Q4 and FY2020 performance

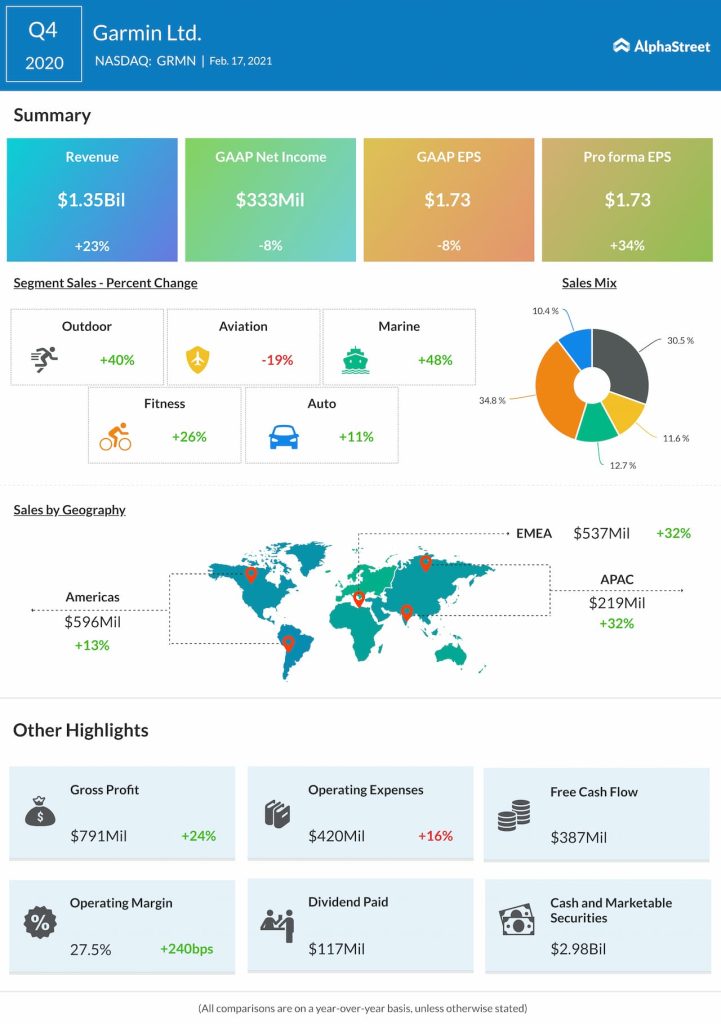

For the full year of 2020, total revenues increased 11% to $4.19 billion while pro forma EPS rose 16% to $5.14. The company witnessed double-digit revenue growth across its fitness, marine and outdoor segments during the year but aviation and auto saw declines.

Growth trends

In 2020, Garmin saw a rise in demand for its advanced wearables and cycling products as well as its adventure watches. Fitness gained importance amid the COVID-19 pandemic and people also started exploring outdoor and adventure activities during this time, which led to an interest in activities like boating and fishing. These trends drove growth in the fitness, outdoor and marine segments and the company expects them to continue this year as well.

Within its auto segment, Garmin witnessed a decline in portable navigation devices (PND) but it saw success on various software, navigation and infotainment programs with top-tier OEMs like Honda, Toyota, Daimler and Peugeot. The company expects to see growth in specialty consumer products and new OEM programs in 2021 but it also expects to incur losses from the OEM operating segment due to the high level of investment required in this space.

Outlook

For the full year of 2021, Garmin expects total revenues of $4.6 billion and pro forma EPS of $5.15. Within its fitness segment, the company plans to take advantage of the demand for indoor cycling products through its Tacx lineup. Garmin expects fitness revenues to increase approx. 10% in 2021.

Outdoor segment revenues are estimated to grow approx. 10% as demand for outdoor activities is expected to continue. Despite a decline in aviation revenues during 2020, Garmin is seeing a stabilization in the general aviation market and expects revenues to grow approx. 5% in 2021 helped by the OEM and aftermarket categories.

Garmin expects marine segment revenues to increase approx. 15% as demand for boating and fishing are expected to see strong growth this year. In auto, revenues are expected to grow approx. 5% driven by growth in specialty consumer products and new OEM programs.

Click here to read the full transcript of Garmin’s Q4 2020 earnings conference call