Accenture plc. (NYSE: ACN) has successfully sailed through the virus crisis so far, and is currently expanding its cloud services in a big way to help enterprises effortlessly go digital. Having identified cloud as a survival tool, rather than a supporting technology, the company is preparing itself for the post-COVID era.

Shares of the American-Irish professional services firm rose sharply early Thursday after the market responded positively to its strong first-quarter results, which is probably their biggest one-day gain ever. After the long-drawn rally that spanned several months, however, the stock is likely to cool down. Analysts’ mixed outlook calls for caution as far as buying the stock is concerned, but it continues to be a good bet for long-term investors.

More IT Spending

Accenture is one of the beneficiaries of the recent spike in IT spending, with the widespread shift to remote work boosting the demand for its cloud, digital, and security services. While the encouraging developments on the vaccine front show that markets would reopen sooner than initially expected, experts believe that digital transformation would gather steam next year. What makes it a unique opportunity for service providers is that businesses which are halfway through this journey want to expedite the process, while those lagging behind are striving to catch up with others.

From Accenture’s Q1 2021 earnings conference call:

“What is becoming even more clear however is that we are in an era of compressed transformation in which the winners by industry will be those who are earliest to re-platform their businesses in the cloud and have the digital core and new ways of working that allows them to continuously improve their operations and find new sources of growth, which for most leading companies is requiring them to simultaneously transform multiple parts of their enterprises and their talent.“

Upbeat Start to FY21

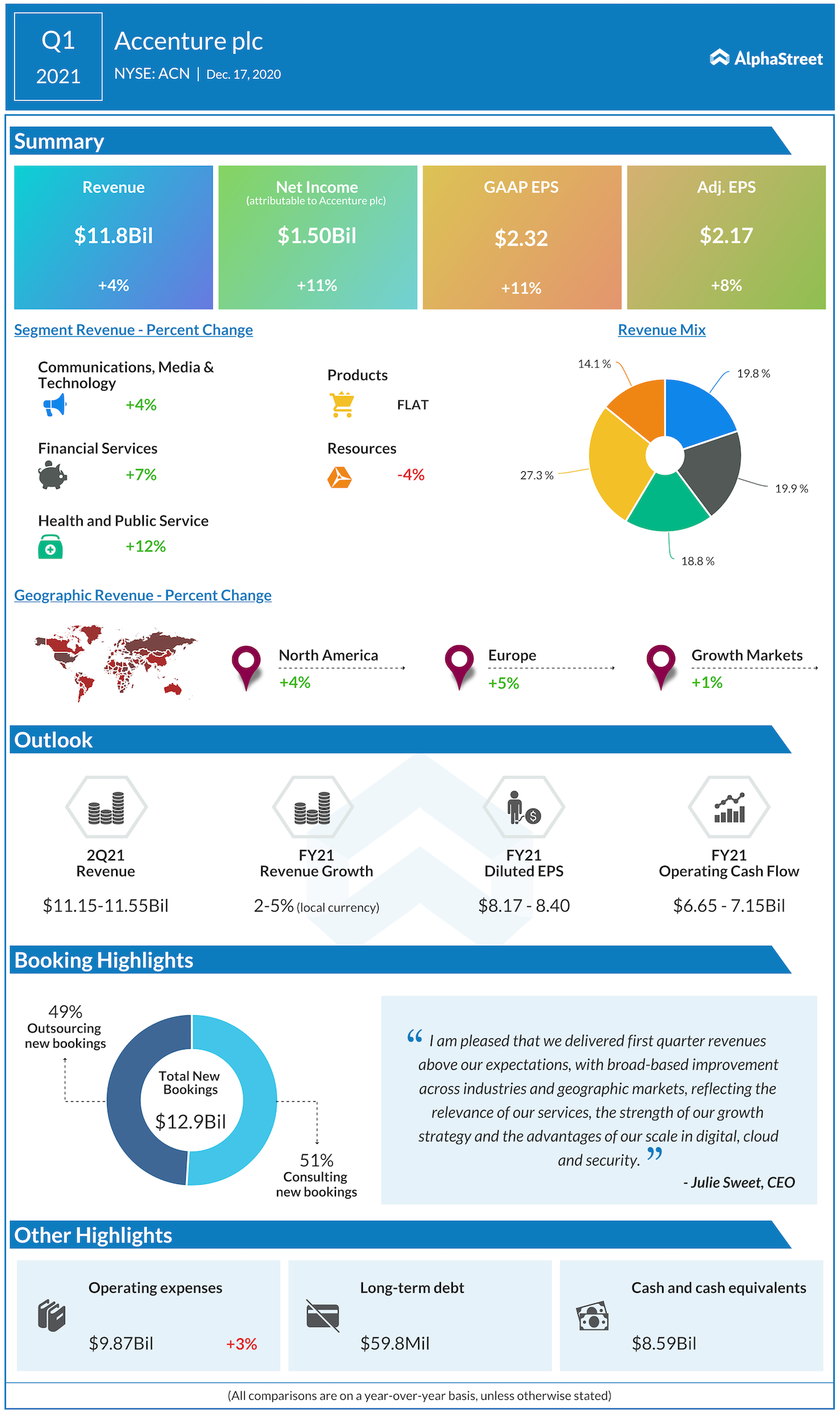

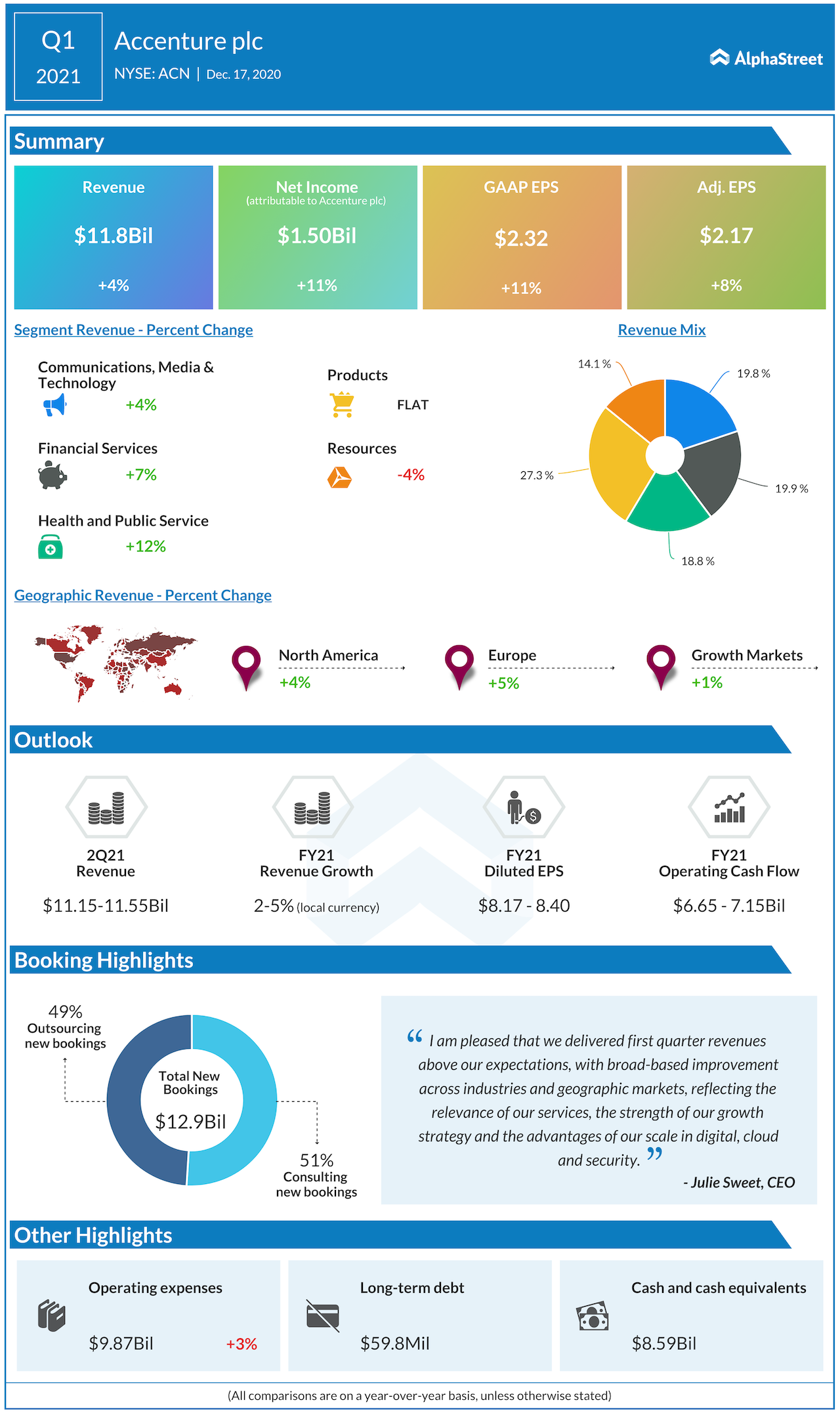

In the November-quarter, the main business segments registered strong growth, pushing up total revenues by 4% to about $12 billion. As a result, adjusted earnings rose 8% annually to $2.17 per share and topped the Street view. The bottom-line also benefited from a decline in the effective tax rate and reduction in share count. Hoping that the positive trend would continue in the whole of fiscal 2021, the management revised up its outlook for the year.

“Approximately 50% of our revenues came from seven industries that were less impacted by the pandemic, and in aggregate, continue to grow high-single-digits with continued double-digit growth in public service, software platforms, and life sciences. At the same time, we saw continued pressure, but at a more moderate level from clients in highly impacted industries, which include travel, energy, high tech, including aerospace and defense, retail and industrial,” said KC McClure, chief financial officer of Accenture.

A few months ago, the tech firm launched Cloud First to support cloud migration across industries, with an investment of about $3 billion. The new multi-service group is designed to integrate the company’s expertise in areas like cloud migration, infrastructure, and application services, besides its cross-industry insights and Applied Intelligence capabilities.

M&A Activity

M&As have always been an integral part of Accenture’s growth strategy. The company closed as many as ten acquisitions in the early months of fiscal 2021, in areas like Industry X, Cloud, and Intelligent Operations. Last month, it acquired Australia-based Olikka, a specialist in cloud migration and related services, as part of the efforts to boost its capabilities in that area.

Read management/analysts’ comments on Accenture’s Q1 earnings

Accenture’s market value expanded steadily in recent years, except for occasional dips like the pull-back seen in Mid-march. The stock set new records regularly and gained about 32% in the last six months alone.