The company, the maker of popular design suite AutoCAD, has been doing quite well in the stock market, but there is apprehension that the stock may have peaked and the current valuation is a bit too high. While the consensus target price points to flat performance in the coming months, experts are quite optimistic about the stock’s ability to create value. According to them, very few stocks would have the potential to match Autodesk’s performance this year, given the unfavorable market conditions.

On Growth Path

There is no doubt that long-term investors would take a cue from the buy rating and consider adding the stock to their portfolio. The bullish outlook and Autodesk’s impressive track record shows the rally is not yet over. Last year, it delivered returns that exceeded the market’s average while continuing its dominance in the Architecture, Engineering & Construction market.

Autodesk’s ramped-up software comes with several new features, giving it an edge over competitors. But that does not mean the Mill Valley, California-based design firm is fully resilient to the market turmoil – several of its customers are affected by the supply chain disruption and such firms tend to cut spending on technology to preserve cash.

High Demand

The good news is that design software is an integral part of the manufacturing, architecture, and engineering sectors, so it is essential for existing customers to renew their licenses to continue using Autodesk’s products. And, the shift to subscription and cloud-based business model bodes well for the company as it ensures stable revenue generation. Moreover, the company continues to innovate and maintains a strong pipeline. That helps it take advantage of the new wave of enterprise software spending.

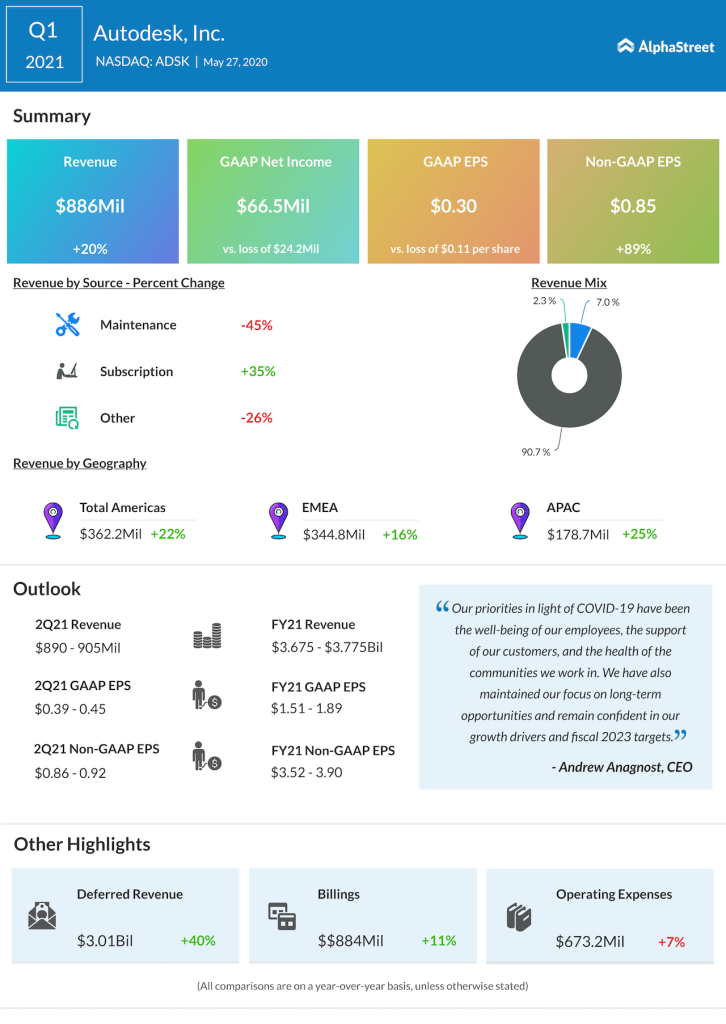

Autodesk had an impressive start to fiscal 2021, which the company owes to the stable performance of its core subscription business, which grew about 35% in the first three months of the year. First-quarter revenues grew in double digits to $886 million, driving up earnings by 89% to $0.85 per share. Overall, the outcome was in line with the solid performance seen throughout last year.

Revit Issue

Meanwhile, there are certain areas of the business that need prompt attention, considering the volatile market conditions. The management recently faced criticism from architects for what they claimed mediocre performance by the company’s building information modeling software Revit, despite the high costs involved in owning and maintaining it. Coinciding with that, the company struck a deal to acquire Pype, a platform that provides cloud-based solutions for construction project management workflows.

Read management/analysts’ comments on Autodesk’s Q1 results

After a short-lived pullback during the early days of COVID, Autodesk’s shares witnessed a surprise rally and hit a record high last month. The company’s value grew 56% since last year and the stock outperformed the market in recent months.