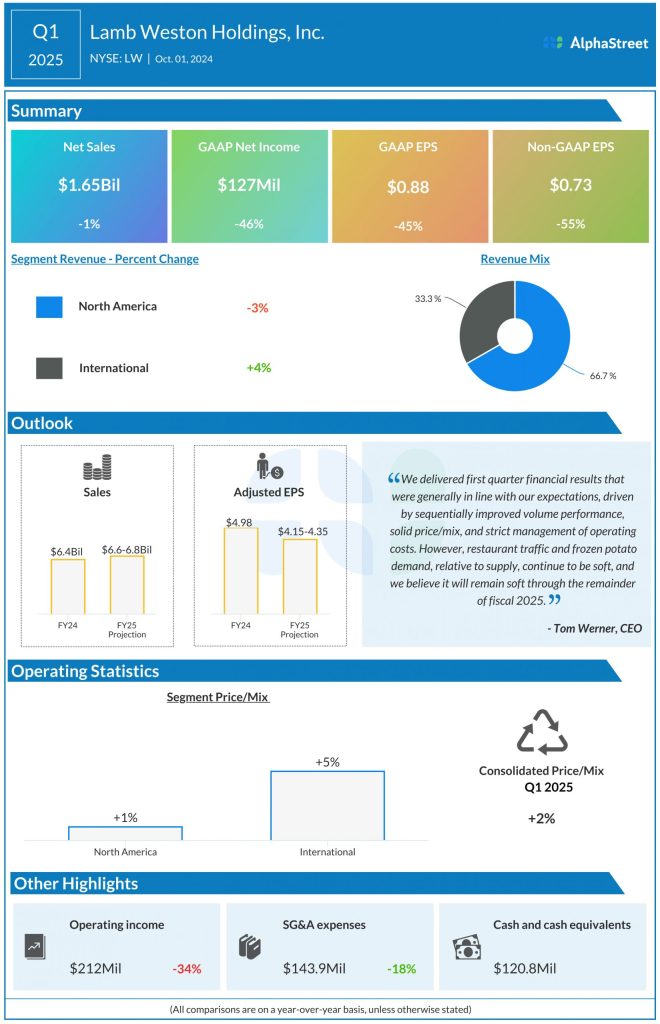

Sales and profits decline

Softness in traffic and demand

During the first quarter, Lamb Weston saw softness in restaurant traffic and frozen potato demand and it expects this trend to continue for the rest of fiscal year 2025. The company’s volume declined 3% in Q1, mainly due to customer share losses, soft restaurant traffic, the impact from exiting lower-priced and lower-margin business in Europe and the impact of a voluntary product withdrawal.

On its quarterly conference call, LW said US restaurant traffic, including QSR traffic, was down 2% in Q1, which was a sequential improvement from a 3% decline seen in Q4 2024. Outside the US, restaurant traffic trends in key international markets were softer compared to Q4 2024. Restaurant traffic in the UK and Germany were both down sequentially, while in France and Italy restaurant traffic continued to rise but at a slower rate compared to Q4.

Based on its expectations over traffic and demand trends, Lamb Weston believes the supply-demand imbalance that has been driven by the traffic decline will persist through the most part of fiscal year 2025.

Guidance cut

Lamb Weston lowered its earnings guidance for the full year of 2025. It expects GAAP EPS of $2.70-3.15 for FY2025. Adjusted EPS for the year is now expected to be $4.15-4.35 versus the previous outlook of $4.35-4.85.

LW reaffirmed its sales outlook for the year. It expects net sales to grow around 2-5% on a constant currency basis to $6.6-6.8 billion.

Restructuring plan

Lamb Weston is executing a restructuring plan in order to lower supply chain costs, reduce operating expenses, and improve cash flows. As part of these efforts, the company has closed down one of its older, higher-cost facilities located in Connell, Washington permanently. As mentioned on its earnings call, the closure of this facility reduces LW’s total capacity in North America by over 5%.

Lamb Weston is also temporarily paring down production lines and schedules across its manufacturing network in North America as it utilizes more efficient, lower-cost production lines and works on lowering its finished goods inventory levels.

As part of the restructuring plan, Lamb Weston plans to cut its global workforce by around 4% and eliminate some job positions that have not been filled. It is also reducing its FY2025 capital expenditures to $750 million from the earlier planned amount of $850 million. The restructuring plan is estimated to generate approx. $55 million in pre-tax cost savings and a reduction in working capital in FY2025.