Meta Platforms, Inc. (NASDAQ: META) is scheduled to report third-quarter results on Wednesday, after the closing bell. The social media giant’s continued AI push has recently attracted more advertisers to the platform, giving a big revenue boost amid concerns about its growing investments in the metaverse, which is still in the development stage.

In early October, the company’s stock peaked and traded close to the $600 mark, before paring a part of those gains in the following weeks. Of late, the stock has been maintaining a steady upward momentum, with aggressive AI initiatives and prospects of the Meta ecosystem driving investor confidence. According to the leadership, Meta AI would soon become the most widely used AI assistant. Even though META is currently valued higher than its historical average, it remains a good long-term investment due to the strength of the business and market dominance.

Bullish Forecast

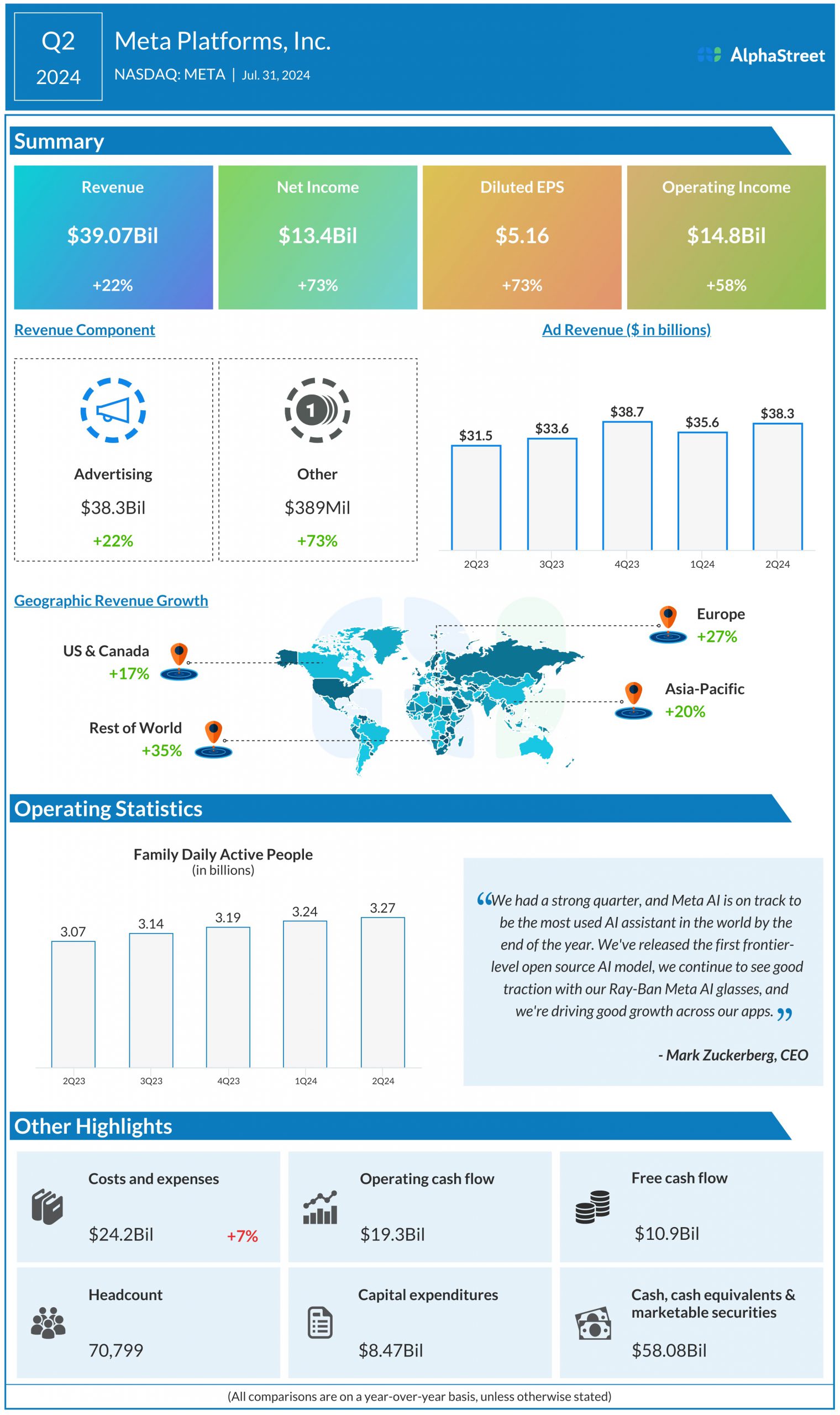

As the company prepares to report third-quarter 2024 results on October 30, analysts predict earnings of $5.24 per share, which is up 31% from what it earned in the corresponding period a year earlier. It is estimated that September-quarter revenue grew by a fifth year-over-year to $40.27 billion. In the second quarter, both earnings and the top line beat estimates, continuing the trend seen over the past several quarters.

Meta’s core business is performing quite well, aided by the steady growth in advertising revenue. There has been a significant increase in engagement on the company’s various platforms, encouraging advertisers to spend more on them. Meanwhile, its capital spending continues to focus on the metaverse, a mega project that is expected to take some time to deliver returns due to the extensive development process. Recently, the company unveiled its much-hyped mixed-reality headsets and smart glasses at the Meta Connect event, promising users an all-new AI experience.

“The growth we’re seeing here in the US has especially been a bright spot. WhatsApp now serves more than 100 million monthly ‘actives’ in the US, and we’re seeing good year-over-year growth across Facebook, Instagram, and Threads as well — both in the US and globally. I’m particularly pleased with the progress that we’re making with young adults on Facebook. The numbers we’re seeing, especially in the US, really go against the public narrative around who’s using the app,” Meta CEO Mark Zuckerberg said during a recent interaction with analysts.

Ad Power

In the three months ended June 30, 2024, advertising accounted for more than 95% of Meta’s revenue which increased 22% year-over-year to $39.07 billion. Revenue grew in double-digits across all geographical divisions. Consequently, Q2 profit surged 73% annually to $13.4 billion or $5.16 per share. Family Daily Active People, a metric that measures the number of unique users who log in and visit at least one of the company’s core products on a given day, rose to $3.27 billion in the second quarter.

Meta stock gained about 2% in early trading on Friday and stayed sharply above its 52-week average price of $463.48. The value has more than doubled since July 2023.