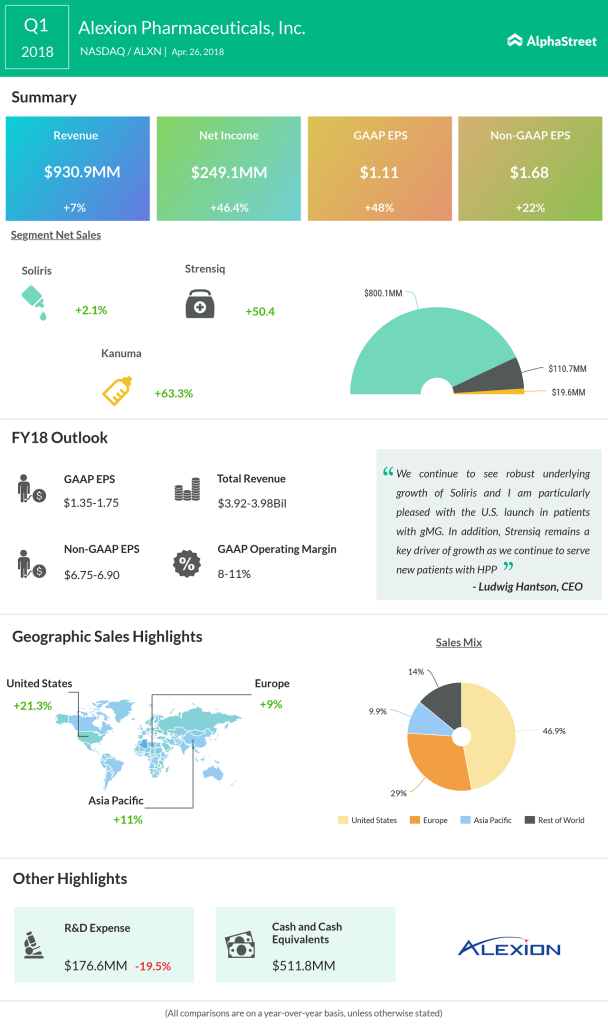

Net product sales of the key drug Soliris, which accounts for a bulk of the company’s revenue and is used to treat serious genetic-based blood condition, grew 2% during the quarter to $800.1 million.

Alexion has been working aggressively on rebuilding its pipeline. This is one of the reasons why it recently acquired Wilson Therapeutics based in Sweden. This deal, valued at $855 million, gives Alexion a greater control over the Wilson’s rare disease drug WTX101. Also, this new drug will reduce the company’s complete dependence on Soliris for generating revenue. The transaction is expected to close during the second quarter of this year.

The drugmaker also reported positive topline results for its Phase 3 study that is again used to treat a rare blood disorder called paroxysmal nocturnal hemoglobinuria (PNH).

The company also raised its guidance for revenue and adjusted EPS for the full year. Alexion now expects its revenue to be in the range of about $3.93 to 3.99 billion, up from the previous estimate of $3.85 to $3.95 billion and adjusted EPS to be about $6.75 to $6.90, up from the prior estimate of $6.60 to $6.80.

Today, apart from Alexion, two other drugmakers reported their results before the market opened. While AbbVie (ABBV) reported strong results and trades in the positive territory, Bristol-Myers Squibb (BMY) shares were down 1% in the morning session. Vertex Pharmaceuticals (VRTX) will announce its quarterly results after the market closes today.