Cardiopulmonary Research

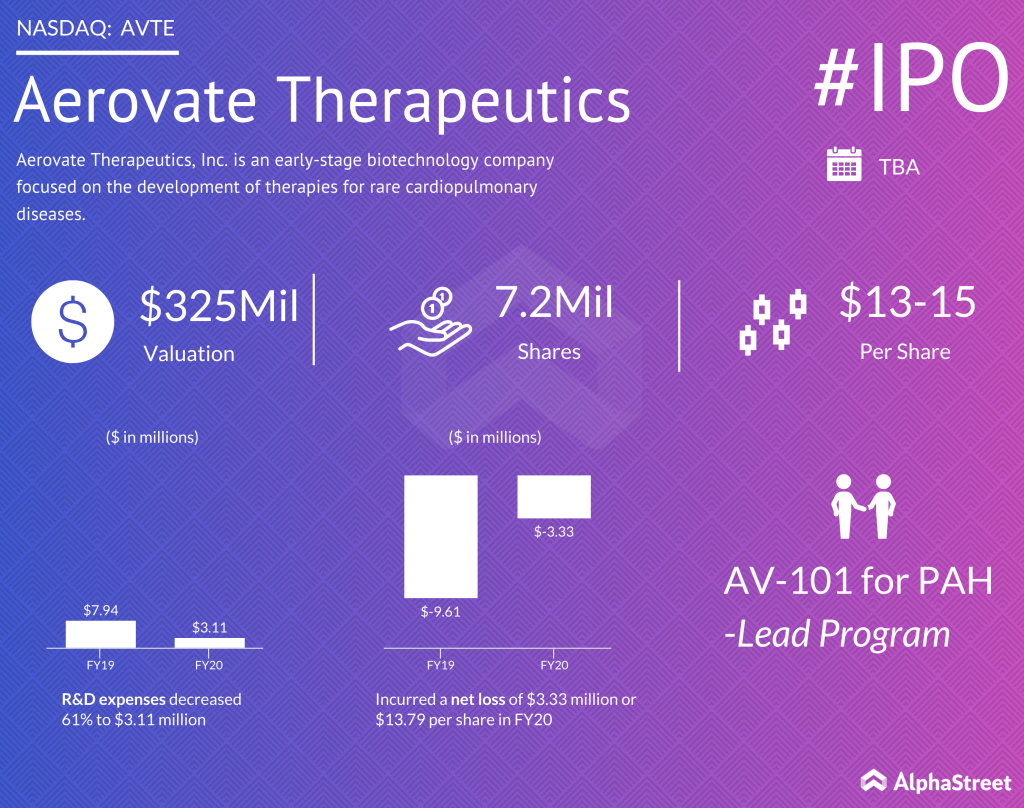

The Boston-based drug-maker, which is focused on the development of therapies for rare cardiopulmonary diseases, was founded in July 2018 by Benjamin Dake who currently serves as its president. The operations are managed by chief executive officer Timothy Noyes, a Merck (NYSE: MRK) veteran who assumed office last month.

Here’s what you should know before EverCommerce goes public

The company’s lead program involves the development of a therapy for the treatment of pulmonary arterial hypertension (PAH). The medicine, AV-101, is an inhaler based on tyrosine kinase inhibitor imatinib. PAH is a progressive proliferative disease of the pulmonary vasculature that is characterized by remodeling, constriction, and occlusion of the small pulmonary arteries, leading to high blood pressure.

New-Gen Drug for PAH

Early-stage clinical trials have indicated that AV-101 is effective in treating patients suffering from PAH by acting directly on the cause of the disease. In phase-II of the trial — designed to assess the safety and tolerability of the drug — around 200 patients will be enrolled. The top-line data from the study is expected in mid-2023.

Proceeds from the upcoming offering – estimated at $100 million at the midpoint of the price range – will be used mainly for the continued development of AV-101 and to meet costs related to its commercial launch. Once it is successfully launched in the U.S, the management would pursue additional indications for the drug and expansion of the pipeline by tapping into new product opportunities. Earlier this month, the company sold around 30 million preferred shares for $56 million.

Risks

It goes without saying that the outcome of the final clinical trial would be crucial as far as the company’s future is concerned. Obviously, the main risk to the program is the uncertainty surrounding COVID-19 — any potential resurgence of the pandemic might delay the process and lead to cost escalation. Prolonged cost pressures can take a toll on the finances of the company, which is dependent solely on AV-101 to become profitable. Moreover, Aerovate will have to compete effectively with the likes of Verve Therapeutics to gain meaningful market share.

Read management/analysts’ comments on quarterly reports

Being an emerging business, Aerovate is yet to generate revenue. In fiscal 2021, it incurred a net loss of $3.33million or $13.79 per share, compared to a loss of $9.61 million or $40.31 per share last year. The improvement reflects a dip in operating expenses, which more than halved annually.