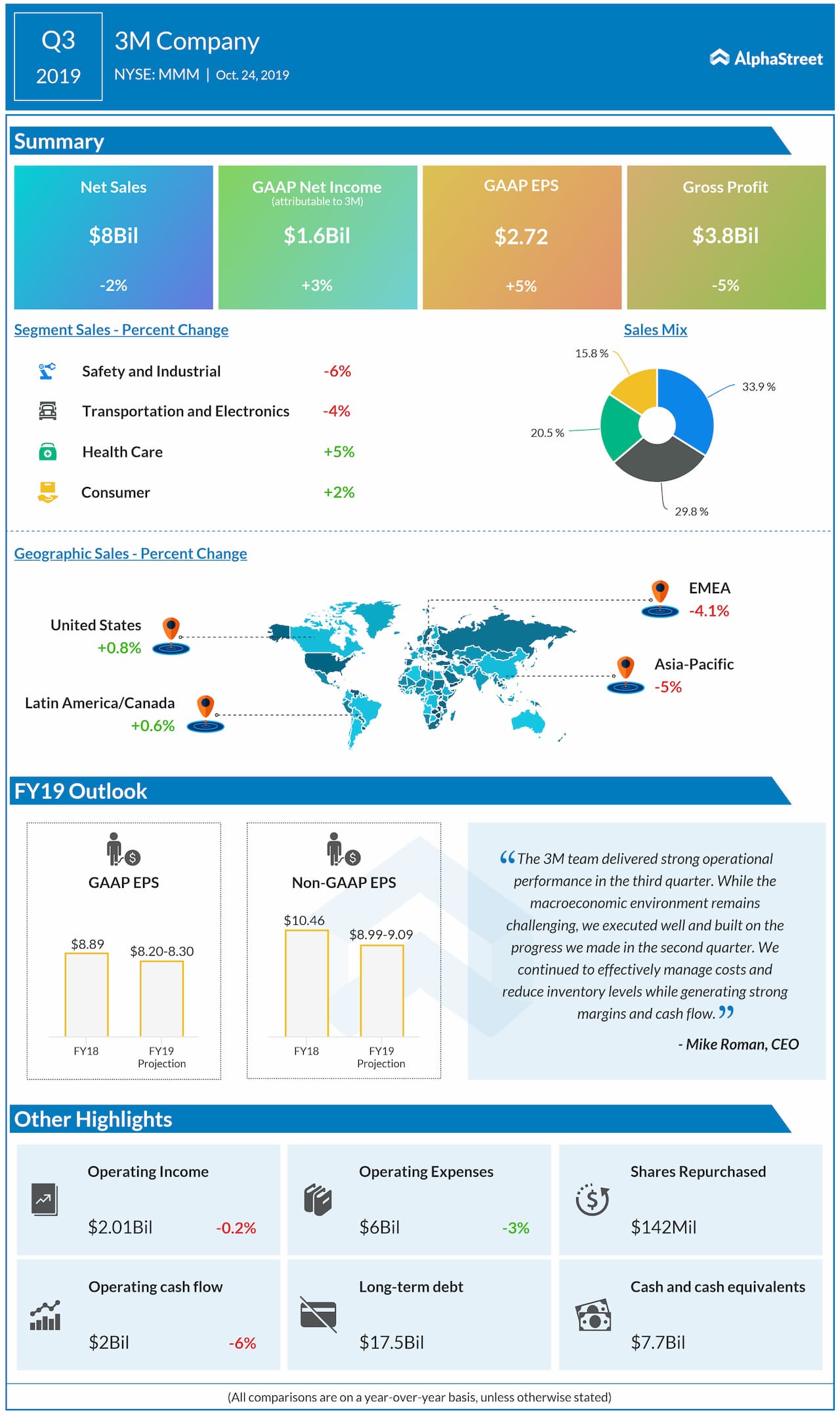

— 3M Company (NYSE: MMM) reported third-quarter 2019 earnings of $2.72 per share versus $2.49 per share expected.

— Sales declined by 2% to $7.99 billion versus $8.16 billion expected. Organic local-currency sales declined by 1.3% while acquisitions, net of divestitures, increased sales by 0.6%. Foreign currency translation reduced sales by 1.3%.

— Sales grew by 4.7% in Health Care and 1.7% in Consumer, while it decreased by 4.4% in Transporation and Electronics and 5.7% in Safety and Industrial.

— On a geographic basis, total sales rose 0.8% in the US and 0.6% in Latin America/Canada, while it declined 4.1% in EMEA and 5% in the Asia Pacific.

— Looking ahead into the fourth quarter, the company expects earnings in the range of $2.05 to $2.15 per share and organic local-currency sales will decline between 1% to 3%.

— For 2019, earnings guidance is lowered to the range of $8.20 to $8.30 per share from the previous range of $8.25 to $8.75 per share.

Read: Dow Q3 earnings snapshot

— The adjusted earnings outlook for the full year is reduced to the range of $8.99 to $9.09 per share from the prior range of $9.25 to $9.75 per share.

— For 2019, the company now expects organic local-currency sales to decline between 1% to 1.5% compared to a prior expectation of minus 1% to plus 2%.

— The return on the invested capital forecast is cut to the range of 18.5% to 19.5% from the previous range of 20% to 22% for the full year.