Advance Auto Parts (AAP) reported fiscal 2018 net sales of $9.6 billion, coming at the upper end of the ambitious target set by the management.

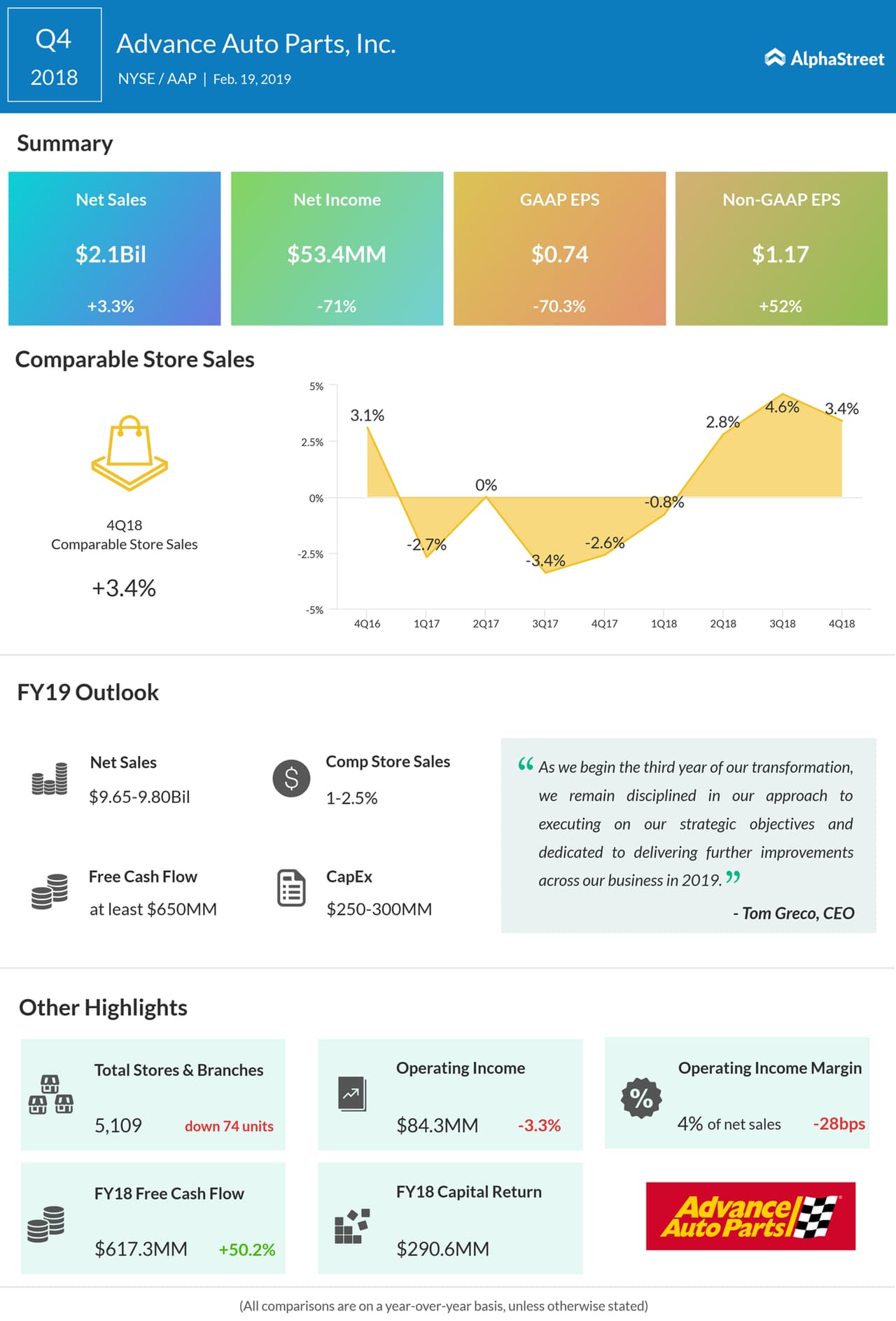

For the fourth quarter, net sales improved 3.3% to $2.1 billion, in line with the street consensus. The improved sales lifted its Q4 adjusted earnings 52% to $1.17 per share, while analysts were expecting $1.14 per share.

However, shares fell during pre-market trading as comparable sales for the quarter grew 3.4%, below the expected levels.

AAP shares ended its last trading session up 0.7% on Friday. Continuing its recovery from the multi-year lows, the stock last year recouped most of the losses but underperformed the sector. In the trailing 52 weeks, the stock is up 62%.

Operating income margin came under pressure from the heavy investment in supply chain and IT infrastructure, and fell 28 bps in Q4.

CEO Tom Greco said, “We are pleased with the continuous progress throughout 2018 versus our long-term strategic objectives and remain committed to further strengthening our Customer Value Proposition to capitalize on the substantial opportunity still ahead for Advance.”

For the full year 2019, the North Carolina-based company expects net sales between $9.65 billion and $9.8 billion, with comp sales increase projected in the range of 1% to 2.5%.

The provider of automotive aftermarket parts seems to be doing everything to boost performance on a long-term basis, including store openings, strategic partnerships, and aggressive e-commerce push. A significant move towards expanding market share was the partnership signed with Walmart (WMT) last year, for setting up a unique auto parts store on the retailer’s online platform.

Advance Auto Parts Q3 profit soars on comp sales growth

The ongoing shift to the digital space bodes well for Advance Auto Parts, as the online traffic has increased notably in recent months. The expanding customer base could add to sales growth in the fourth quarter, with the extensive portfolio of auto accessories and parts reaching more markets now.

Last week, the company announced the appointment of Jeffrey Jones, CEO of H&R Block (HRB), and Best Buy’s (BBY) former CFO Sharon McCollam to its board of directors, effective immediately.