AbbVie Inc. (NYSE: ABBV) reported a 31% dip in earnings for the third quarter of 2019 due to higher costs and expenses. However, the results exceeded analysts’ expectations. Further, the company tightened its full-year adjusted earnings forecast.

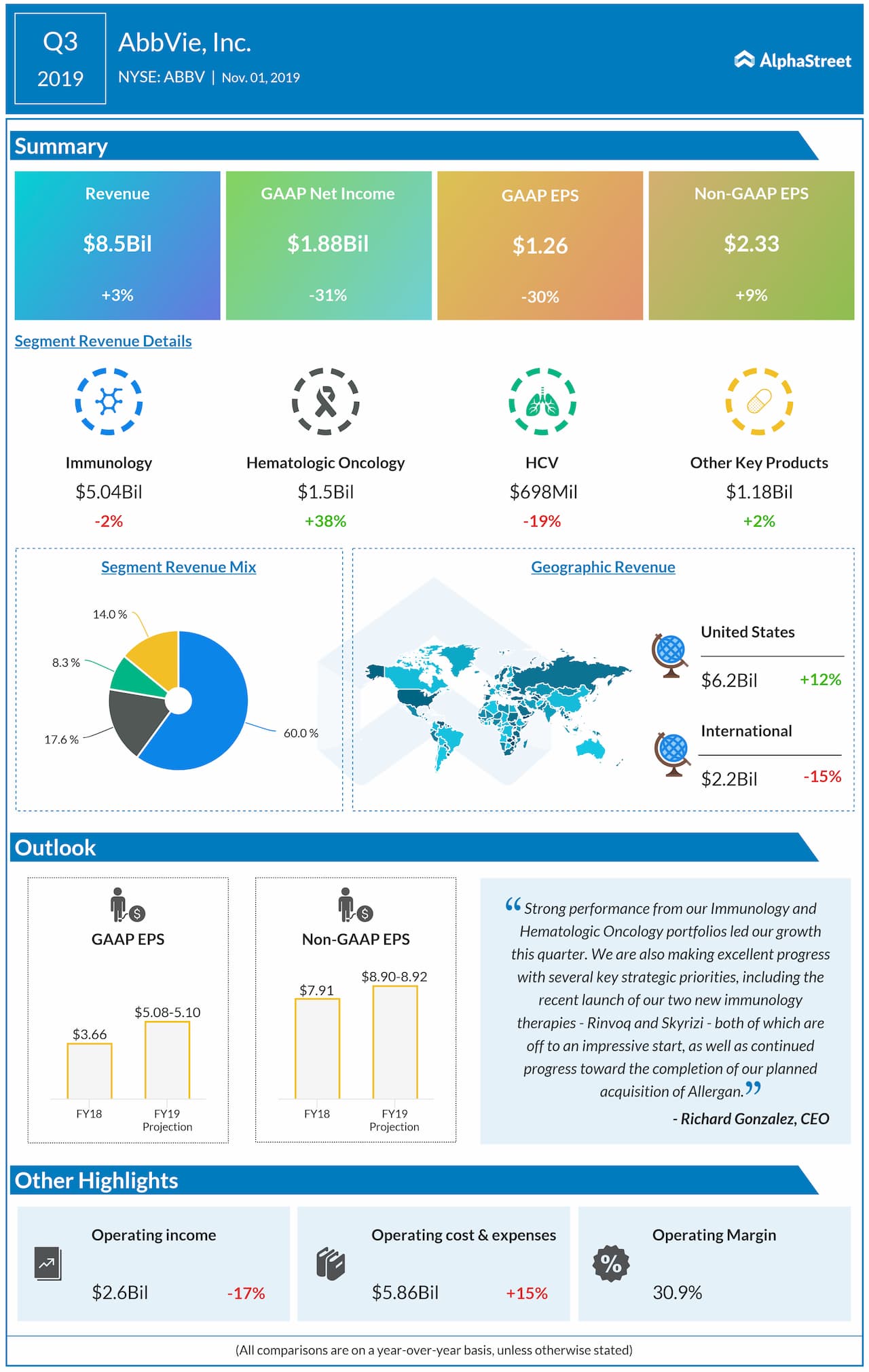

Net income plunged by 31% to $1.88 billion or $1.26 per share. Adjusted earnings increased by 9% to $2.33 per share. Revenue rose by 3% to $8.48 billion. The results were driven by a strong performance from its Immunology and Hematologic Oncology portfolios.

Looking ahead into the full year 2019, the company narrowed its adjusted earnings guidance to the range of $8.90 to $8.92 per share from the prior range of $8.82 to $8.92 per share. The revised outlook represents a growth of 12.6% at the midpoint. However, AbbVie lowered its GAAP earnings forecast from the previously stated range of $5.69 to $5.79 per share to the range of $5.08 to $5.10 per share.

Humira sales fell by 3.7% on a reported basis, or 3.2% operationally. In the US, Humira sales grew by 9.6%. Internationally, Humira sales fell 31.8% operationally due to direct biosimilar competition. Cancer drug Imbruvica revenues jumped 29% to $1.26 billion while revenue from the Hematologic Oncology Portfolio climbed 38.3% to $1.48 billion. However, global HCV (hepatitis C virus) revenues dropped 19% to $698 million.

On Thursday, the company announced positive topline study results of Rinvoq (upadacitinib) for the treatment of psoriatic arthritis. Rinvoq, a selective and reversible JAK inhibitor discovered and developed by AbbVie, is being studied as a once-daily therapy in psoriatic arthritis and multiple immune-mediated diseases.

The company announced its board of directors declared a 10.3% increase in its quarterly cash dividend from $1.07 per share to $1.18 per share beginning with the dividend payable on February 14, 2020, to shareholders of record as of January 15, 2020.

AbbVie and Allergan (NYSE: AGN) continue to cooperate fully with regulators regarding AbbVie’s proposed acquisition of Allergan and both companies received a Request for Additional Information (Second Request) from the Federal Trade Commission. Also, Allergan shareholders voted to approve the proposed acquisition. The deal is expected to close in early 2020.