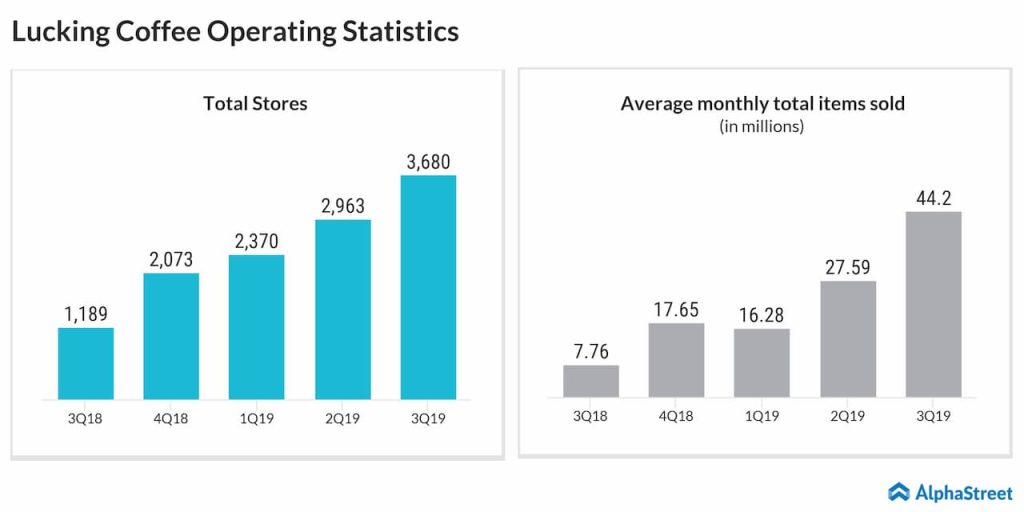

The positive trend complements the management’s goal of becoming the largest coffee chain in China by year-end. The fact that Luckin remained largely unaffected by the tariff war, while several Chinese companies were hit by trade-related uncertainties, added to the upbeat sentiment surrounding the stock.

What Next?

As the company enters 2020, the question most investors will be asking is whether the current excitement will be sustained. The answer lies in a statement issued by CEO Zhiya Qian earlier – that the Chinese coffee market is highly underpenetrated. Luckin owes its high growth rate to the relatively low prices and promotional offers. Since the majority of the stores have been open for less than one year, it is too early to judge the long-term trend.

Looking High

With multiple factors working in its favor, Luckin will be giving arch-rival Starbucks a run for its money. Starbucks, the American beverage giant that introduced the coffee culture in China, is already losing market share to Luckin. However, it would be a tricky situation when it comes to choosing between the two companies from an investment perspective. Despite solid sales and a growing store base, Luckin is yet to become profitable, while Starbucks is a profit-making company with strong fundamentals.

Recently, Luckin impressed the market by posting stronger-than-expected results for its most recent quarter. Net loss narrowed to $0.32 per share on revenues of $215.7 million, which was up 40% from last year.