The financial performance of Abbott Laboratories (NYSE: ABT) has been positively impacted by the high demand for COVID-related diagnostic services. However, in a sign that the uptrend is not entirely linked to the pandemic, all the key business segments performed well last year. The company looks poised to repeat the success this year too.

Buy ABT?

Shares of the Illinois-based diversified healthcare company got a major boost after last month’s earnings release and hit a new record. It is on track to scale new heights in the coming months, according to analysts following the stock who have assigned strong buy rating. The latest target price represents an 11% upside. Also, the company is a dividend-aristocrat and offers an investment opportunity that is unique.

Last year, tailwinds from pandemic-related growth in the business contributed significantly to the top-line, mainly the diagnostics business. Meanwhile, the medical devices segment had a disappointing performance, marked by annual and sequential declines, as most of the elective procedures were postponed during the crisis period.

Growth Strategy

The focus of the management’s growth strategy is on sustaining the momentum through innovations in services and the product portfolio, especially medical devices. That should allay concerns of a potential slowdown in the post-pandemic era since most of the recent momentum was linked to COVID testing.

From Abbott’s fourth-quarter 2020 earnings conference call:

“Our new product pipeline continues to be incredibly productive, delivering ground-breaking innovations and a steady cadence of important new products with more on the horizon. We continue to lead in the area of diagnostic testing for COVID, which is helping to fight the virus and accelerating our long-term decentralized testing strategy, and we’re forecasting more than 35% adjusted EPS growth in 2021 which is truly unique in this environment.”

Blockbuster Q4

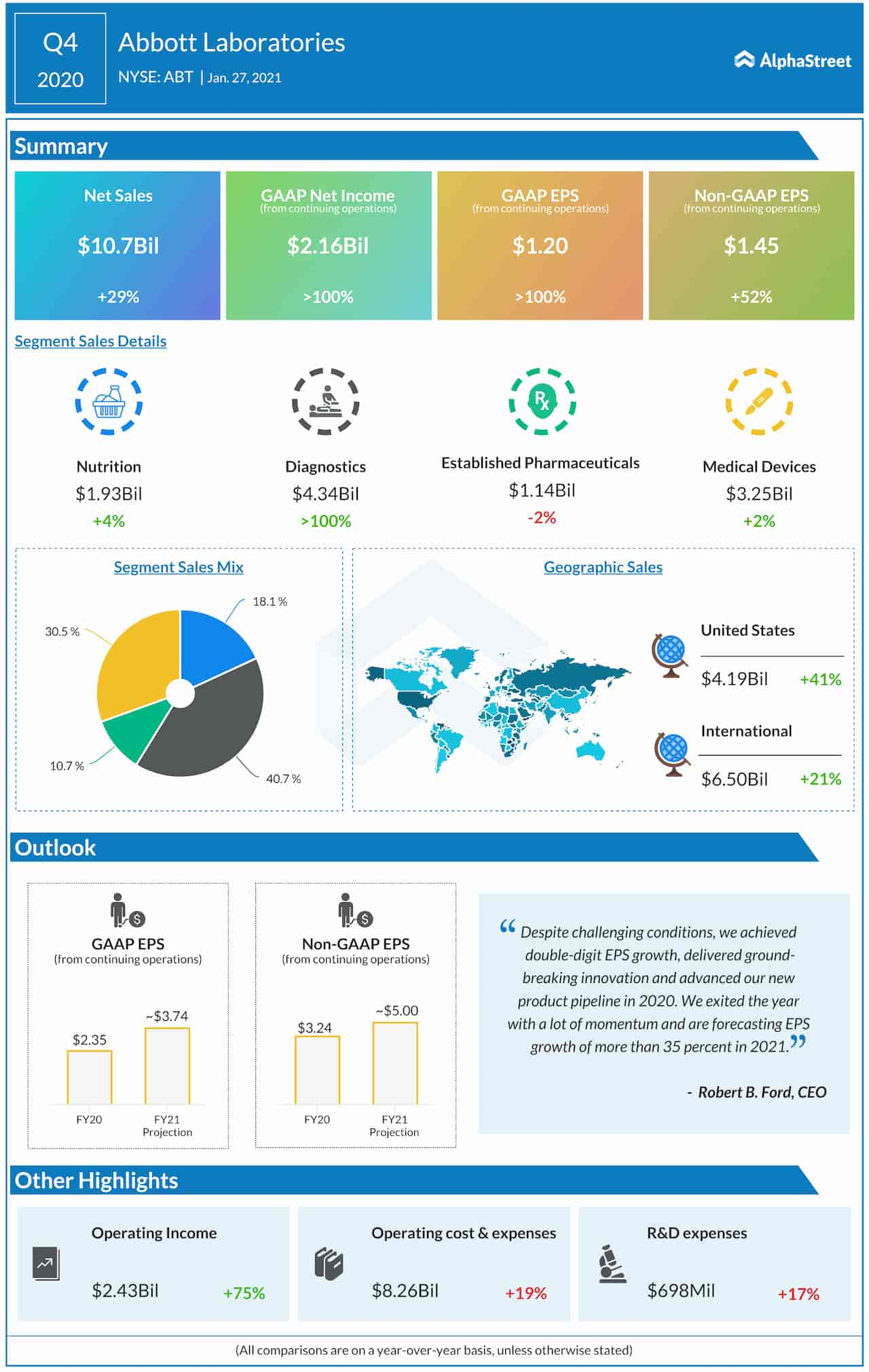

Revenues of diagnostics, the largest business segment, more than doubled in the December-quarter aided by the strong demand for COVID testing. That, combined with strong performance by the other key divisions, drove revenues up by 29% to about $11 billion. At $1.45 per share, adjusted earnings were up 52% year-over-year. Both international and domestic segments registered growth. The results also beat expectations. Buoyed by the positive outcome, company executives are predicting a 35% earnings growth for fiscal 2021.

Read management/analysts’ comments on Abbott’s Q4 earnings

After climbing to an all-time high earlier this month, Abbott’s stock pared a part of the gains and traded slightly above $120 on Thursday. This year alone the stock gained more than 11% and outperformed the market. Over the past twelve months, it moved up 57%.