Q3 results

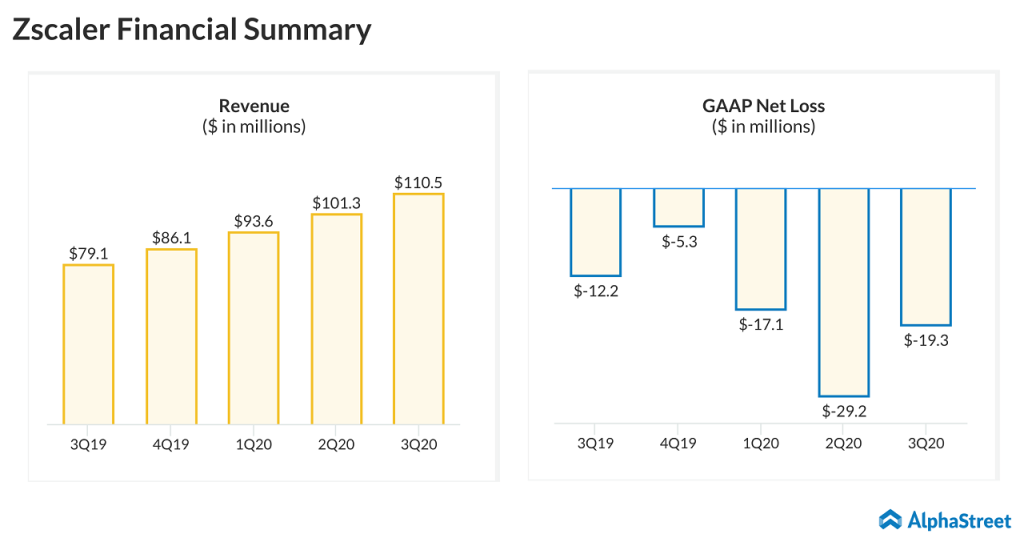

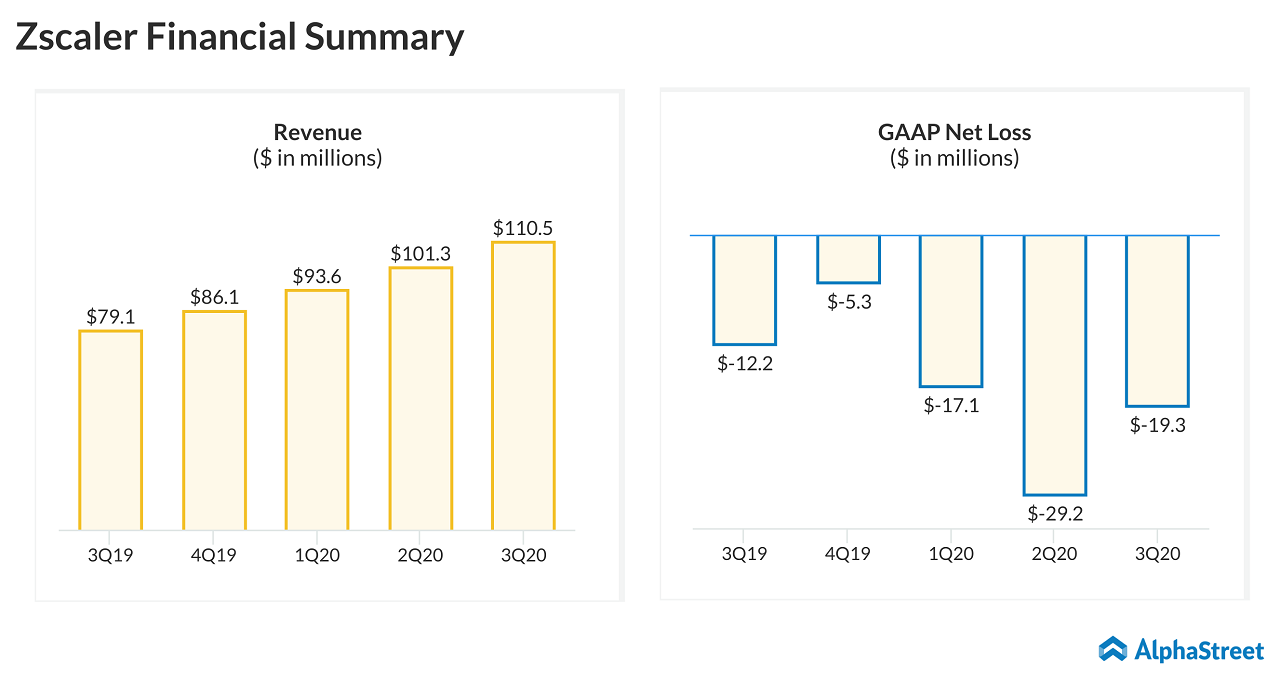

The company once again beat the analysts’ estimates by earning 7 cents per share compared to the estimated earnings of 2 cents per share on an adjusted basis. Net loss expanded to $19.3 million or $0.15 per share on a GAAP basis, from a net loss of $12.2 million or $0.10 per share in the prior-year quarter. Revenue grew 40% and billings grew 55% year-over-year.

Zsclaer offers two solutions. Zscaler Private Access (ZPA) provides secure access to internally managed applications that are hosted internally in data centers or in private or public clouds, and Zscaler Internet Access (ZIA) enables users to connect to externally managed applications, including SaaS applications and internet destinations regardless of device, location or network.

[irp posts=”63259″]

As quarantine orders went into effect around the globe in March, Zscaler had strong growth in both ZIA and ZPA during the quarter. Especially, ZPA contributed 43% of new and add-on business compared to approximately 20% in the first half of fiscal 2020. Growth was broad-based across all the verticals, with notable strength in financial services.

Impacts of COVID-19

Zscaler stated that many new and existing customers deployed more number of new ZPA users in Q3. Deployment of ZIA services also accelerated in Q3 due to COVID-19. The company didn’t experience a negative impact on its topline results as a result of the massive increase in work from home culture. The dollar-based net retention rate stood at 119% for the quarter and benefited from increased adoption of ZPA with existing customers.

During the earnings call, CFO Remo Canessa stated:

“We have not seen any meaningful pressure on renewals, receivable collections to-date due to COVID-19, though the long-term impact on our customers and partners is not fully known. Renewals due in the next 12 months to 18 months may face downward pressure, depending on how the economy recovers. Our overall exposure to industries particularly impacted by COVID-19 like transportation, hospitality, retail and leisure, where workforce reductions have been announced publicly is less than 10%.”

Hiring

In Q3, Zscaler hired a record number of field sales reps and also built out strong sales leadership at the higher levels. During the conference call Q&A session, management said that it is planning and expecting to get the 60% field sales rep growth. Zscaler increased sales productivity in third quarter and recruited cloud-focused channel partners to drive further sales leverage.

Outlook

For fiscal 2020, Zscaler expects revenue in the range of $422 million to $424 million, representing a growth of 39% to 40%. Calculated billings are expected to grow annually by 36% to a range of $529 million to $531 million. Non-GAAP EPS is targeted to be in the range of $0.20 to $0.21 in FY20.

[irp posts=”62958″]

For the fourth quarter of fiscal 2020, revenue is touted to

be between $117 million and $119 million, while non-GAAP EPS is projected to be

$0.02 to $0.03.

The acquisitions of Cloudneeti and Edgewise Networks are expected to have an immaterial impact on revenue in Q4 and fiscal 2021, as they are early-stage companies. The cash purchase price of Cloudneeti, which closed in mid-April was $9 million, and the cash purchase price of Edgewise, which closed in May, was $31 million.

In the current uncertain situation, no company will be able to accurately predict the long-term impact of the pandemic. However, as the digital transformation is increasing day-by-day, it’s obvious that the companies providing cloud security services will grow in the near future. When answering a question on the company’s future, Zscaler CEO Jay Chaudhry said,

“If you look at what COVID has done, it has forced everyone to work from home. It is accelerating digital transformation and that’s a market we were designed to address. So, we are getting benefit from COVID-19, as every customer had to work from home and you saw a number of examples where we enabled so many customers literally overnight or over a week or two weeks. So, it’s helping us. Now, the next question ends up being, what happens after two or three months? We think the changes that CIOs, CTOs are seeing with transformation, with being able to work from home, they are actually accelerating their transformation.”

Read the entire Zscaler (ZS) Q3 2020 earnings call transcript