The company’s bottom-line factor an expense charge related to the cancellation of corporate events including Adobe Summit due to the COVID-19 situation, which impacted both the GAAP and adjusted results.

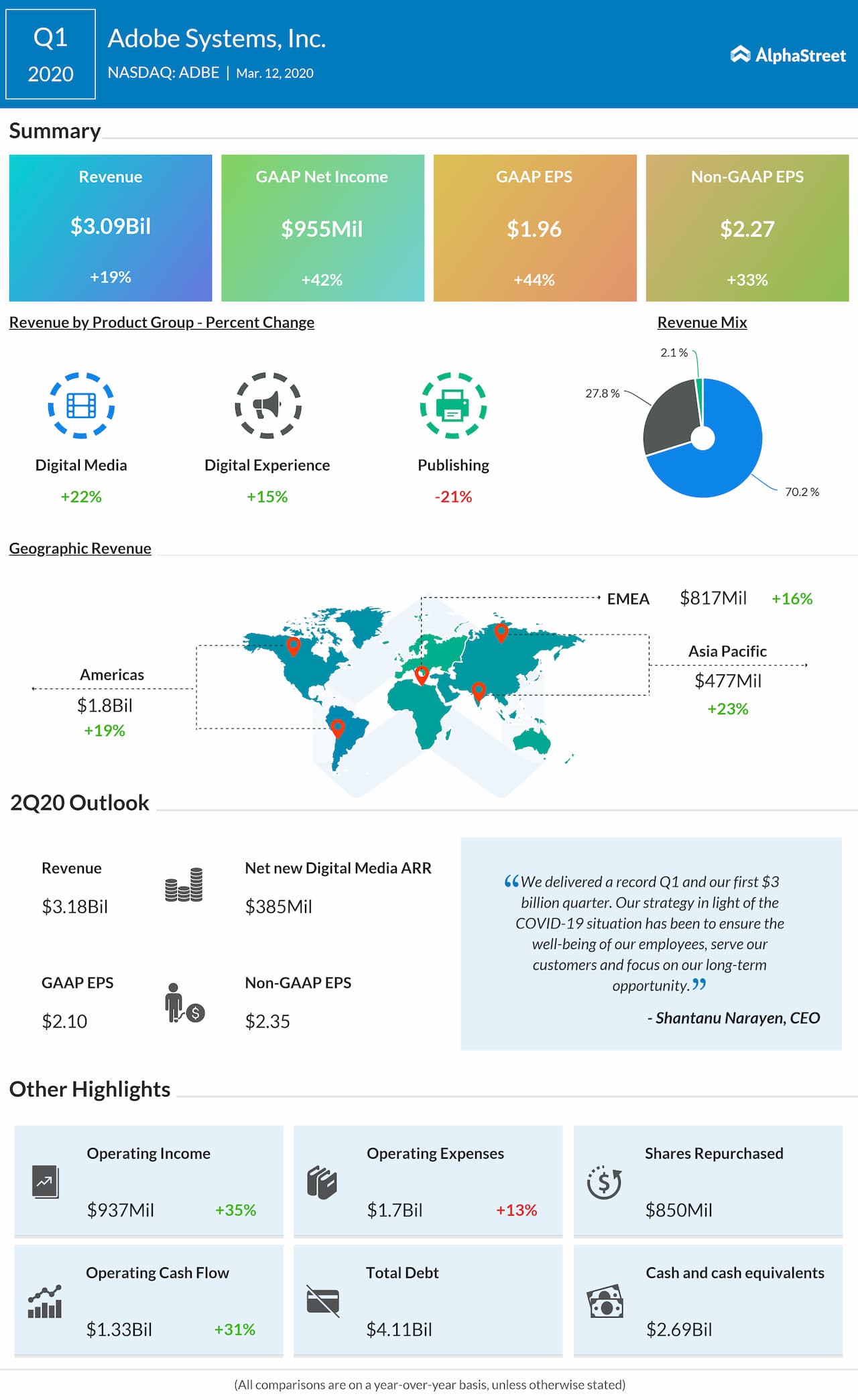

Looking ahead into the second quarter, the company expects total revenue of about $3.175 billion, unadjusted earnings of about $2.10 per share and adjusted earnings of about $2.35 per share. The consensus estimates EPS of $2.33 on revenue of $3.22 billion.

The forecast factor the expected impact of the global uncertainty caused by the COVID-19 situation. The company’s revenue and earnings are relatively predictable as a result of its subscription-based business model. For the second quarter, digital media segment revenue is predicted to grow by about 19% year-over-year and the digital experience segment revenue is expected to grow by about 12%.

For the first quarter, the performance was driven by its creative strategy, accelerating document productivity and powering digital businesses. In the digital media segment, revenue increased by 22% helped by growth in both creative cloud and document cloud. The document cloud was backed by strong customer acquisition and the expanding portfolio of PDF mobile and web applications.

In digital media, the coronavirus crisis did not impact its overall business in Q1 but it experienced weakness in China that is primarily a channel-based reseller market. In digital experience, the impact of the crisis was some unanticipated deal slippage during the last ten days of the quarter.

Photoshop has remained Adobe’s key creativity platform that had taken photography to graphic design. The company continues to experience an increase in the demand for mobile applications like Photoshop on iPad, Lightroom and Photoshop Express. Mobile has been proving to be a strong pipeline with more than 35 million new Adobe IDs in Q1.

The company has shifted Adobe Summit, its annual digital experience user conference, to an online event and virtual conference starting on March 31.