Shares of Dollar Tree, Inc. (NASDAQ: DLTR) stayed green on Friday. The stock has dropped 12% year-to-date. The company delivered better-than-expected earnings results for the second quarter of 2023 a day ago but its guidance for the third quarter was below expectations. Here are a few points to note about the discount retailer’s quarterly performance:

Traffic and customer gains

As stated on the company’s quarterly conference call, in the current macro environment, customers from all income levels are searching for value. Dollar Tree’s pricing and merchandising initiatives have positioned it well to cater to these value shoppers. In Q2, the company saw traffic growth of 9.6% in its Dollar Tree segment and 3.4% in its Family Dollar segment.

Customers continue to focus more of their spending on consumables than discretionary. Dollar Tree has been seeing positive unit growth in consumables across both its segments. The company’s food business is well positioned and it is seeing high volume growth across its frozen and center store food categories.

Over the past year, Dollar Tree has added nearly 5 million new customers across both its segments, a large part of whom are likely to be repeat customers. These positive trends in traffic and customer additions are leading to strong market share gains.

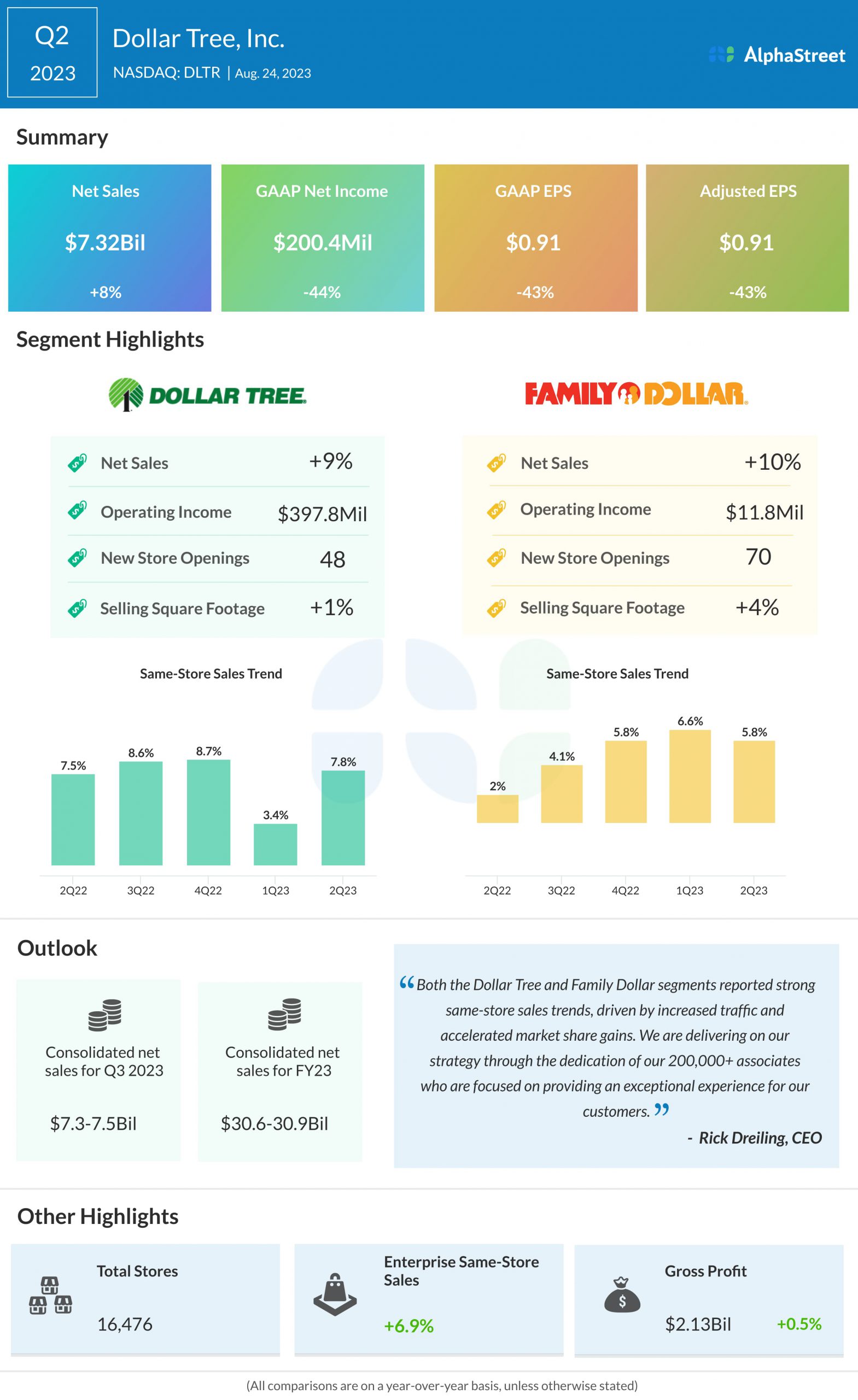

These factors helped drive a growth of 8.2% in total sales to $7.3 billion along with a 6.9% growth in enterprise same-store sales. Same-store sales in the Dollar Tree segment increased 7.8% while in the Family Dollar segment, it was up 5.8%.

Private brands

As mentioned on its call, Dollar Tree believes customers are opting for private brands to get more value. The expansion and improvement of its private brand assortment is expected to be a significant growth driver for the company going forward. It remains on track with its private brand expansion program at Family Dollar.

Dollar Tree has rolled out over 125 private brand items this year and this number is expected to increase with the launch of its new family wellness and vitamin products during the fourth quarter. In Q2, private brand penetration expanded by 55 basis points, units sold grew 4%, and private brand comps rose over 15%.

Outlook

Dollar Tree expects consolidated net sales of $7.3-7.5 billion for the third quarter of 2023, along with a mid-single-digit increase in enterprise same-store sales. Q3 EPS is estimated to range between $0.94-1.04, which is lower than analysts’ projections.

For FY2023, consolidated net sales are expected to be $30.6-30.9 billion, with a mid-single-digit increase in comparable store sales. EPS is expected to be $5.78-6.08.