And this also reflects in last quarter’s results for gunmaker American Outdoor Brands Corp (AOBC).

Smith & Wesson parent American Outdoor Brands Corporation is estimated to report its fourth-quarter earnings in the first week of July. Their last quarter results were heavily impacted by a massive slide in free cash flow as well. A slump in orders led to lower shipments, worsening things further. Firearms veteran Remington’s sudden demise (bankruptcy) did not help matters as well.

The word on the street is that gun stocks like Sturm Ruger & Co. (RGR) and AOBC tend to outperform after mass shootings, but with the current political scenario, this theory is seeing cracks.

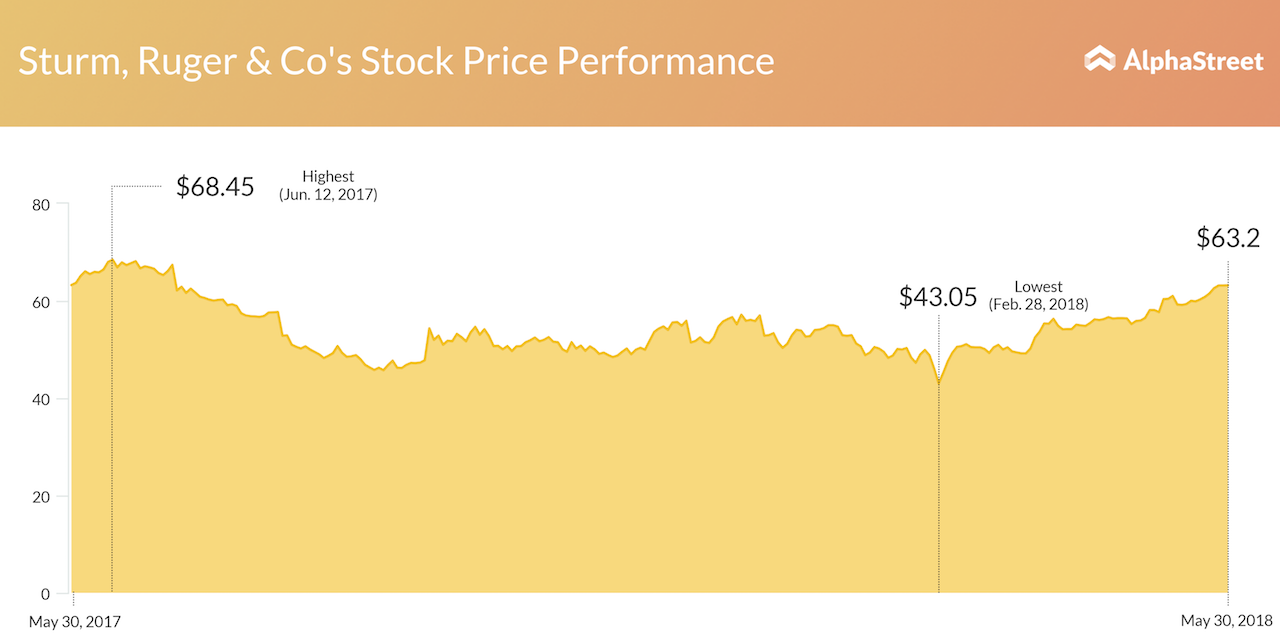

The Smith & Wesson parent is still struggling with a stock price almost half of what it was in June last year. Sturm Ruger, however, seems to have picked up steam. Lower expectation helped its case though, with the firearm maker posting slightly better-than-expected earnings if $0.81 per share for the quarter that ended this March. Revenue for the quarter was $131.2 million, beating the Street estimate of $127.5 million, as it posted results early this month.

While it remains to be seen on how the absence of a significant legislative threat could affect firearm sales, it is safe to say that the stocks would not hit any surprise highs this quarter. With more calls to boycott NRA social movements picking up steam, there is also a sudden aversion to invest in gun stocks – the recently transpired events adding fuel to the fire. Maybe, NRA did shoot itself in the foot by giving people the confidence that the right to bear arms might not be taken away, after all.