Strong first half

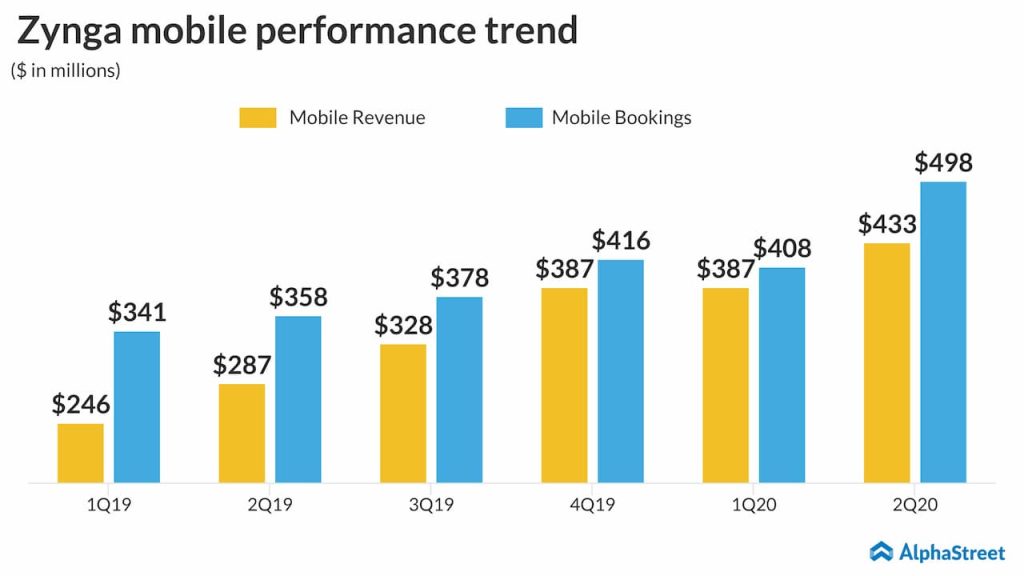

Zynga’s total revenues in the first half of 2020 increased 50% to $855 million while bookings grew 28% to $943 million. Total online game revenues increased 66% to $732 million, helped by a 72% growth in mobile game revenues. During this period, Empires & Puzzles and Merge Dragons! were the top revenue generators comprising 25% and 20% of online game revenue respectively.

Acquisitions

Zynga has made many strategic acquisitions that has helped it build a strong portfolio. The Small Giant Games and Gram Games acquisitions are exceeding expectations in terms of performance. In July, the company acquired mobile puzzle game maker Peak, adding two more titles to its live services portfolio and increasing its forever franchises to eight.

Zynga is also acquiring mobile games developer Rollic and the deal is expected to close in October. While Peak is expected to drive significant international growth, especially in Japan, Rollic will help Zynga enter the fast-growing hyper-casual games market.

Strategy

Zynga’s strategy for driving growth over the long term involves strengthening its live services portfolio. The company continues to integrate and expand popular brands within live services like Fast & Furious in CSR2 and Rick and Morty in Merge Dragons!.

The company is also adding new forever franchises to its live services portfolio. The acquisition of Peak brought Toon Blast and Toy Blast to Zynga and the company plans on launching new games this year which are expected to scale over time. Last week, Zynga unveiled Harry Potter: Puzzles & Spells worldwide. The company is also seeing good progress on titles like Farmville 3 and Puzzle Combat which are in soft launch.

Within mobile, Zynga is investing in new platforms, markets and technology to drive growth across interactive entertainment. As part of these efforts, the company released Bumped Out on Snap Games and Word Pop on Amazon Alexa during the second quarter. These initiatives are expected to drive growth over the long term.

Risks

The majority of Zynga’s revenues comes from a small number of games and this dependency poses a risk as the company needs to consistently launch new games and add new features to existing games to retain players. The company could also see a drop in revenue and bookings from many of its games over time once they peak in popularity and usage. It is also not easy to predict player behavior and preferences in the current fluid environment.

Zynga’s paying players make up only a small part of its total player base and the company needs to increase this number in order to drive topline growth, or effectively monetize its players through advertising and other strategies.

Looking ahead

Zynga expects to generate revenues of $1.8 billion and bookings of $2.2 billion in 2020. Looking ahead into fiscal year 2021, the company expects to see double digit topline growth, margin expansion and positive operating cash flow.

Click here to read the Zynga Q2 2020 earnings conference call transcript