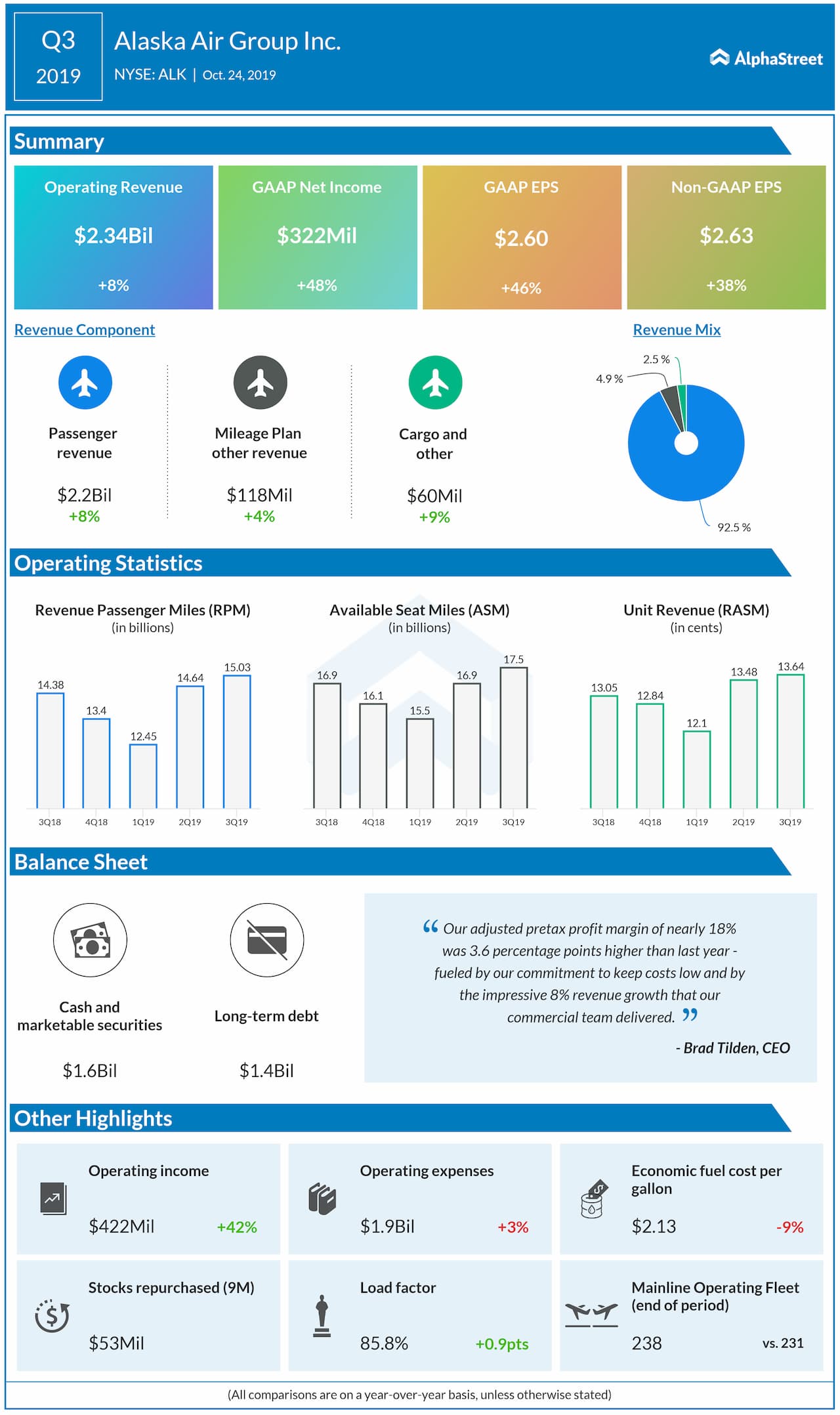

Alaska Air Group (NYSE: ALK) reported better-than-expected revenue and earnings for the third quarter of 2019, allowing the stock to gain over 1% in aftermarket hours on Thursday. Analysts had forecast earnings of $2.52 per share on revenues of $2.38 billion.

The airline posted an 8% growth in total operating revenues to $2.39 billion in the quarter versus the year-ago period.

GAAP net income was $322 million, or $2.60 per share, compared to $217 million, or $1.75 per share in the prior-year quarter. Adjusted net income was $326 million, or $2.63 per share.

CEO Brad Tilden said, “Our adjusted pretax profit margin of nearly 18% was 3.6 percentage points higher than last year – fueled by our commitment to keep costs low and by the impressive 8% revenue growth that our commercial team delivered.”

Passenger revenue grew 8% while Mileage Plan other revenue rose 4% during the quarter. Cargo and other revenue increased 9%.

Also read: American Airlines Q3 2019 Earnings Report

During the quarter, traffic increased 4.4% versus the year-ago period while capacity grew 3.4%. Load factor improved by 0.9 points to 85.8%. Yield was up 3.6%. RASM increased 4.5% while CASM, ex fuel, rose 3.4%. Economic fuel cost per gallon fell 8.6% to $2.13.

The company had $1.6 billion in unrestricted cash and marketable securities as of September 30, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.