Stock Dips

The Adobe Creative Cloud got a major boost from the introduction of advanced applications like Express and Firefly, which have been a hit among users since the recent launch. Firefly-powered features are integrated into Creative Cloud Apps to deliver more creative power to users. Continued heavy investments to enhance the technology platform should help the company take full advantage of the shift to AI-supported design. Also, the recent price hike, which will come into effect later this year, would drive margin growth.

Strong Q3

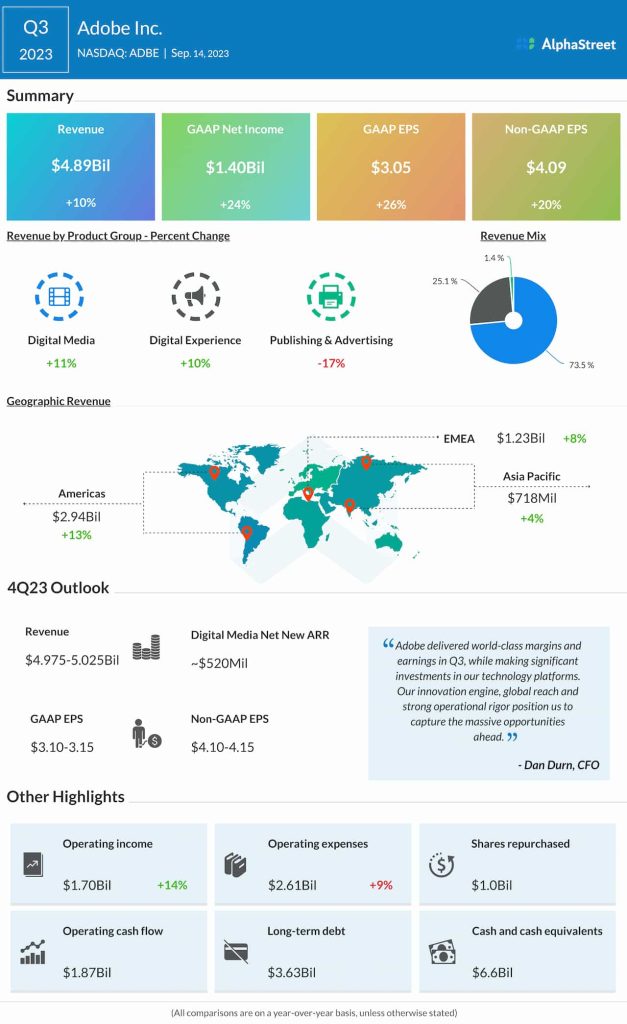

In the August quarter, revenues came in at $4.89 billion, compared to $4.43 billion in the same period of last year. Revenues of Digital Media and Digital Experiences, the main business segments, rose 11% and 10% respectively. That was partially offset by a 17% fall in Publishing and Advertising revenue. Revenues grew across all geographical divisions.

The top-line growth translated into a 20% growth in adjusted earnings to $4.09 per share. On an unadjusted basis, net income was $1.40 billion or $3.05 per share, compared to $1.14 billion or $2.42 per share in the year-ago period. The numbers came in above analysts’ forecast, continuing the long-term trend.

From Adobe’s Q3 2023 earnings call:

“On the Creative side, digital content creation and consumption are exploding across every creative category, customer segment, and media type. Creative Cloud is the leading creativity platform, offering a comprehensive portfolio of products and services for every discipline across imaging, photography, design, video, animation, and 3D. We’re excited about the growth we are driving with our creative flagship products, and with Adobe Express, our AI-first, all-in-one creativity app that makes it fast, easy, and fun for any user to design and share standout content.”

What’s in Cards

Anticipating the momentum to continue, the management expects revenue to be in the range of $4.975 billion to $5.025 billion in the final three months of the fiscal year. The guidance for fourth-quarter adjusted earnings per share is $4.10-$4.15. The company is looking for Digital Media Net New ARR of approximately $520 million for Q4.

The post-earnings downturn continued on Monday and Adobe’s stock traded lower in the early hours of the session. In the past six months, ADBE has grown about 50%.