Buy KBH?

It might not be a good time to invest in the company now, but it would be a good idea to keep an eye on the stock given the underlying strength of the business. Also, the long-term outlook on the housing industry is healthy, while the demographics are favorable for KB Home’s business which mainly serves the first-time-buyer segment. Meanwhile, affordability will remain an issue for home buyers in the near future, due to softening spending power and elevated home prices. That is likely to dent the prospects of homebuilders to some extent.

Latest Data

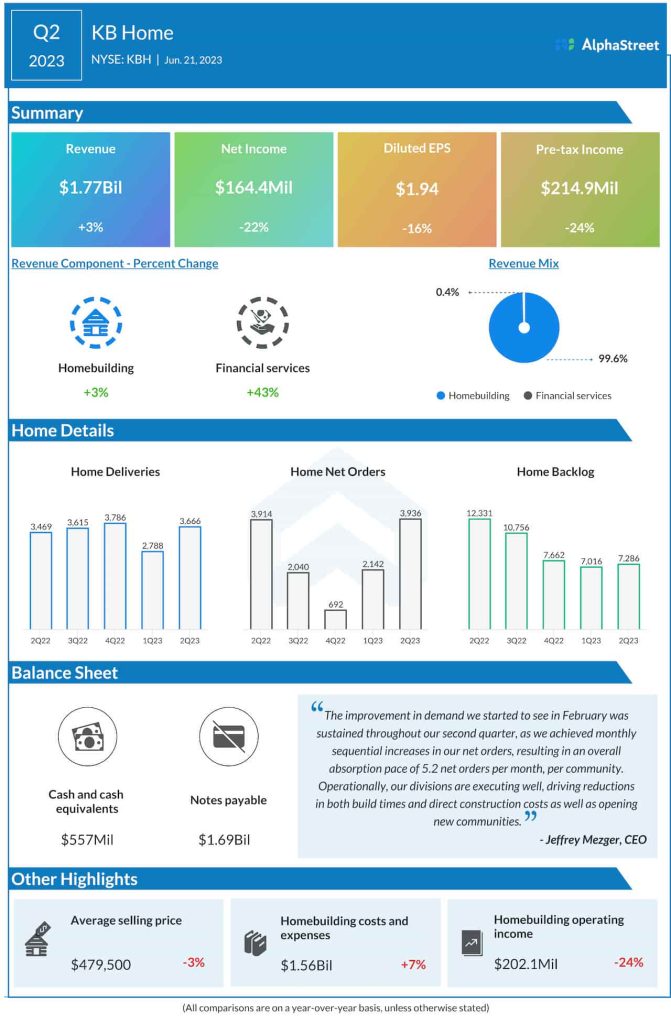

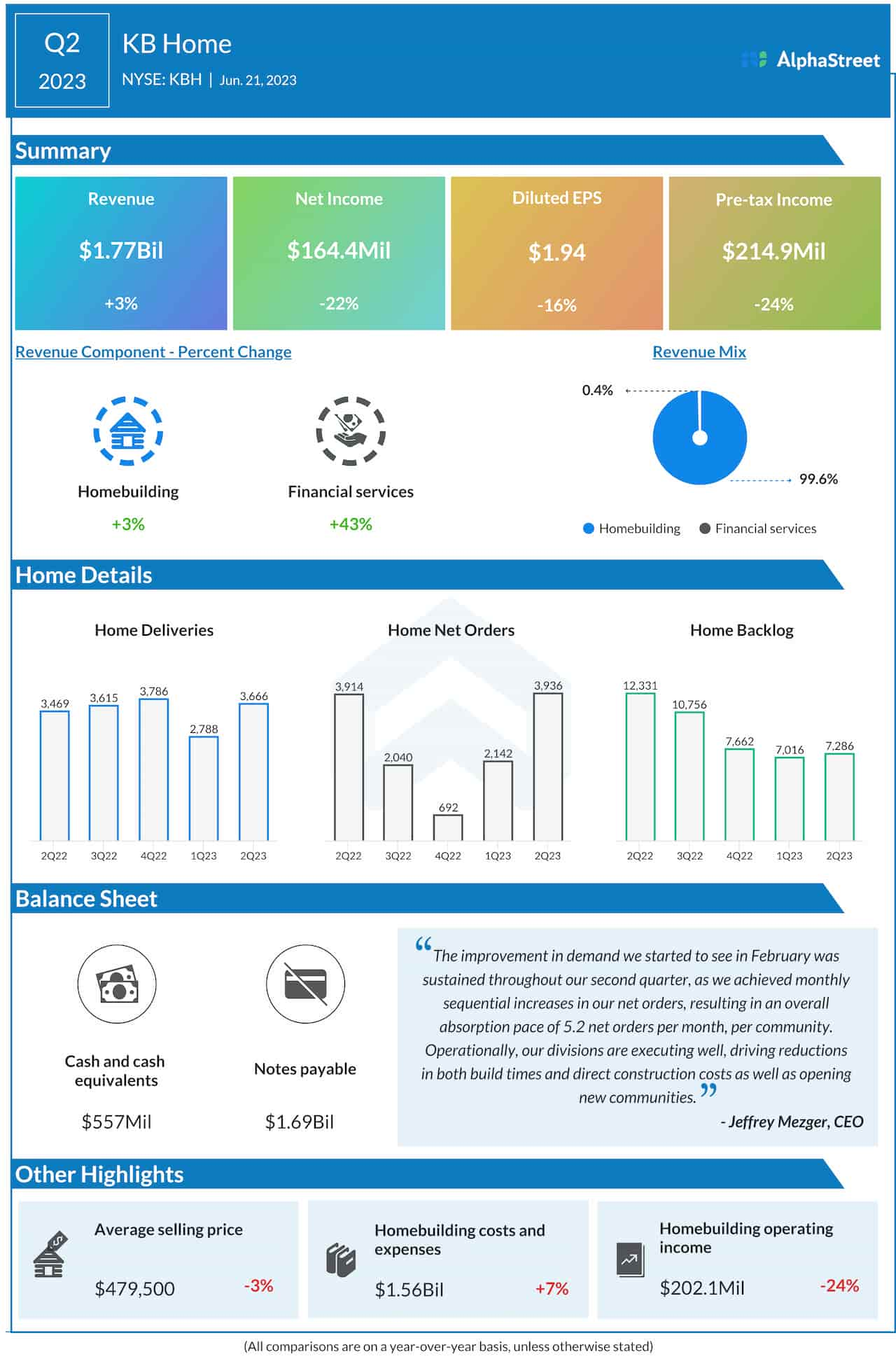

In the second quarter, KB Home’s earnings and revenues beat estimated by a wide margin, which is the second beat in a row. Net income, however, declined in double digits to $1.94 per share, while the top line grew modestly to $1.77 billion helped by higher Homebuilding revenues. The weak bottom-line performance is mainly attributable to an unfavorable comparison with the year-ago quarter, which included a positive impact on the company’s mortgage banking joint venture. Though the average selling price declined 3% the management sees a recovery in the second half of the year, which in turn would enhance gross margins.

From KB Home’s Q2 2023 earnings call:

“We continue to attract buyers above our targeted income levels with healthy credit, who can qualify at higher mortgage rates and make a significant down payment. During the quarter, we maintained our cautious approach to land investment, spending $81 million to acquire new land. While our divisions are diligently looking for land deals, we’re being disciplined in our underwriting with respect to achieving our required returns. We have the flexibility to remain selective given our current lot position and healthy balance sheet. With demand improving, we expect our land acquisition activity to accelerate during the second half of 2023.”

Guidance

The company issued positive full-year guidance, taking a cue from an uptick in orders and favorable backlog position. Housing revenue is expected to be in the range of $5.80 billion to $6.20 billion, and the average selling price is expected to be around $485,000. The guidance for housing gross profit margin is 21.2%, assuming no inventory-related charges, while SG&A expenses as a percentage of housing revenues are expected to be about 10.3%.

On Thursday, KBH opened sharply lower, extending the post-earnings weakness. It has grown 58% in the past six months.