Qualcomm (QCOM) swung to a profit in the first quarter of fiscal 2019 from a loss last year, which was negatively impacted by its dispute with Apple (AAPL) and its contract manufacturers as well as a charge related to tax act. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates. The chipmaker guided first-quarter earnings and revenue in line with the Street’s view.

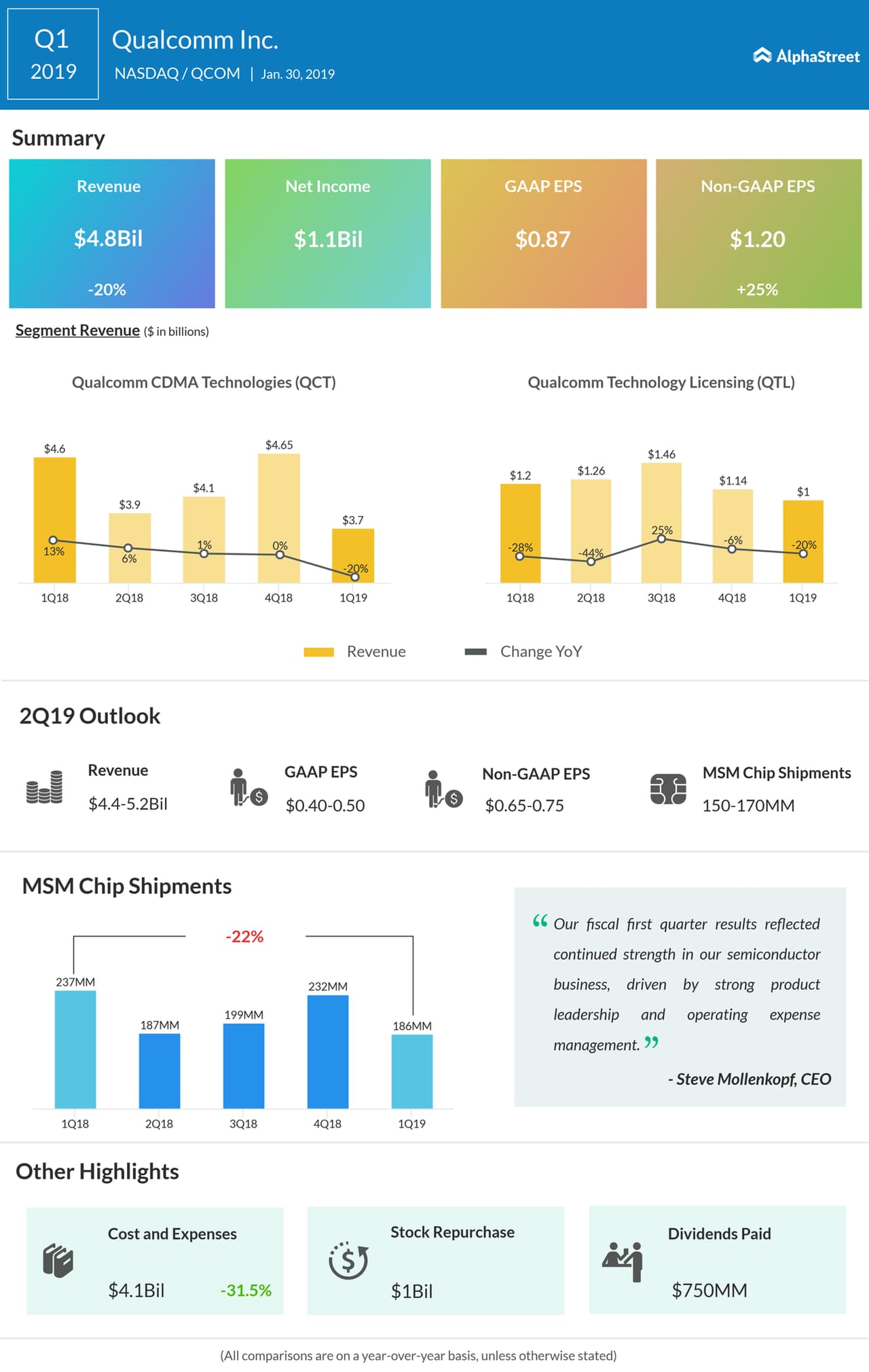

Net income was $1.1 billion or $0.87 per share compared to a loss of $6 billion or $4.05 per share in the previous year quarter. Non-GAAP earnings increased 25% to $1.20 per share. Revenue plunged 20% to $4.8 billion.

Looking ahead into the second quarter, the company expects revenue in the range of $4.4 billion to $5.2 billion and earnings in the range of $0.40 to $0.50 per share. Adjusted earnings are anticipated to be in the range of $0.65 to $0.75 per share.

The company predicts MSM chip shipments in the range of 150 million to 170 million for the second quarter. Qualcomm Technology Licensing (QTL) revenues are anticipated to be in the range of $1 billion to $1.1 billion, which is down 10% to 18% year-over-year.

The forecast excludes QTL revenues for royalties due on sales of Apple and other products by Apple’s contract manufacturers, as Qualcomm expects the actions taken by these companies will continue until the respective disputes are resolved. The outlook also includes $150 million of QTL revenues from Huawei under an interim agreement while negotiations continue.

For the first quarter, revenues from Qualcomm CDMA Technologies (QCT), which account for the lion’s share of total revenues, fell 20% year-over-year, and Qualcomm Technology Licensing (QTL) segment generated a 20% plunge in revenues in the quarter.

Also read: Qualcomm Q1 2019 earnings conference call transcript

During the first quarter, the company returned $1.8 billion to stockholders, including $750 million or $0.62 per share of cash dividends paid and $1 billion through repurchases of 17 million shares of common stock. On January 14, the company announced a quarterly cash dividend of $0.62 per share, payable on March 28, 2019, to stockholders of record on March 7, 2019.

“We continue to execute on our strategic objectives, including driving the global transition to 5G, protecting the established value of our technology and inventions and expanding into new industries and product categories,” Qualcomm’s CEO Steve Mollenkopf said.

Shares of Qualcomm ended Wednesday’s regular session up 1.56% at $50.17 on the Nasdaq. Following the earnings release, the stock inched up over 1% in the after-market session.