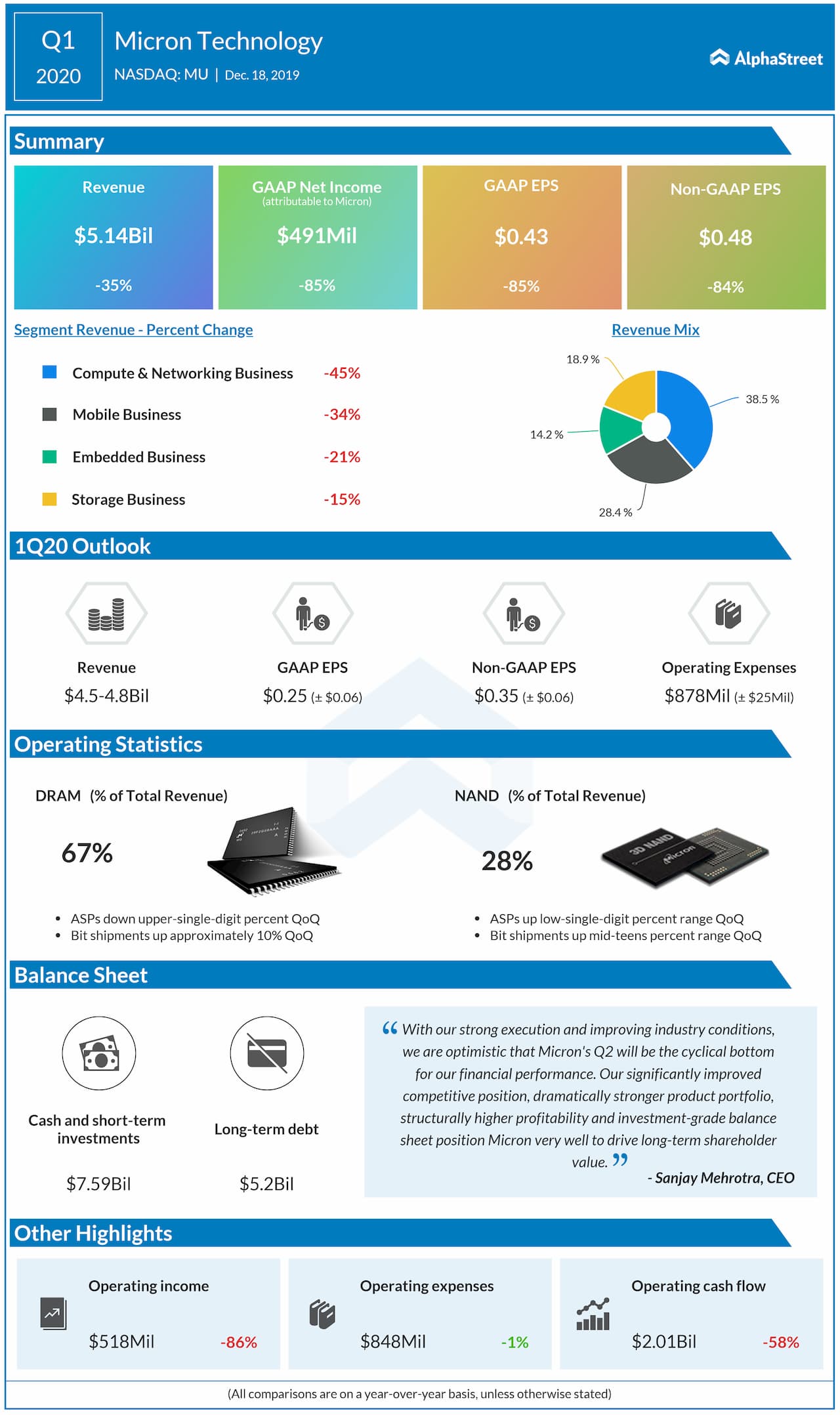

In the first quarter of 2020, Micron beat market estimates

despite recording decreases in revenue and earnings. Revenues fell 35% to $5.14

billion while adjusted EPS dropped 84% to $0.48. The company saw double-digit revenue

declines in all its segments.

For the second quarter, the company has guided for revenues of $4.5-4.8 billion and adjusted earnings of $0.29-0.41 per share. It will be worth watching how much of an impact the current situation will have on the third quarter outlook.

Micron’s stock has dropped 32% since the beginning of this year and 36% in the past one month. If the company beats estimates, the stock could see a pickup.