Bullish View

Read management/analysts comments on Broadcom’s Q1 report

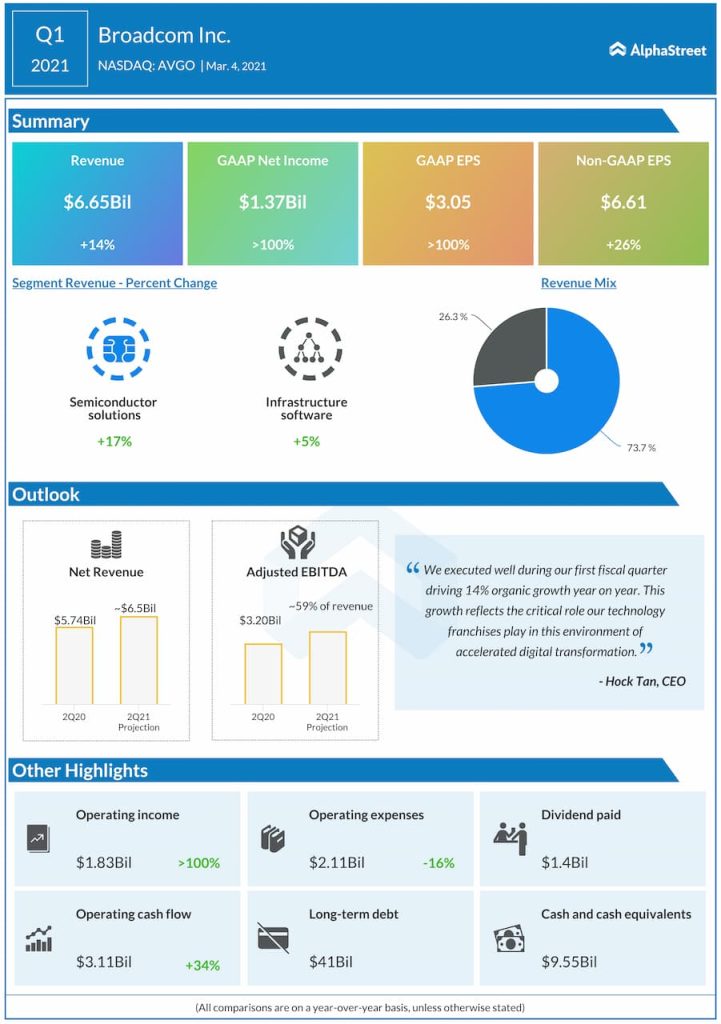

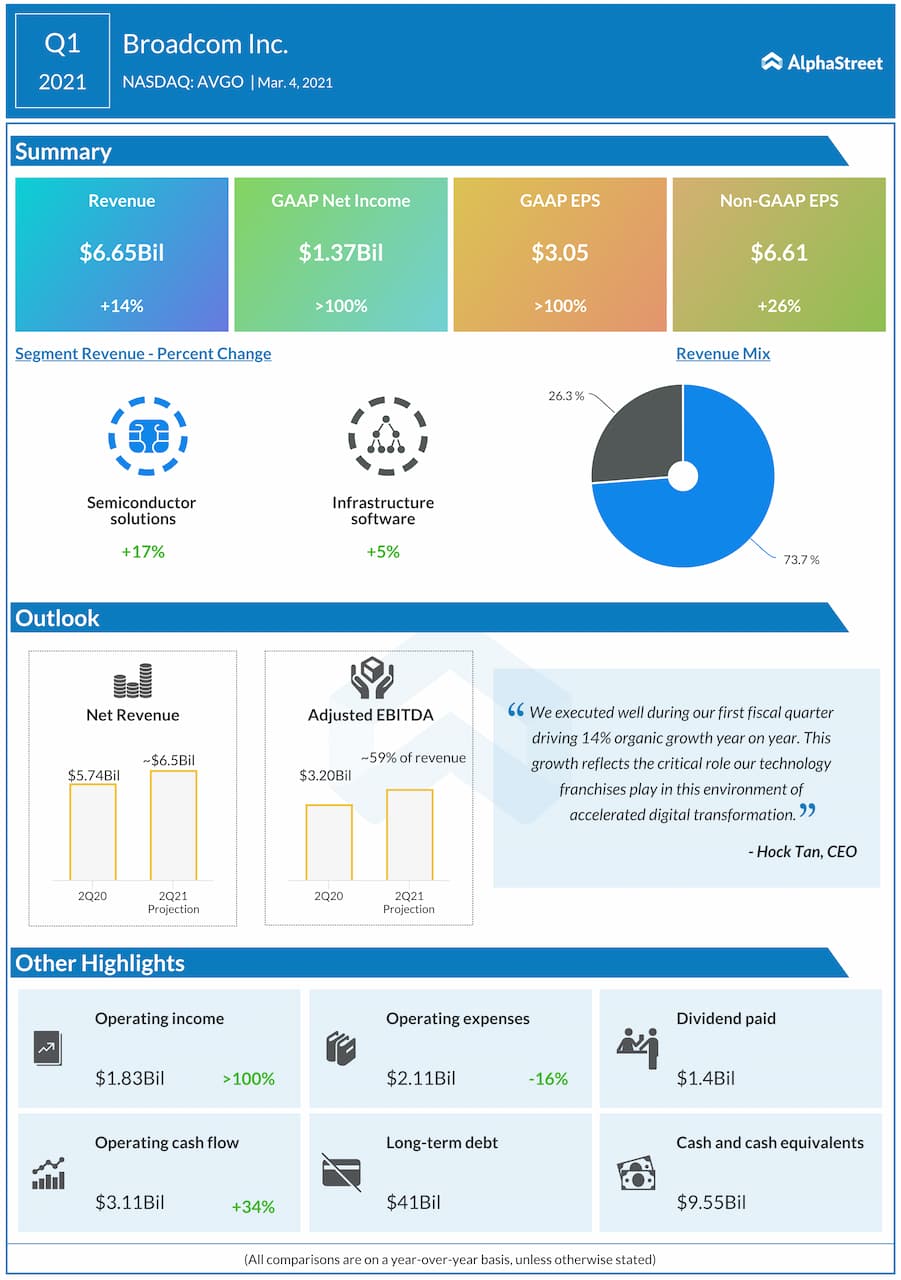

The Silicon Valley-headquartered company, which is specialized in the development of a broad range of semiconductor and infrastructure software solutions, has set new records regularly in its earnings performance, supported by robust demand and a favorable pricing environment. It entered 2021 on a high note, reporting a 26% increase in earnings to $6.61 per share in the first three months. The record growth is attributable to the high demand that lifted the top-line to $6.65 billion, up 14% from last year.

Positive Cash Flow

While reaping the benefits of past growth initiatives, focused on strategic acquisitions, Broadcom is well-positioned to achieve its current goals, leveraging the positive cash flow that grew 35% to about $3 billion in the first quarter. The company closed a number of acquisitions in recent years, including the high-value buyouts of Symantec and CA Technologies. Had regulators granted approval, fellow chipmaker Qualcomm (QCOM) would have become a part of Broadcom by now.

From Broadcom’s Q1 2021 earnings conference call:

“Our strategy of focusing on core accounts continues to perform well as we cross-sell our portfolio of software tools. In other words, our software portfolio continues to perform as we had planned and continues to be on track with our long-term financial model for organic software revenue growth of around mid-single-digit percentage year-over-year. And that’s something we expect to continue to see in Q2.”

Tailwinds

Broadcom’s continuing association with top customers like Apple and its fabless business model, which reduces production cost significantly, add to the growth prospects. Also, the growing market share in the wireless and broadband communication industries should help the company tap unfolding opportunities in the 5G realm.

Broadcom’s stock market performance has been quite impressive over the past several months, and the shares climbed to an all-time high earlier this year. The stock closed the last session at $485.48.