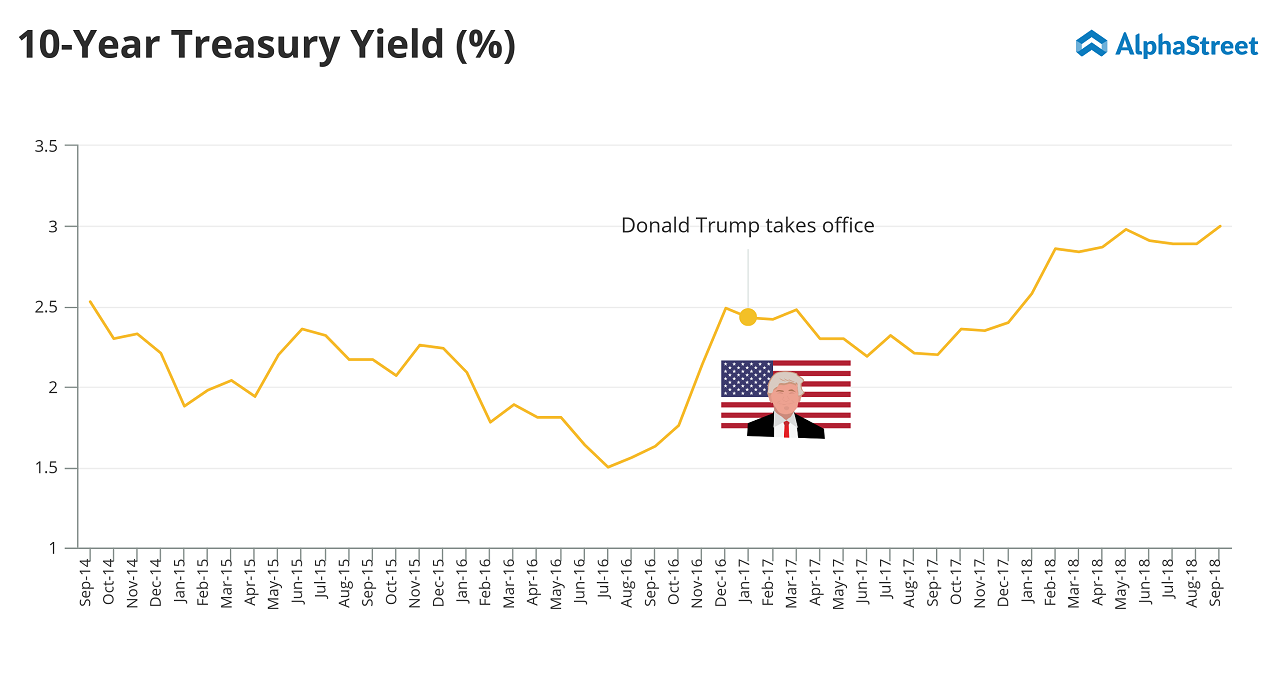

Two of the major factors that drive banks downside are credit risks, and increasing loan losses reserve. And none of them is happening now. When we take the past seven years, the 10-year treasury yield rates are at their highest level. In the infographic below, you can see that when we take monthly rates, they are hitting a ceiling when compared to rates since September 2014.

Along with these favorable factors, the Trump administration’s dubious yet masterful stroke of tax cuts benefitted the banking sector. The tax cuts are expected to drive in 30% of the revenue, which also makes banking a good investment in the short term.

Three major banks are touted to post strong earnings on Friday; JPM stock is already up 7% this year. Citi has beaten the earnings consensus four times in the past year, while Wells Fargo is looking good, especially after a proactive rebranding effort.

There is a lot of upside to be expected in what looks to be a good week for financials. While corporate rates might affect bank earnings, net interest margin is expected to offset it. And any other interest debts are expected to be balanced off by yields on bond portfolios.

In the earnings call, be on the lookout for questions on how the strong dollar is translating to the American banking sector, and how the various foreign policies will contribute to the financial sector, especially the trade tensions between the US and China, and between America and the European bloc.

While short-term investments are looking good, it is better to vary in the long-term, as these financial institutions might suffer a dip in the absence of the tax gain it had this year. Given the chunky contribution of the tax reform, it is expected that 2019 might bring in a sudden dip in the sector.

Do check out our earnings previews on the major banks later this week and the bank earnings coverage starting Friday.

(DISCLAIMER: This is an opinion-based article based on the author’s views. AlphaStreet does not necessarily share the same views expressed in this article)