Entertainment segment results

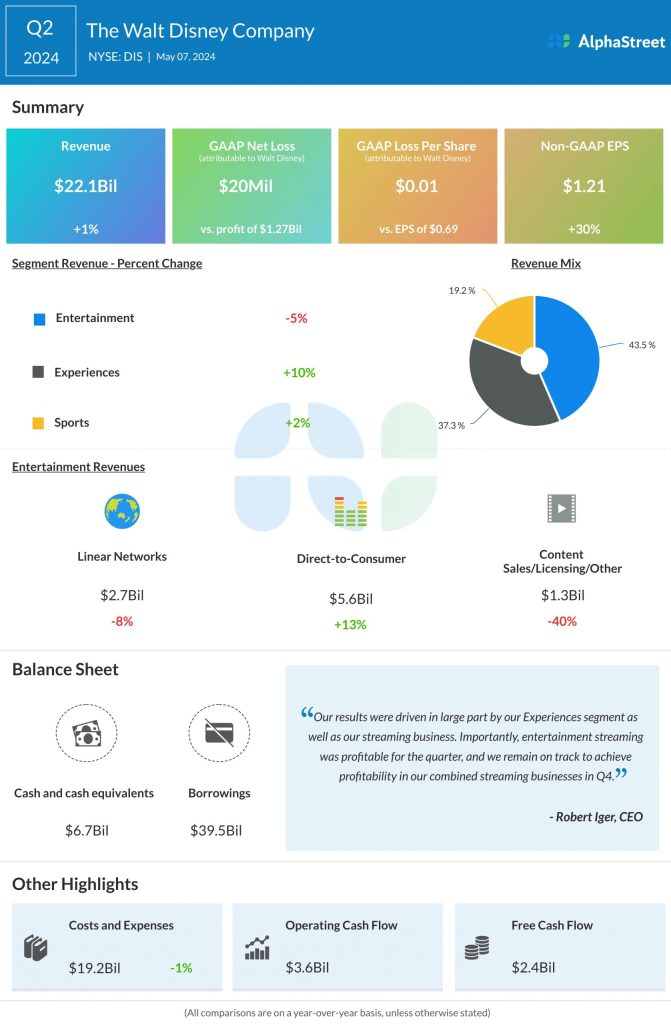

Operating income for linear networks dropped 22% to $752 million while content sales/licensing and other posted a loss of $18 million. Direct-to-consumer delivered operating income of $47 million in Q2 2024 versus a loss of $587 million last year. The improvement in DTC was driven mainly by subscription revenue growth led by higher rates due to retail price increases across the company’s streaming services, as well as subscriber growth at Disney+ Core.

Subscribers

In Q2, domestic paid subscribers for Disney+ grew 17% YoY to 54 million while international subscribers, excluding Disney+ Hotstar, rose 9% to 63.6 million. In total, Disney+ Core subscribers stood at 117.6 million, up 12% YoY. Subscribers for Disney+ Hotstar declined 32% YoY to 36 million. Total Hulu subscribers increased 4% to 50.2 million.

Average monthly revenue per paid subscriber (ARPU) for Disney+ Core increased 13% YoY to $7.28 in Q2. Domestic Disney+ ARPU increased 12% to $8.00, helped by increases in retail pricing, partly offset by a higher mix of wholesale subscribers and of subscribers to multi-product offerings.

International Disney+ (excluding Disney+ Hotstar) ARPU rose 12% to $6.66, driven by retail price increases, partly offset by the addition of subscribers to ad-supported offerings. Disney+ Hotstar ARPU increased 19%, supported by retail price increases, partly offset by a higher mix of subscribers from lower-priced markets and lower advertising revenue.

Outlook

Disney is forecasting a loss for entertainment DTC in the third quarter of 2024. The company does not expect core subscriber growth at Disney+ during the third quarter but anticipates subscriber growth will return in the fourth quarter of 2024. Disney expects its combined streaming businesses to be profitable in Q4 and expects profitability to further improve in fiscal year 2025.