The company has beaten the quarterly estimates three times in the last year.

Looking Back

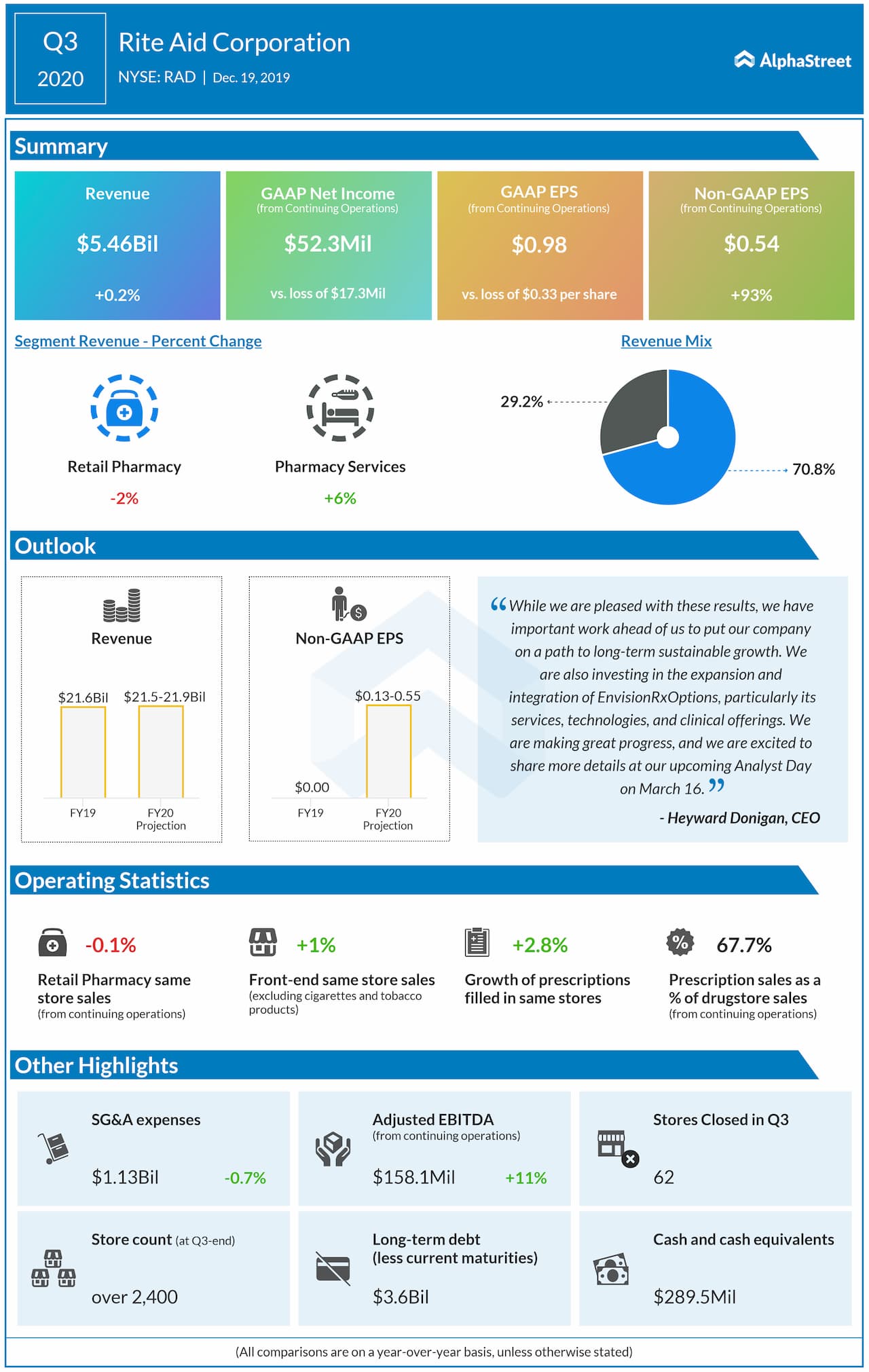

A week after Rite Aid reported strong Q3 results last December, its shares reached a new yearly high ($23.88). The pharmacy retailer reported a profit of $0.54 per share compared to the market’s projected EPS of $0.09. Revenue of $5.46 billion bettered the target of $5.42 billion in Q3.

FY20 Outlook

When the company announced its third-quarter results it had projected fiscal 2020 sales to be in the range of $21.5 billion to $21.9 billion and annual same-store sales growth in the range of 0-1%. Adjusted earnings projected to be in the range of $0.13-0.55. Last month, the company narrowed down its fiscal 2020 revenue outlook. Currently, Rite Aid expects FY20 revenues to be between $21.9 billion and $21.925 billion with same-store sales expected to range from an increase of 1.0% to an increase of 1.1% over fiscal 2019.

FY21 Outlook

During the last month’s analyst day event, Rite Aid projected 2021 revenue to be in the range of $22.5 billion to $22.9 billion and adjusted net income per share to be between a loss of $0.22 and income of $0.19 per share. For the Retail Pharmacy segment, the company expects same-store sales increases to be in the range of 1.5% to 2.5%. Rite Aid estimates to incur restructuring charges of $60 million in fiscal 2021 and spend $350 million in capital expenditures.

Growth Initiatives

The Camp Hill, Pennsylvania-based firm plans to perform physical refreshes on all stores to change their exterior look and invest in fixtures and displays to support merchandising initiatives. The company targets to complete 75 Store of the Future remodels by the end of fiscal 2021 at an average cost of $600,000 per store. These growth initiatives are expected to drive cumulative savings of over $300 million over the next three years and the company expects to incur capital investments of $700 million over the next two years.

Rite Aid, which now wants to penetrate more into the pet care market, is working to expand its selection of prescription and over-the-counter products to support pets.

COVID-19 Update

Rite Aid has been experiencing higher traffic in its physical stores as well as online due to the panic buying in the wake of the recent COVID-19 outbreak. The company has enabled home delivery upon request at all stores and it had waived the traditional delivery service fees. For the consumers who want to pick up their medications quickly, Rite Aid offers a drive-through pickup option at over 50% of its stores.

Earlier this month, Rite Aid announced that it will hire 5,000 associates for full and part-time roles across the US to support store and distribution center teams. The management had hiked the pay of hourly workers in its stores, distribution centers, and RediClinic outlets. As part of this hike, the increase of $2 per hour pay hike will be applicable from March 15 and will last until at least May 2. Current retail store management, including pharmacists, distribution center management and RediClinic professional associates will get a bonus of $1,000.

RediClinic, a wholly-owned subsidiary of the Rite Aid, launched a new telehealth service, RediClinic@Home, for the patients. This will connect patients to RediClinic clinicians through a video chat and help them in getting clinical advice. Currently, the company doesn’t have plans for store closures or altered store hours.

Once the pandemic is over, the retail pharmacy sector is expected to bounce back quickly. The management is expected to share more on the impacts of COVID-19 during its earnings conference call.

Peers Walgreens Boots Alliance (NASDAQ: WBA) and CVS Health (NYSE: CVS) have ramped up their coronavirus testing sites recently. Walgreens reported its second-quarter 2020 results earlier this month and its management said that the sales will be negatively impacted by the low traffic in Q3. CVS Health is yet to report its earnings. RAD stock, which soared 8.42% to $14.16 at the end of today, had dropped 8% from the beginning of this year.