AlphaStreet: A majority of your users are from Android, and in the past, you have said that Apple shows ‘monopolistic behavior’. Do you think Android still offers better prospects for Zedge as compared to iOS? Or are you looking into penetrating more into iOS users?

Jonathan Reich: Mobile phone customization is core to the Android operating system and is a very intimate part of the user experience. By contrast, Apple has not yet embraced the personalization vertical and the user experience is inferior when compared to Android. So, there is no doubt that Android continues to be a major and overwhelming part – around 90% – of our user base. We saw a little bit of a door crack opening in terms of Apple with the rollout of widgets and icons and we hope that over time, Apple will begin to open up the space for growth in this vertical. And if and when they do make personalization more easily accessible, we think that we are very well positioned to benefit from that and grow our customer base, and our business overall.

AlphaStreet: Can you tell us what percentage of your users actually upgrade to premium content?

Jonathan Reich: We haven’t shared that number with investors. One of the things that I do want to underscore is that, as indicated in previous earnings calls, we launched our premium marketplace. In 2020, we spent the better part of the year focused on overhauling our content management system. There is a very specific reason why we undertook this initiative and that was to help us in terms of expanding the relevance of our premium marketplace.

Now that we’ve completed the CMS work, some of the initiatives that we think will help include things like personalized recommendations, where we can commingle both premium content and user-generated content, aligning it with particular interests of users. There is no question that we are investing in expanding our premium marketplace. I think that we will see the fruits of our labor over the course of the next 12 to 24 months.

AlphaStreet: It’s been almost half a year since the launch of Shortz. Can you tell us a bit about the response to the product and its revenue potential?

Jonathan Reich: Shortz is in beta and we are excited about where we can go with the product. I think that a lot of our focus has really been on building the core functionality and infrastructure to see how users engage with the content. More material developments over the last couple of months have been, number one, rolling out an ad-supported version of Shortz. The intention here is to get more users engaging with that content, without them having to subscribe immediately. Number two is beginning to test high-quality podcasts of this content. And we’re going to see how this continues to evolve over the course of the year. Based on what we see, we continue the development process accordingly.

AlphaStreet: Is there anything that you can share about the revenue potential of this specific product?

Jonathan Reich: We are not there yet in terms of projections. I’m sure that you guys are aware that there has been activity by our competitors on the M&A side including Radish acquisition by Kakao in Korea. So, there is no question about there being an appetite for this type of content. And our focus is on really trying to find the right path to unlock that prospective customer base and bring value to them while driving engagement and revenue.

AlphaStreet: Going forward, do you see the need to enter new verticals to keep the growth trajectory steady in the future?

Jonathan Reich: Well, if you take a look at Shortz, that would be a new vertical for us. What we have said publicly is that we’ve got a pipeline of potential opportunities, both within our organic flagship app, and separate from it too. So, whenever we identify an opportunity, we align it with resource investments, and we would pursue new opportunities accordingly.

AlphaStreet: How has the COVID-induced lockdown affected business?

Jonathan Reich: That’s a complicated question. On the downside, part of our business relates to the sale of new phone handsets. With retail locations being closed or severely restricted, global handset sales have fallen materially year over year. Having said that, on the upside, more screen time with people sheltering in one place and working from their homes have no doubt benefited us. Although I would like to underscore that we’ve made a lot of progress over the course of the previous year, which we feel is fundamental. And as the world begins to return hopefully to a normal state where people can get around and maybe there’s not as much screen time, we still feel that we will have some insulation based upon fundamentals that we’ve invested in improving our app user experience.

AlphaStreet: Is there anything else you would like to add?

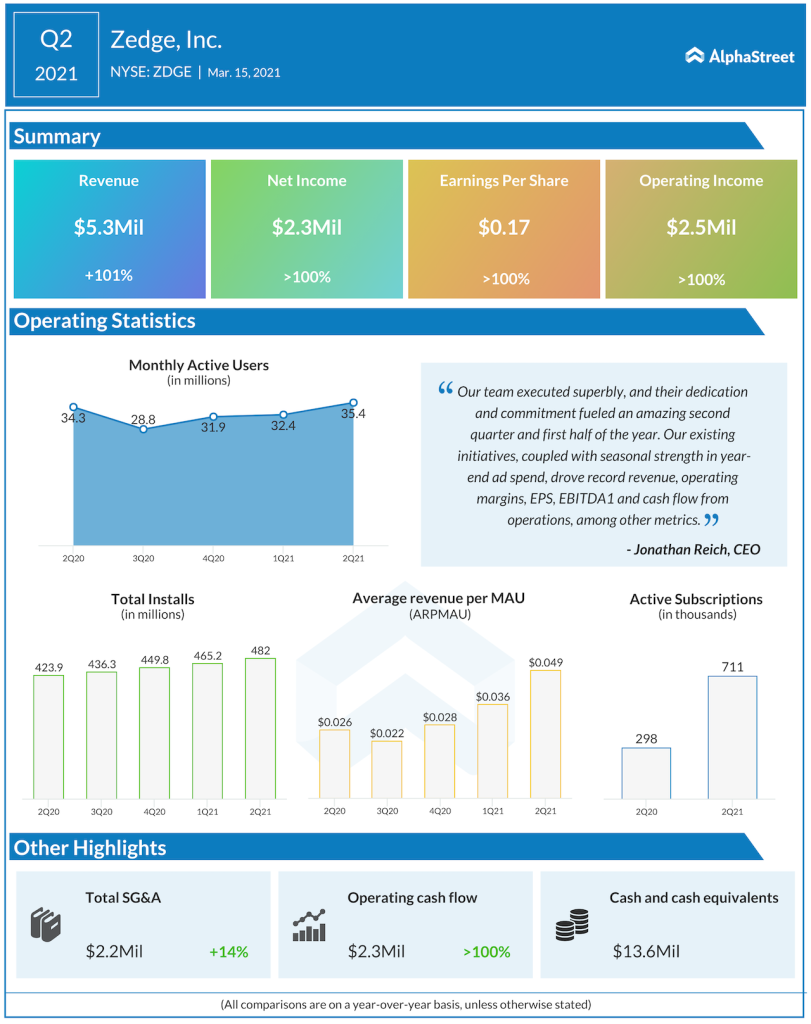

Jonathan Reich: Looking back to where we were around 18 months ago, we are now in a much better place financially. We announced last quarter that we had around $14 million cash on our balance sheet and no debt. Revenue at the end of Q2 2021 was $9.1 million, compared to annual revenue of $9.4 million for fiscal 2020. So, almost double the growth. We are excited by being in a position where we are self-sustaining, and that we’re able to invest in growing the business, and even look at potential M&A opportunities that we think can be valuable to our continued journey.

______