Abercrombie & Fitch Co. (NYSE: ANF) is set to release its third-quarter 2019 earnings results on Tuesday before the market opens. The bottom line will be hurt by investments in store opening, increased promotional activity, and foreign exchange currency headwinds.

The company has been investing in opening stores in the international markets as it sees significant opportunities for global growth in the EMEA region. The results continue to be impacted by consumer confidence and consumer spending due to the changes in global economic and financial conditions.

The company’s growth strategy depends on the expansion of direct-to-consumer sales channels and omnichannel initiatives. The growth and profitability will be negatively impacted by the failure to successfully implement its strategic plans. The changes in the level and mix of pre-tax earnings between operating and valuation allowance jurisdictions could be behind the effective tax rate changes.

The company could achieve sustainable long-term growth and high-expected returns on projects due to the prioritize of investments in capital allocation strategy. The company also evaluates opportunities to accelerate potential investments, including improvements in customer experience, both in stores and online, store remodels and right-sizes, new store openings and acceleration of transformation efforts.

Analysts expect the company’s earnings to drop by 27.30% to $0.24 per share, while revenue will rise by 0.8% to $868.28 million for the third quarter. The company has surprised investors by beating analysts’ expectations in all of the past four quarters. The majority of the analysts recommended a “hold” rating with an average price target of $17.69.

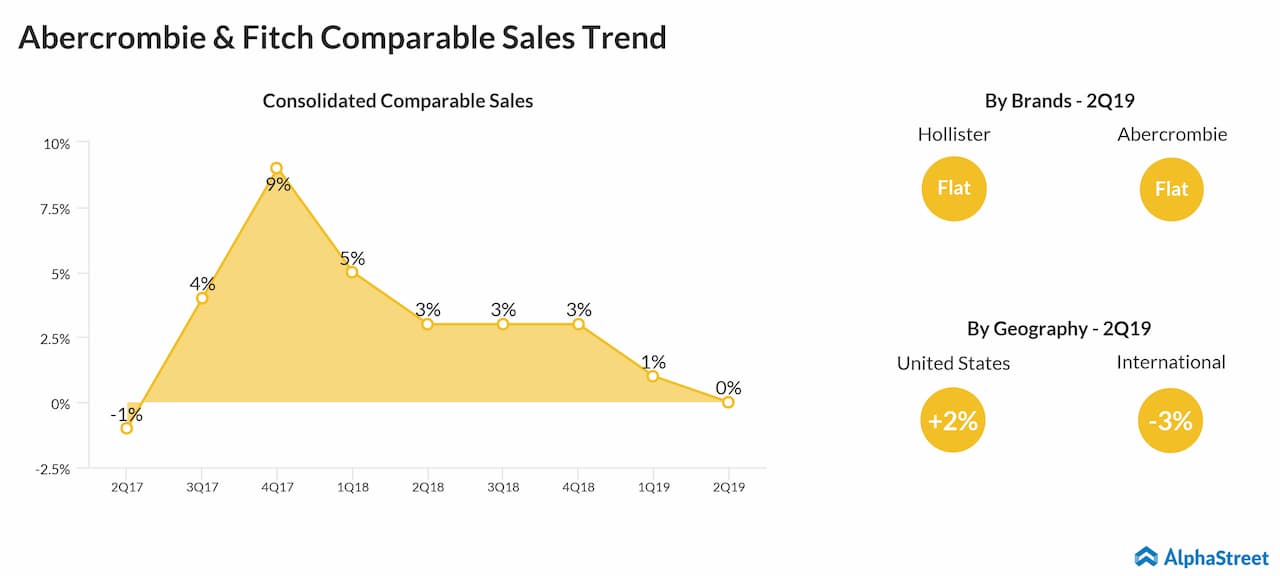

For the second quarter, Abercrombie & Fitch posted a wider loss due to lower sales. Operating margin dropped by 470 basis points owing mainly to the adverse impact of flagship store exit charges. Comparable sales were flat against positive sales of 3% last year.

For the third quarter, the company expects net sales to be up around 1% reflecting the impact of changes in foreign exchange rates. Comparable sales are estimated to be flat and gross profit rate to be down 100 basis points. For the full year 2019, net sales are anticipated to be flat to up 2% on positive comps and new store openings. Same-store sales are forecast to be flat to up 2% while the gross profit rate is seen falling by 50-90 basis points.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.