Enterprise software company Workiva (WK) Wednesday reported stronger than expected revenues for the fourth quarter. Consequently, the bottom line improved to a greater extent than estimated.

The Ames, Iowa-based company reported flat earnings for the fourth quarter, on an adjusted basis, compared to a loss of $0.19 per share in the same period a year earlier. Market watchers were expecting a loss for the most recent quarter.

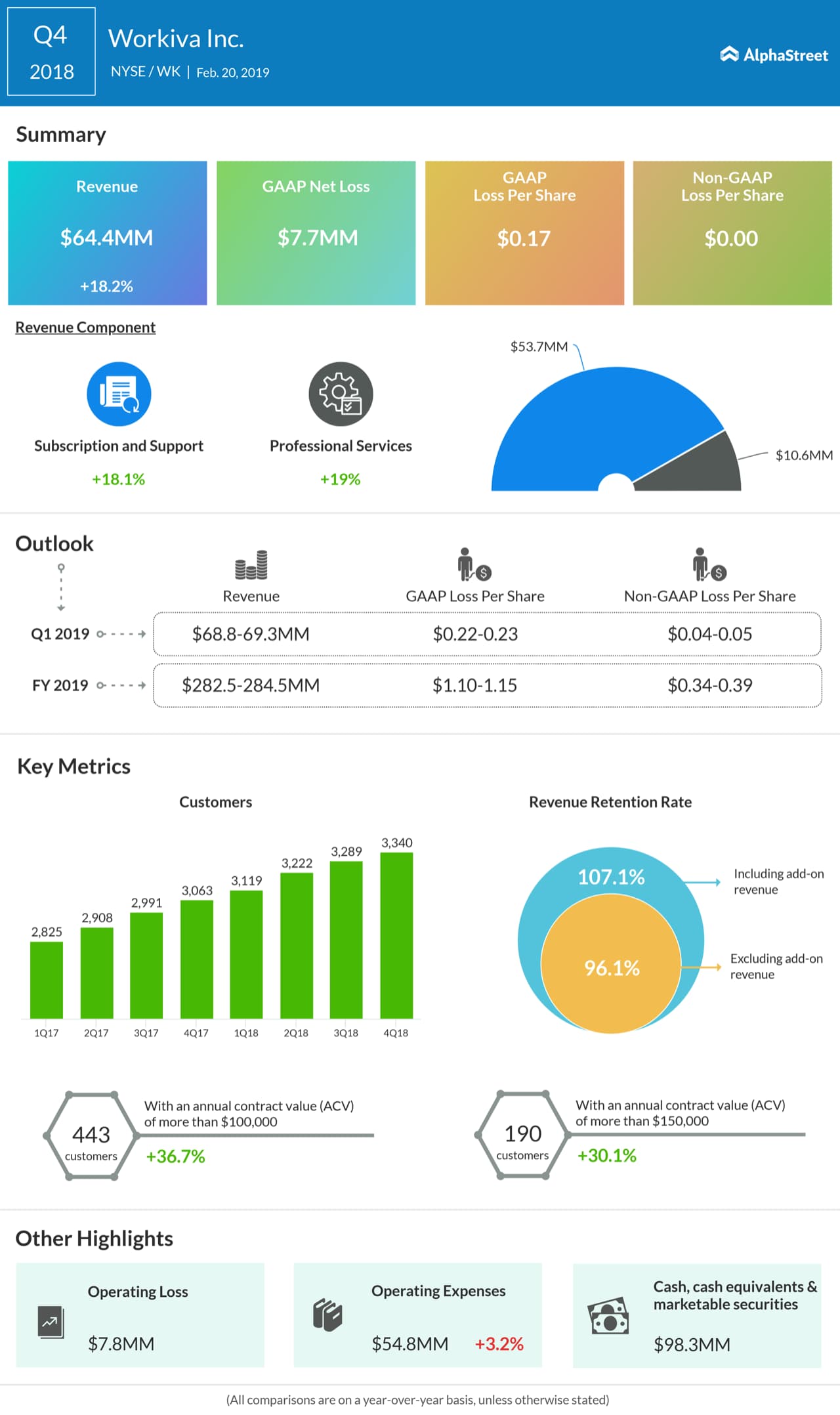

On an unadjusted basis, Workiva reported a net loss of $7.71 million or $0.17 per share for the December quarter, marking an improvement from the year-ago quarter when the loss was $14.32 million or $0.34 per share.

A double-digit growth in the key business segments pushed up revenues by 18% to $64.4 million. Analysts were looking for slower growth. Subscription and Support revenue surged 18.1% annually to $53.78 Million, while Professional Services revenue advanced 19% to $10.66 million.

Double-Digit growth in the key business segments pushed up fourth-quarter revenues by 18% to $64.4 million

Workiva’s CEO Marty Vanderploeg said, “We posted strong results for the fourth quarter and full year 2018. Operating margin improved significantly in the quarter, and we outperformed our guidance for revenue, operating loss and loss per share. We remain committed to achieving profitable growth over time.”

As of December 2018, the company had 3,340 customers, which is higher by 9% compared to the corresponding period a year earlier.

Looking ahead, the management expects cash flow from operations to improve significantly in 2019. Revenues are expected to be between $282.5 million and $284.5 million this year, while adjusted loss is forecast in the $0.34- $0.39 per share range. Unadjusted loss is estimated to be between $1.10 per share and $1.15 per share.

Also see: Workiva Q3 2018 Earnings Conference Call Transcript

The company is expected to record an adjusted loss between $0.04 per share and $0.05 per share for the first quarter when revenues are estimated to be in the range of $68.8 million to $69.3 million. Unadjusted loss is forecast to be between $0.22 per share and $0.23 per share.

Workiva’s shares closed Wednesday’s trading up 1.05%, after hitting a record high during the session. Their value of the stock more than doubled in the past twelve months.