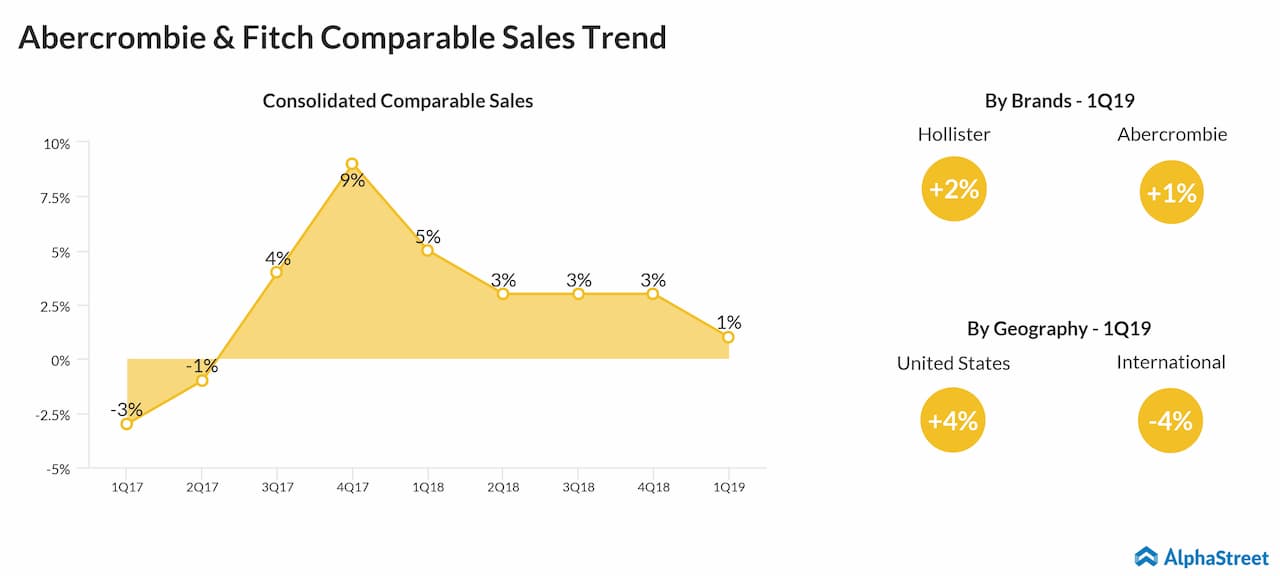

Net sales rose 0.4% to $733.97 million. The latest quarter included the adverse impact from changes in foreign currency exchange rates of about $16 million or 2%. Comparable sales grew 1% on top of 5% growth in the previous year.

Looking ahead into fiscal 2019, the company expects sales to be up in the range of 2% to 4% and comp sales to be up low-single digits, on top of 3% last year. The gross profit rate is expected to rise slightly from fiscal 2018 rate of 60.2%, assuming only the current tariffs in place. Capital investments are anticipated to be about $200 million.

For the second quarter of 2019, the company expects sales in the range of flat to up 2% and comp sales to be flat, on top of 3% last year. The gross profit rate is predicted to be down about 100 basis points compared to 60.2% last year, assuming only the current tariffs in place.

The company remained focused on its transformation initiatives, with global store network optimization a key priority. In line with its strategy, Abercrombie & Fitch is announcing plans to close three additional flagship locations, bringing the total to five since 2017. Except for the charges from these flagship store actions, the company remained on track to achieve the previously communicated 2019 outlook and continues to lay the foundation to achieving fiscal 2020 targets.

Last week, apparel retailers Ross Stores (ROST) and Urban Outfitters (URBN) posted their quarterly results. Ross Stores reported better-than-expected earnings for the first quarter of 2019 backed by higher sales and lower provision for taxes while the stock declined due to weak second-quarter guidance. Urban Outfitters posted a 1% rise in revenues for the first quarter of 2020 driven by a double-digit increase in online sales while earnings fell by 21% due to higher costs and expenses.

Shares of Abercrombie & Fitch ended Tuesday’s regular session up 1.58% at $25.01 on the NYSE. The stock has fallen over 1% in the past year while it has risen over 13% in the past three months.