Clash of Titans

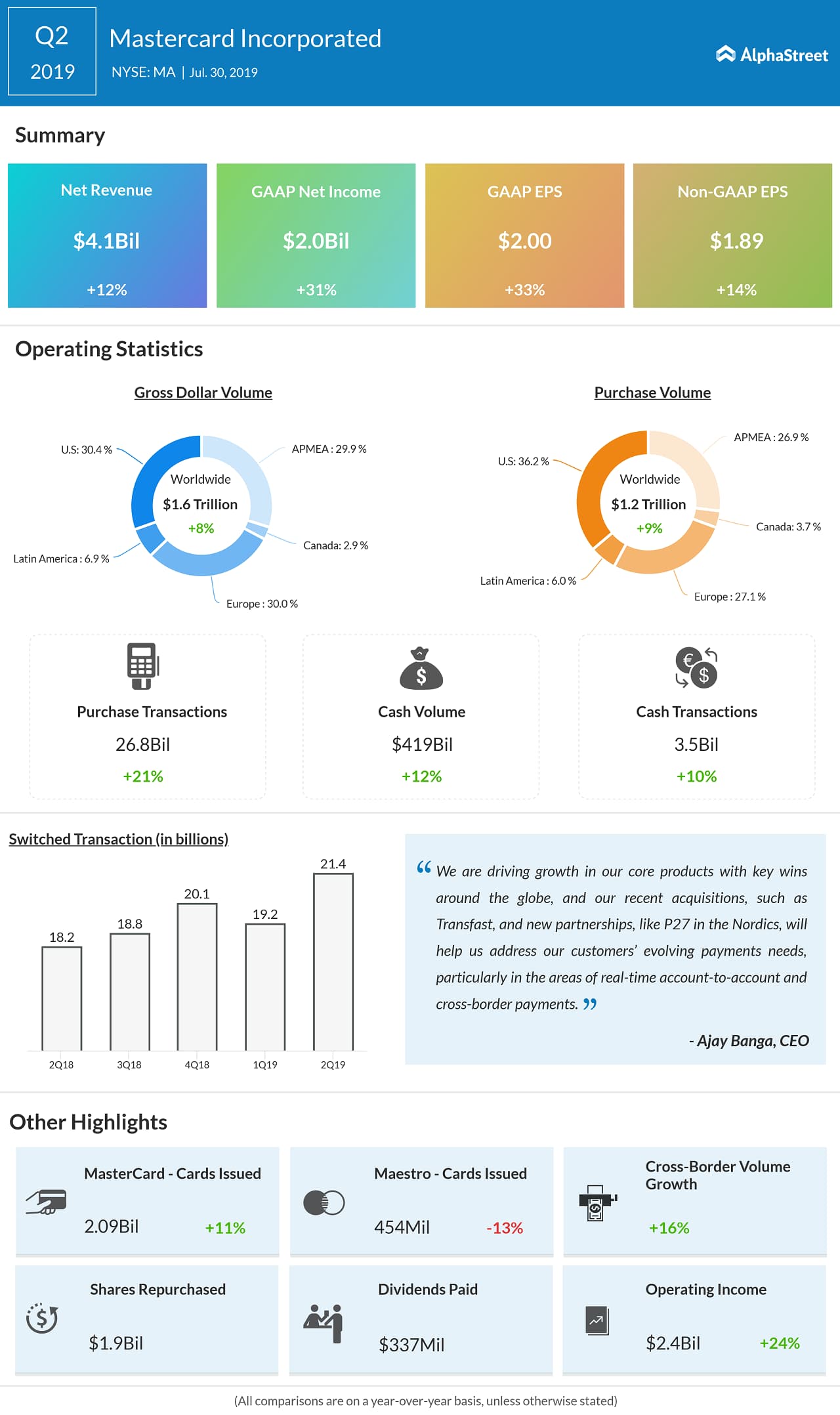

Though it is difficult to pick the better performer of the two, their business strategies indicate where the companies are currently headed. Having managed to catch up with Visa, which enjoyed a clear lead for long, Mastercard is probably marching to the top. Both companies registered double-digit earnings and revenue growth in their most recent quarter. Mastercard recorded a bigger bottom-line number compared to Visa, aided by its robust cross-border business.

Though there is a striking similarity in the performance of the stocks, Mastercard consistently outperformed its rival and trades at a significantly higher price of about $275. Both the stocks hit new highs this month and Visa crossed the $180-mark yet again. American Express (AMX), which follows a slightly different business model and works on a smaller network, trades at a distant third place.

Cross-border Bet

The strength of cross-border payments gives Mastercard an advantage over others in terms of profitability and market value, which the company is expected to sustain in the foreseeable future. Since the fintech firm has already established in the international market, it faces little threat from rivals who will find it difficult to grab market share due to the entry barriers. The relatively low risk and potentially high returns make Mastercard an investment option worth considering.

Also see: Visa Inc. Q3 2019 Earnings Conference Call Transcript

The recently launched Mastercard Track Business Payment Service is a key initiative that would allow the company to tap the growing market for business-to-business payments. It needs to be noted that the commercial payments space is yet to shun the conventional system and take the digital route.

E-commerce Highway

The fact that e-commerce is growing at a faster rate in emerging markets bodes well for the credit card giant as the lion’s share of the digital transactions expected to take place in the future will be processed by it. The positive economic momentum in the emerging markets, marked by people’s improving spending power, will catalyze the shift to cashless payment modes. Another factor that will add to Mastercard’s growth prospects is the penetration of smartphone point-of-sale systems.

Related: MasterCard Q2 2019 Earnings Conference Call Transcript

Taking a cue from the positive trend, almost all of the analysts following the Mastercard stock recommend buy, with a 12-month price target of around $317 that represents a 15% upside from the current level. The stock has risen about 45% since the beginning of the year and hit a record high last week.