Alibaba Group (BABA) reported double-digit growth in its fourth quarter earnings and revenues, aided by strong performance in its core commerce business and gains from recent investments. Both revenue and profit topped analysts’ forecast.

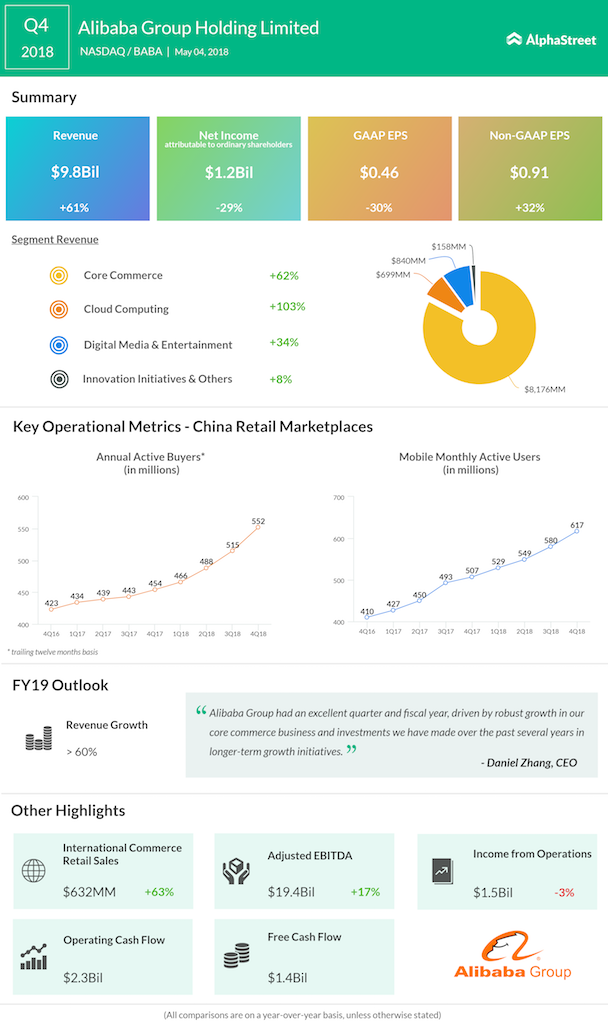

During the first three months of the year, adjusted earnings jumped 32% annually to $0.91 per share and came in above estimates. Earnings, on an unadjusted basis, were $0.46 per share, down 30% from the fourth quarter of 2017 when the company registered non-recurring disposal gains.

Group revenue surged 61% to $9.87 billion, exceeding expectations. The top-line benefited significantly from a 62% gain in core commerce revenues to $8.2 billion. Cloud computing revenue more-than-doubled to $699 million and digital entertainment revenue advanced 34%.

At the end of the fourth quarter, Alibaba had 552 million Annual Active Consumers on its China retail marketplaces, up 22% compared to last year. The number of Mobile Monthly Active Users also grew by a similar degree and reached 617 million.

“Alibaba Group had an excellent quarter and fiscal year, driven by robust growth in our core commerce business and investments we have made over the past several years in longer-term growth initiatives. With the continuing roll out of our New Retail strategy, our e-commerce platform is developing into the leading retail infrastructure of China,” said Alibaba CEO Daniel Zhang.

The top-line benefited significantly from a 62% gain in core commerce revenues

As part of expanding its tech division, Alibaba has doubled its cloud computing business, a fast-emerging segment that competes with Amazon (AMZN) and Microsoft (MSFT). Encouraged by the sustained growth of its core business and new ventures, the company is looking for a 60% growth in full-year 2019 revenue.

Recently, the largest e-commerce firm in China agreed to acquire a major stake in its payments affiliate and micro financial services company Ant Financial. The company also acquired Ele.me and made investments in Easyhome, continuing the efforts to broaden its total addressable market and to enhance the New Retail environment.

Alibaba’s strategy of generating synergies for growth through acquisitions, mainly startups, rather than developing technologies from scratch, is yielding the desired results. In the third quarter, the company reported a 56% growth in revenues and an 18% increase in adjusted earnings.

Alibaba’s stock, which dropped nearly 11% in the last three months, gained almost 4% in the premarket after the earnings announcement, but retreated in the early trading hours.