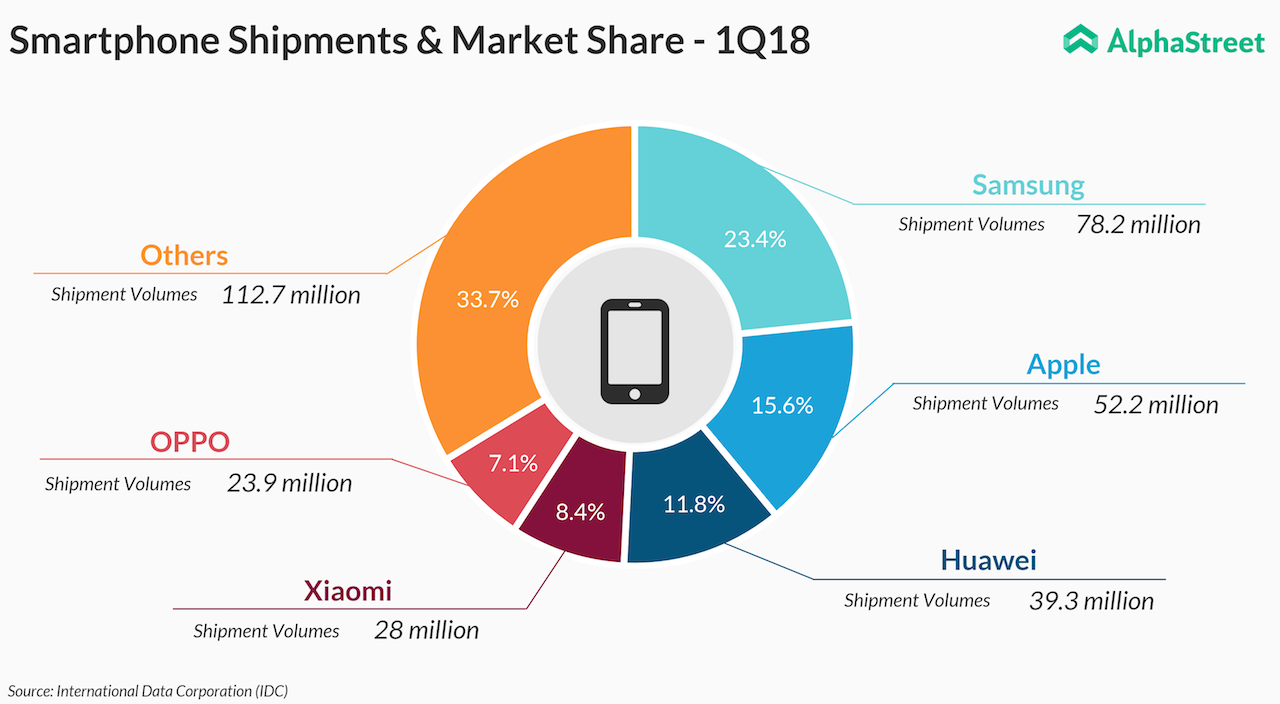

The company led by Lei Jun stands as the fourth largest phone maker worldwide, according to a report by International Data Corp. (IDC) based on shipment volume during the first three months of this year. Not just smartphones, Xiaomi has recently diversified its business and has ventured into retail and Internet business. However, the company gets a lion share of revenue from smartphones.

Selling high-end smartphones at a modest price resulted in its rival Apple (AAPL) losing market share in China. Xiaomi has also been expanding its footprint out of China. The company’s smartphones have a huge demand in India. But the other countries constitute less than 30% of the total revenue.

The Beijing-based tech behemoth that was founded in 2010 initially set a $100 billion valuation goal. The company has now reduced the target to $70-80 billion. Xiaomi’s upcoming IPO is said to be the biggest, after Alibaba (BABA), and expects to raise $10 billion.