Humira is expected to rake in more than $20 billion by 2020. AbbVie has been successful in ring-fencing the drug in the US, as it has inked deals with several of its peers to stop launching biosimilars until 2023. This is going to augur well for the company for the next few years.

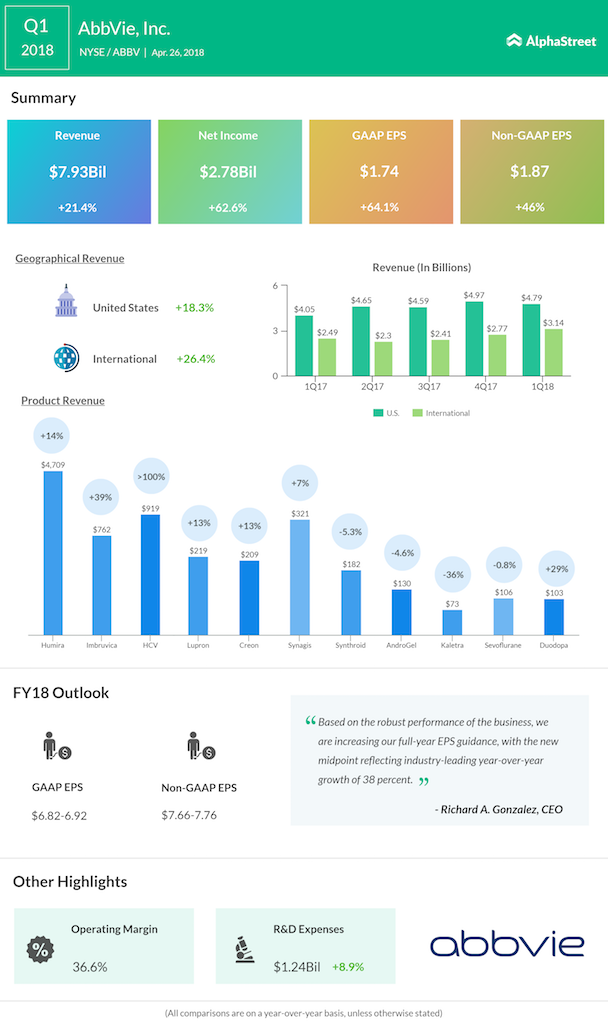

Cancer drug Imbruvica’s sales came in at $762 million, which grew 38.5% over the prior-year period. HCV (hepatitis C virus) product sales soared 90% touching $919 million compared to previous quarter. R&D expenses rose 9% to $1.2 billion, which is 15.7% of sales.

The drugmaker expects the tax rate for 2018 to be at 9% post the tax reforms. However, on an adjusted basis, the tax rate is going to be likely at 13% over the next five year due to increased sales and investments in the US.

Based on the strong first quarter results, the company is raising its 2018 outlook. GAAP earnings are expected to be between $6.82 and $6.92, while adjusted earnings now projected in the range of $7.66 to $7.76 compared to $7.33 to $7.43 reported earlier. AbbVie’s share was up 3% before the bell today.