Meta Platforms, Inc. (NASDAQ: META), the parent of popular social media platform Facebook, is all set to bring the next wave of digital revolution by building the metaverse. Of late, the company has been experiencing a slowdown in sales growth amid a decline in enterprise spending on digital advertising.

The tech firm’s unimpressive third-quarter numbers triggered a selloff and the stock slipped below the $100-mark last week. The management’s cautious revenue outlook for the fourth quarter, reflecting the slump in advertising demand globally, contributed to the 25% fall in valuation. META has been in a free fall since peaking more than a year ago.

Stock Falls

Investor sentiment is hit hard by the prolonged downturn, catalyzed by the tech selloff, and the stock is currently trading at the lowest level in around seven years. Experts are of the view that the stock would recoup most of the recent losses in the twelve-month period. The bullish outlook should bring cheer to those looking to buy the current dip. Being a social media market leader with a successful business model, the company’s long-term growth prospects remain intact.

Read management/analysts’ comments on quarterly results

The good thing about the decline is that the valuation has become attractive. Advertising income accounts for the lion’s share of Meta’s revenues, and the company generates enough revenues to remain comfortably profitable, despite weakness in ad demand. With around three billion daily active users, it continues to be the biggest social networking company.

Investing in META

While betting on the powerful Facebook brand, prospective buyers should also weigh the uncertainties facing the business and the broad market. The market’s underwhelming response to Meta’s transition from a social media firm to a metaverse platform shows investors are skeptical about the change in organizational structure. The move assumes significance considering the stiff competition posed by other players like Tik-Tok.

After the historical rebranding, the management is currently taking steps to streamline the business, like intense scrutiny of operating expenses. Meanwhile, cash flows might come under pressure from investments in the business and initiatives like rationalization of the office footprint.

From Meta Platform’s Q3 2022 earnings call:

“One of the things that we have talked about this quarter is some of the new advertising tools that we’ve rolled out, the Advantage+ suite of advertising tools. We’ve started those in particular with the e-commerce and retail verticals, in particular the Advantage+ shopping tool that we’ve launched, which basically enables advertisers to, A, easily access a lot of disparate features of our product and then, B, use sort of new machine learning on technology.”

Key Numbers

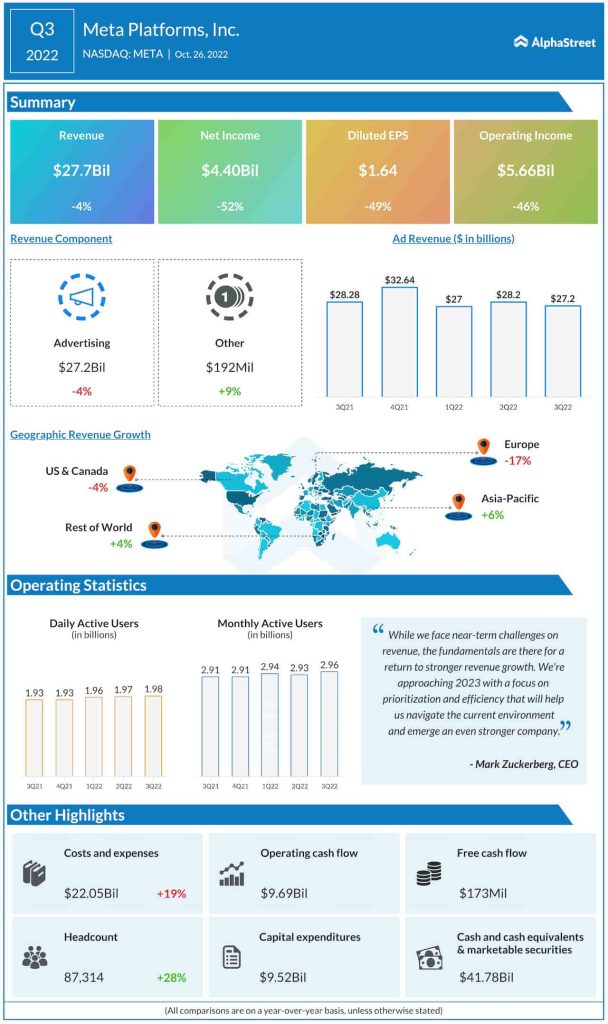

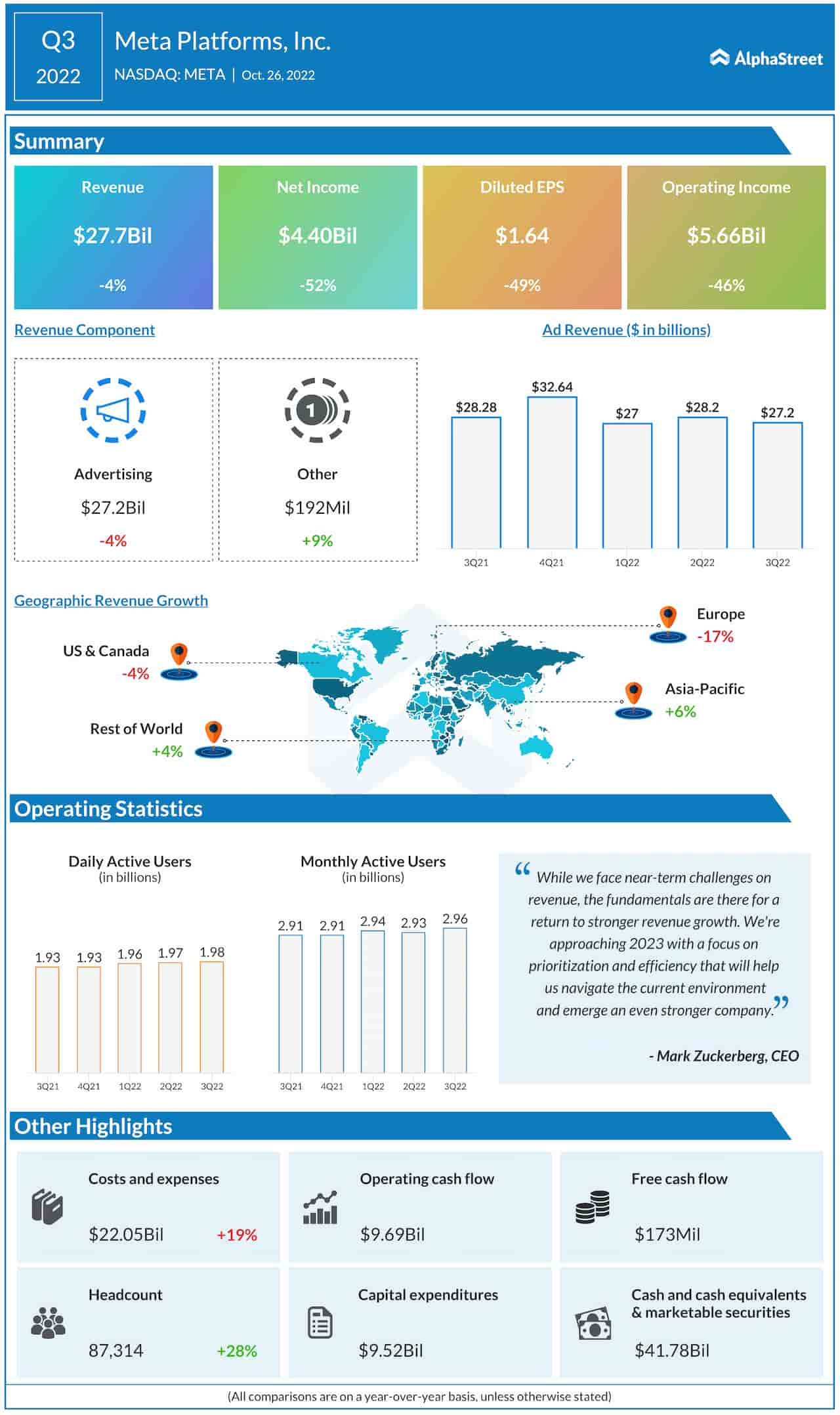

Meta’s earnings missed consensus estimates for two consecutive quarters, which marks a deviation from the long-term trend of regular beats. In the third quarter of 2022, earnings decreased sharply to $1.64 per share, hurt by a 4% drop in advertising revenues to about $27 billion. The company had 2.96 billion monthly active users at the end of the quarter.

Earnings Infographic: Microsoft Q1 revenue up 11%; earnings beat

Shares of Meta are among the worst affected by the market downturn and macroeconomic uncertainties. The stock, which has lost about 71% so far this year, traded higher on Tuesday afternoon.