Shares of Abiomed Inc. (NASDAQ: ABMD) were down 4% in afternoon trade on Wednesday. The stock has dropped 22% over the past three months and 10% in the past one week. The company reported its third quarter 2020 earnings results last Thursday, beating earnings estimates but missing on revenue.

The stock was hurt by the revenue miss as well as by misleading reports by some researchers over the safety of its key product Impella. Abiomed submitted clinical evidence as proof of the safety and effectiveness of its product in response to these reports.

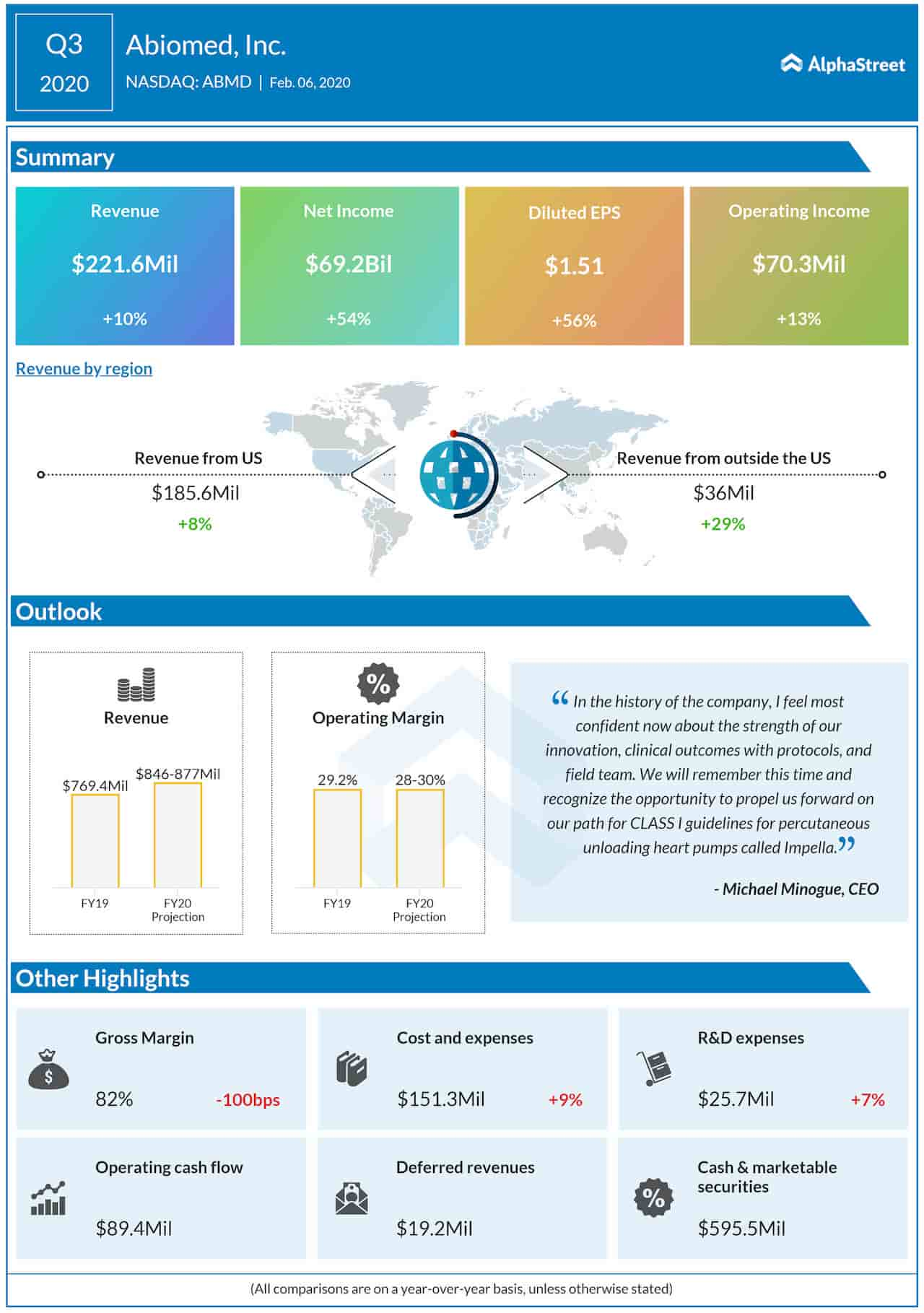

Revenues in the third quarter increased 10%, driven by

higher Impella product revenue due to increased utilization in the US, Europe

and Japan as well as the commercial launch of Impella 5.5 in the US and Europe.

The company saw revenue growth both in the US and internationally.

Going forward, Abiomed expects revenue from its Impella devices to increase

globally. The company received PMA approvals in the US and continues to focus

on expanding the utilization of Impella devices in international markets,

particularly Germany and Japan.

Abiomed continues to invest in the expansion of its manufacturing capacity in the US and Germany as well as in the roll-out of new products. These investments are expected to impact margins in the near-term.

The company also expects to see an increase in expenses

going forward due to costs related to clinical studies, development of new

technologies, the improvement of existing products, and marketing efforts.

For fiscal year 2020, Abiomed expects revenue to increase 10-14% to a range of $846-877 million and operating margin to be 28-30%.

The majority of analysts have rated the stock as Buy and it has an average 12-month price target of $208.33, which represents an upside of 23% from its current level.