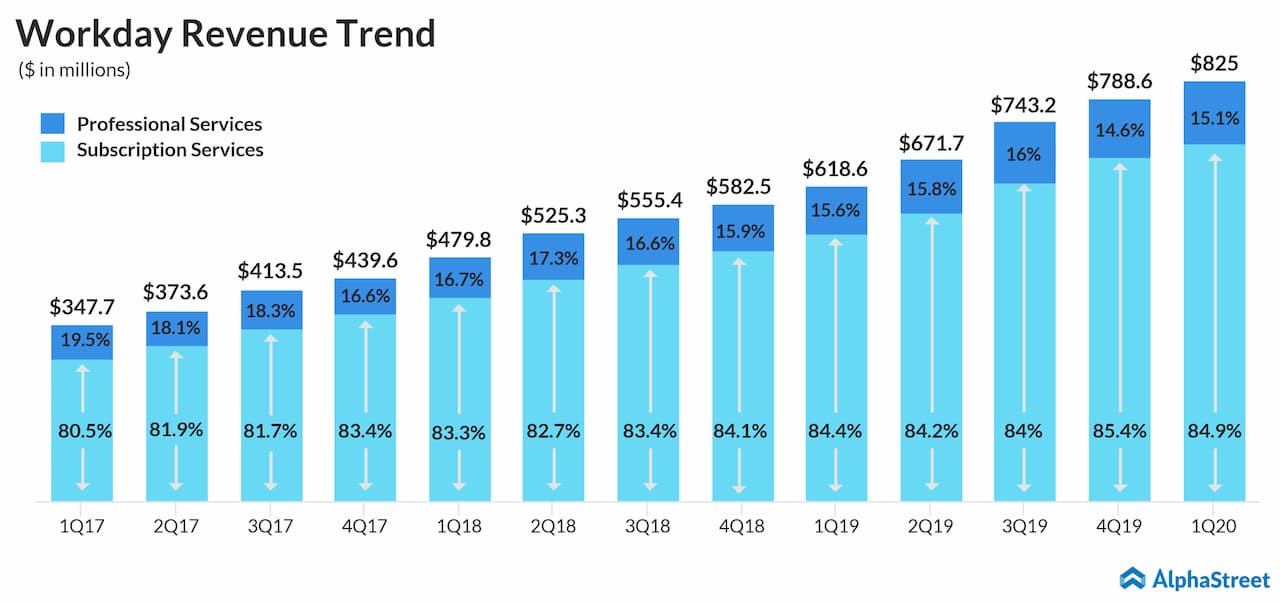

Workday had projected Q1 revenue to be in the range of $812 million to $814 million, with subscription revenue of $692 million to $694 million.

“Based on our strong first quarter results, we are raising our fiscal year 2020 outlook for subscription revenue to $3.045 to $3.060 billion, or growth of 28%. We expect our second quarter subscription revenue to be $746 to $748 million, or growth of approximately 32%,” said CEO Aneel Bhusri. Earlier, the company had projected FY20 subscription revenue to be in the range of $3.030 billion to $3.045 billion.

Also read: Nutanix (NTNX) to report Q3 results on May 30

Workday opened its new 410,000-square-foot headquarters in Pleasanton on May 13. The new campus will include a 16,000-square-foot Workday Customer Center, which is scheduled to open this summer.

Shares of Workday have advanced 33% since the beginning of 2019 and 62% in the past 52 weeks.