Is it a Buy?

The current weakness is unlikely to persist, considering the accelerated shift to digital payment. So, MA has the potential to bounce back and reach new highs. But the high valuation is a concern, as prospective investors might find the stock a little too expensive. Market watchers, in general, are optimistic about its growth prospects and forecast robust growth in the next twelve months. MA has outperformed the market regularly in recent years.

The ongoing improvement in labor market conditions and wage growth are having a positive effect on consumer spending, and that bodes well for credit card companies. Also, recent economic data show that the Federal Reserve’s efforts to tame inflation through monetary tightening have started bearing fruit. However, there is lingering inflation pressure, which together with persistent economic uncertainties would compel people to tighten their family budgets.

Travel Recovery

International travel is picking up momentum and countries are opening their borders to visitors. The convenience and perks associated with credit card transactions, especially while traveling and engaging in leisurely activities, are making it a preferred payment mode for more and more people. Interestingly, a huge growth opportunity awaits credit card companies because the cash-to-digital shift is still at a nascent stage.

“We’re monitoring the environment closely and are ready to adjust investment levels, as appropriate, while maintaining focus on our key strategic priorities. As a reminder, these priorities are, one, expanding in payments; two, extending our services; and three, embracing new networks. First, we’re expanding in payments by continuing to win deals with a diverse set of customers, powering growth and acceptance, capturing a prioritized set of new payment flows, and exploring new ways to ensure payment choice by leveraging multiple alternatives…,” said Mastercard’s CEO Michael Miebach at the Q2 earnings call.

Double-digit Growth

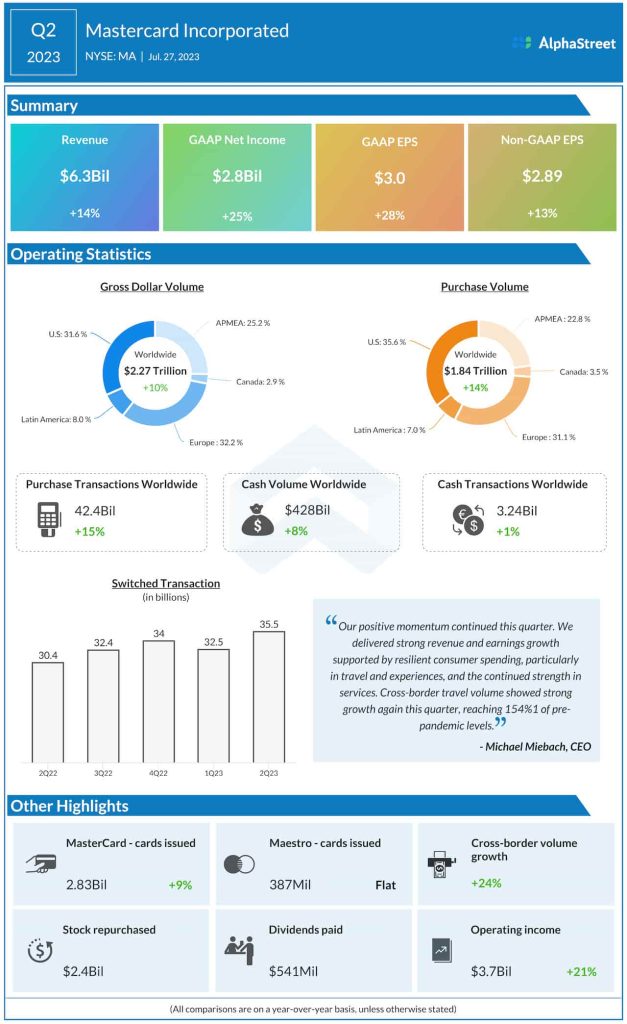

Mastercard’s earnings topped expectations for the fourth time in a row. In the second quarter of 2023, revenues also exceeded estimates, rising 14% year-over-year to $6.3 billion. Consequently, there was a 13% increase in adjusted earnings to $2.89 per share. Worldwide gross dollar volume and purchase volume increased by 10% and 14% respectively.

After starting the week on a low note, the stock is struggling to regain momentum. However, it traded slightly higher on Thursday afternoon.