Q4 performance

Play and Partnership

The two main pillars of Hasbro’s Playing to Win strategy are play and partnership. The company’s brands remain hugely popular, reaching over 1 billion people every year through toys and games, and its entertainment partnerships continue to fuel growth with movies and theme parks.

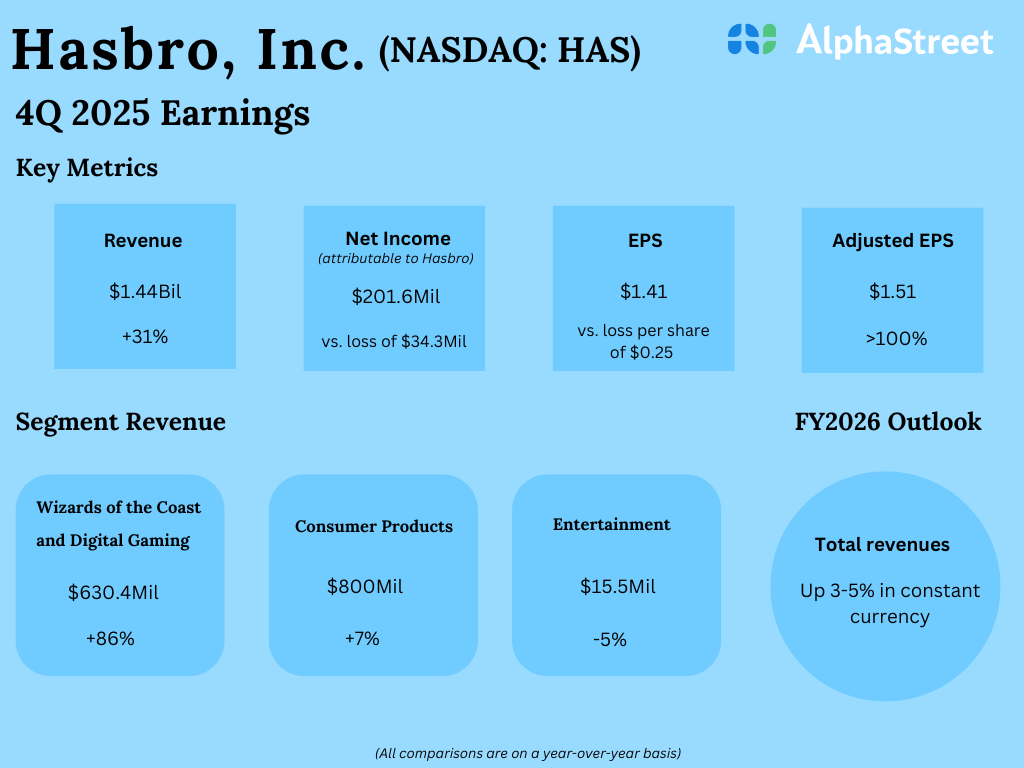

In Q4, the Wizards of the Coast and Digital Gaming segment saw revenue growth of 86%, driven by strength in MAGIC: THE GATHERING and licensed digital gaming. Within MAGIC, it has a strong line-up of releases in 2026, including original IP like Lorwyn Eclipsed and Secrets of Strixhaven as well as Universes Beyond collaborations, including Teenage Mutant Ninja Turtles, and Marvel Superheroes.

Consumer Products segment revenue grew 7% in Q4, helped by growth in MONOPOLY, PEPPA PIG, and Marvel. Hasbro is set to bring forth a range of new toys, games, interactive plush, and action figures and collectibles through its K-Pop Demon Hunters and Harry Potter movie partnerships.

The launches of new video games such as Exodus and Warlock along with the rollout of toys and collectibles tied to Disney movie franchises such as Toy Story, Star Wars and Avengers are expected to help drive meaningful growth and engagement for the company.

Outlook

For the full year of 2026, Hasbro expects its consolidated revenue to grow 3-5% YoY in constant currency, with growth across all segments. The Wizards segment is expected to deliver mid-single-digit revenue growth for the year, helped by new releases and strong engagement for the MAGIC brand. Consumer Products revenue is expected to grow low-single-digits, led by a strong entertainment slate from its Disney partnership. Entertainment revenue is projected to be slightly positive YoY.

Revenue growth is anticipated to be stronger in the first half of the year due to the timing of new releases, and retail order patterns. Higher royalty expenses will hurt margins in the first half, with an expansion anticipated in the back half, driven by favorable business mix, supply chain productivity, and operating expenses leverage.