Winnebago had a strong start to fiscal year 2019, helped by momentum in the North American RV business and the positive integration of the Chris-Craft business into its portfolio. The company saw sales and retail market share growth on the RV side.

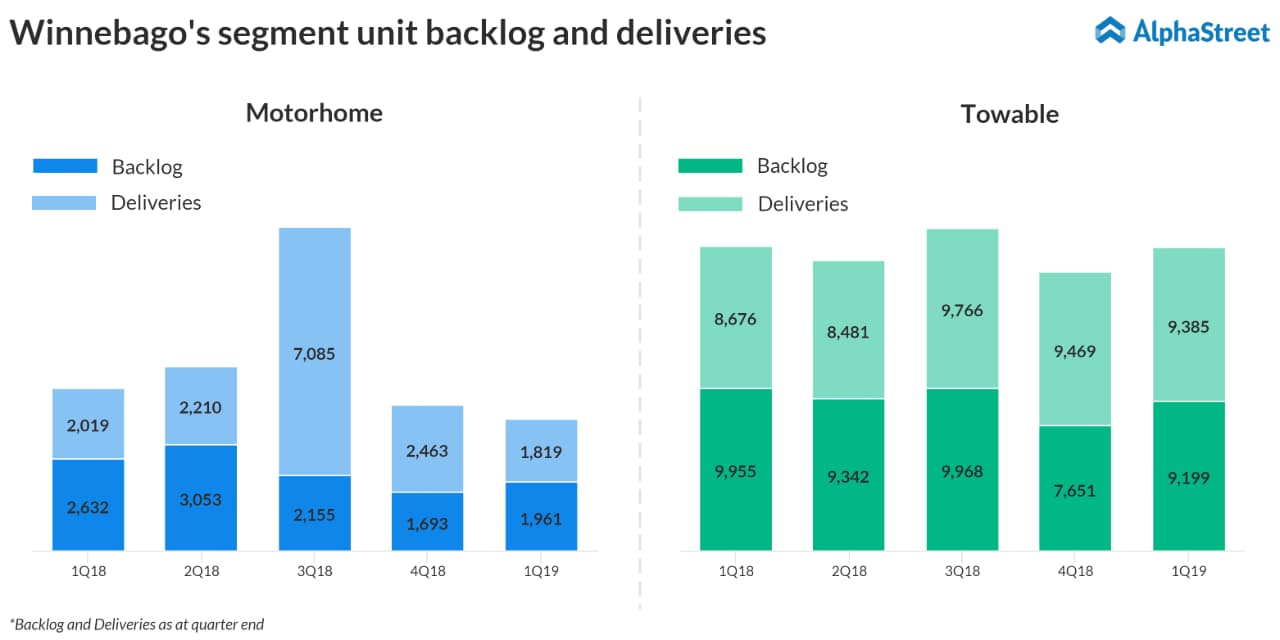

Revenues in the Motorhome segment fell 3.6% year-over-year to $181.3 million. Backlog decreased 23.6%, in dollars, from last year, reflecting rental unit and new product order timing as well as a challenging late fall shipment environment.

Revenues for the Towable segment grew 12.8% to $292.8 million versus last year, driven by strong organic unit growth across the Grand Design RV branded line and pricing. Backlog levels fell 3.9%, in dollars, due to a rebalance from high backlog levels in Q1 2018 and utilizing additional capacity added during calendar 2018 as well as a challenging late fall shipment environment.

Last week, the company declared a quarterly cash dividend of $0.11 per common share, payable on January 23, 2019 to shareholders of record on January 9, 2019. The annualized dividend rate of $0.44 per share represents an increase of 10% over the 2018 dividend.